The cryptocurrency market has been buzzing with interest lately, particularly surrounding Hedera Hashgraph and its native token, HBAR. Many are keen to understand the underlying factors affecting its price and overall performance. In this blog post, we’ll delve into the on-chain metrics, trading volume, and market dynamics that define the current state of HBAR.

Table of Contents

Understanding the Surge in Interest

Recent trends show a significant spike in interest for HBAR. Google Trends data reflects a five-year chart that reveals an increase in searches for the term "H bar." This surge in interest correlates with a substantial rise in the total value locked (TVL) within the Hedera ecosystem, which now exceeds $200 million. However, a closer examination indicates that this increase is largely attributed to the rising price of HBAR itself rather than an increase in capital inflows or platform usage.

Total Value Locked: A Closer Look

When we consider the total value locked in the Hedera ecosystem, it’s essential to measure it not just in USD, but in HBAR tokens. Interestingly, while the dollar value has risen, the total value locked measured in HBAR tokens has decreased. This situation suggests that the increase in total value locked is not necessarily indicative of a growing user base or increased activity on decentralized finance (DeFi) platforms within the Hedera ecosystem.

Price Action and Market Dynamics

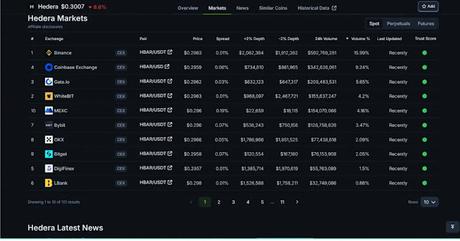

As of now, HBAR has a market cap of approximately $11.7 billion. Despite a recent sideways movement in price, trading volumes have doubled this week, primarily driven by activity on centralized exchanges like Binance, which accounts for about 16% of trading volume. This high trading volume indicates robust market-making activity, which is crucial for price determination.

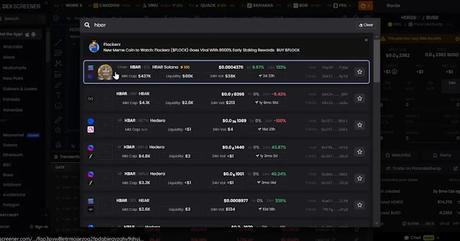

Beware of Fake Tokens

Investors looking to buy HBAR must exercise caution. There are instances of misleading tokens masquerading as HBAR on various platforms, particularly decentralized exchanges. One such token recently surged by 133% but is merely a memecoin, not the actual Hedera token. Therefore, it's vital to verify the authenticity of any HBAR tokens before making a purchase.

On-Chain Activity: Analyzing Growth

When examining the on-chain activity, we look at the number of account creations and transaction volumes over time. Current data indicates a steady flow of accounts and transactions, but there's no substantial long-term growth to justify the recent price increases. Additionally, the NFT market on Hedera remains relatively dormant, with minimal activity recorded.

Comparative Analysis With Bitcoin and Ethereum

To evaluate HBAR's performance, we can compare it to Bitcoin and Ethereum. Historically, HBAR has underperformed Bitcoin by about 65%. While there have been rallies, the overall trend suggests a consolidation phase may be forthcoming. When comparing HBAR to Ethereum, the correlation is higher, which indicates that HBAR's price movements are more closely aligned with Ethereum's performance.

Market Dominance and Positioning

Currently, HBAR holds a market dominance of 0.3%, marking a historical high. As Bitcoin continues to reach new all-time highs, the broader altcoin market also experiences upward movements. However, there are still ways to outperform the market by identifying emerging tokens early, particularly in the meme coin sector, which has shown remarkable growth recently.

Hedera (HBAR) Price Surge: This is Bigger Than You Think

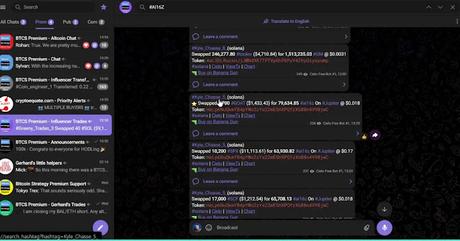

Strategies for Identifying Emerging Tokens

Identifying promising tokens early can be akin to venture capital investing. Following influential market players and tracking their transactions can provide insights into potential high-return investments. For instance, influencer Kyle Chesse recently bought a token that saw its price skyrocket by over 2,000%. Utilizing wallet tracking and on-chain analytics can help investors stay ahead of the curve.

Evaluating the Future Potential of HBAR

With all these metrics in mind, it raises the question: Is now a good time to invest in HBAR? To determine this, we must consider the token’s upside potential. If HBAR cannot achieve a 5x to 10x increase, it may not be the best investment choice for those seeking substantial returns. Furthermore, in comparison to other enterprise-focused blockchains, the space for HBAR to grow is shrinking, especially when considering competition from larger players like XRP and Solana.

Conclusion

In summary, while HBAR is experiencing heightened interest and trading activity, the underlying metrics suggest a more complicated picture. The total value locked is not growing in terms of HBAR tokens, and on-chain activity remains steady but not expanding. Investors should proceed with caution, ensuring they are purchasing authentic tokens and considering the broader market dynamics before making investment decisions. The potential for HBAR to achieve significant growth exists, but it will require increased on-chain usage and a stronger competitive position in the market.