Business

Business

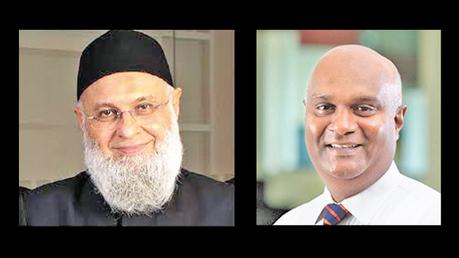

Chairman Osman Kassim-CEO Gehan Rajapakse

Tags:

Print Edition

Chairman Osman Kassim-CEO Gehan Rajapakse

Tags:

Print Edition

Amana Takaful Life Insurance (ATLI) Sri Lanka’s homegrown life insurance provider, has reported a huge healthy net profit growth in Year (Y) 2021, steadily bouncing back from its a relatively challenging period in 2020 slump.

In 2021, ATLI Amana Takaful Life also boosted its Net Earned Contributions Premium (NECP) Gross Written Premium Contribution (GWP), and to total at 881.7 Mn. NECPs are the premiums actually paid, compared to the total number of premiums signed up. ATLI’s financial strength grew as its total equity levels surged by 3% YoY.

ATLI’s the organization’s convincing 2021 annual performance has been built on its winning Quarter-on-Quarter numbers throughout the year –including that of the 4th quarter triumphant Q4-’21 of 2021 where it reported 163% net profit growth, and a steady 32% GWP growth, boldly bouncing back from Q4-2020’s slump in comparison to Q4 2020.

Chief Executive Officer, Gehan Rajapakse elaborates: “2021 was not an easy year in the insurance sector as it was a year where the Pandemic spread further while other unexpected economic challenges sprung up suddenly. As per our provisional reports, ATLI we braved these and recorded a winning fourth quarter which boosted our overall annual bottom-line of Y2021.”

“ATLI Amana Life Insurance recorded a huge healthy, 128% YoY surge growth in its net profits in Y2021, overcoming the challenging position faced by the company over the past few years at Rs 9.68 Mn in comparison to Y2020’s loss of Rs 34.7 Mn.

ATLI increased its total equity levels by 3% YoY in this challenging period to total at Rs 472 Mn, from 2020’s Rs 459 Mn. In 2021, ATLI also boosted its Gross Written Premium Contribution (GWP) Net Earned Contributions – Premium (NECP- the premiums actually paid, compared to the total number of premiums signed up)by a steady 1921% YoY, totalling at 881.7 Mn.

“Our overall growth has been well-aided by the significant 35% growth in our first-year regular business premium. During the year 2021, our cash and bank balances increased by 41%. Our total assets increased by 7.6% YoY to Rs 3.33 Bn. We also managed to expand our geographic foot-print through nearly 35 locations across Sri Lanka, covering all provinces.”

Chairman of Amana Takaful Life Insurance, Osman Kassim states: “A few years ago, Amana Takaful Life embarked on a refreshed strategic direction under new leadership with the objective of steering the organization towards a positive growth trajectory. In 2021, as a result of the significant turnaround that we have witnessed, I can now say that our plan has come to fruition.”

Friday, April 29, 2022 – 01:00