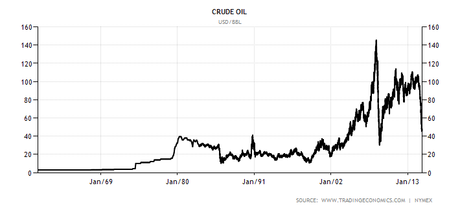

The recent drop in oil prices has caused the market to become volatile again. Oil prices have dropped from a high of $100+ to a low of $40+. That's more than 50% drop so far. Those who drive will notice that petrol prices are cheaper now. Instead of seeing the digit $2/litre, we start to see it at $1+/litre.

Crude oil is the most important natural resource of the industrialized nations. It can generate heat, drive machinery and fuel vehicles and air planes. Its components are used to manufacture almost all chemical products, such as plastics, detergents, paints, and even medicines.

The drop in oil prices seems good for most of us. Petrol prices become cheaper, electricity will become cheaper also. To know which countries will benefit and which countries will suffer because of the drop in oil price, we have to look into which are exporters or importers of oil. Those countries who import most of their oil will benefit while those countries who export most of their oil will suffer.

The 1970s Oil Shock (Price Increase)

Right now we're seeing a drop in oil prices but what if the opposite happens? In the early 1970s, oil prices more than doubled from about $4 to $10 and caused chaos in some countries. One such country was Japan. Japan imports almost all of its oil for consumption and they were badly affected. The government even made a statement that their country would run out of oil in 4 days during that time. The whole country had to save electricity by turning off lights on the streets and buildings also shut down every alternate lifts they had.

The 1980s Oil Shock (Price Decrease)

Fast forward 10 years later, from 1980 to 1986, oil prices declined from a high of $39 to a low of $12. That is a 70% drop in oil price. The rise of Asian economies was evident during the late 1980s and the 1990s as lower oil prices increased industrial production. Saudi Arabia, which is one of the largest exporter of oil, suffered because of the falling oil prices. They did cut their oil production back then but this lead to 16 years of budget deficits that left the country deeply in debt.

What is happening to oil prices now and how it affects our investments?

It seems like history is repeating itself that oil prices have dropped more than 50% now. As investors, we will want to know what is happening so we can better position ourselves in allocating our investment capital.

Let's take a look at some net oil exporters countries which will likely be affected by the fall in oil prices:

Russia's economy is heavily dependant on oil exports. In fact, oil and gas accounts for 70% of its export income. Russia's currency, the Ruble, has fallen more than 50% against the US dollar. This prompted the central bank to increase rates to 17% in order to limit the negative effects of the depreciating currency.

Malaysia derives 30 percent of state income from energy exports. Malaysia currency (Ringgit) has also fallen substantially. Most of us who live in Singapore will know the exchange rate of the Ringgit and a lot of people have went on to exchange more Ringgit to spend in Malaysia.

Saudi Arabia has the world's largest crude oil production capacity and is the largest exporter of total petroleum liquid in the world. Recently, the previous king of Saudi Arabia passed away and caused a spike in oil prices as investors bet on a change in the country's policy to reduce production of oil which can lead to an increase in the price of oil again. This is how powerful its production capacity and exports are.

Now, let's take a look at some net importers of oil. These are the countries who will most likely benefit from the decline of oil prices:

Japan is the third largest net importer of oil behind China and the US. Previously, Japan suffered badly when oil prices rose substantially during the 1970s to 1980s. In 1985 when the oil price started to decline and crashing in 1987, Japan still could not recover due to its strong YEN that stalled its economy.

Today, Japan has embarked on an aggressive monetary policy, dubbed Abenomics. This has caused their currency to depreciate which lead to a boost in exports. With oil prices falling, this will benefit the country as they can import oil at a cheaper rate. Of course, the depreciating currency will offset some decrease in oil prices but I think overall it should still be good for the Japanese economy.

I've invested substantially in the Japan market since last year. You can read my previous post here: The Japan story - Croesus retail trust and Saizen Reit

China may be the largest or second largest net importer of oil before or after the US. It was said that the decline in oil prices now is partly due to the decreased demand of oil from China. It is hard to know what exactly is happening in China. Recently, its stock market also slumped more than 7%. That is a scary decline. I'll choose to stay out of any investment in China until I know what is happening.

The European Union has been suffering slow growth ever since the sovereign debt crisis in 2012. With the EU importing most of its oil, lower prices will certainly lead to an increase in economic output.

India imports 75% of its oil. With its account deficits, lower oil prices will help to ease it. India has also been going through many economic reforms to spur growth.

Industries that will benefit from lower oil prices

Industries that rely heavily on oil for transportation will benefit from the lower oil prices. Airlines and Shipping industries are two examples of it. Previously, airlines and shipping companies have suffered a prolonged period of slow or even negative growth for the past few years when oil prices were above $100. There may be a turn around soon for these companies.

Oil affects all of us and affects the profits of various companies. Having a little knowledge of oil will help us in our investment decisions in times like this. There are also opportunities that we can look out for in the oil and gas industry. Stocks of companies in the oil and gas industry have fallen significantly for the past few weeks. This is a good time to accumulate good companies at undervalued prices. But before you invest in these companies, make sure the company's balance sheet is healthy and they can ride out the tough times. Many companies will go bankrupt during bad times and the few strong ones will emerge out even more successful. Invest wisely and safely.

Enjoyed my articles?You can Subscribe to SG Young Investment by Email

or follow me on my Facebook page and get notified about new posts.

Related Posts:

1. Saizen REIT - Income from Japanese residential properties?

2. Looking to invest in Japan's real estate