One of the biggest world’s NFTs is OpenSea, which has worried about

a potential market bubble growth.

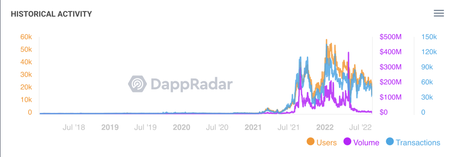

OpenSea’s value has deeply dropped

In August, about $5 million in a wealth of NFT marketing has processed.

according to DappRadar: on May 1,

almost 99% lower than its record high of $405.75 million.

equally severe drops in OpenSea users and their transactions happening with the enormous decreases in daily quantities is the reason that proving that blockchain-based collectibles have decreased in the later months.

That is further noticeable in the minimum quantity a person is prepared to pay for an NFT of leading digital collectible projects.

For example, Bored Ape Yacht Club had a high amount of 153.7 ETH on May 1 but on August 28 has declined to 72.5 ETH.

Furthermore, CryptoPunks as another top NFT collection has a high price of 83.72 in July but declined by nearly 20%.

Approaching the original value

So a digital collectible established on Ethereum will be purchased using Ether, which also means that NFT’s prices will decline if ETH’s market valuation plummets.

One of the reasons for low NFT statistics is a bearish ETH market.

BendDAO wants to boost NFT liquidity

BendDAO is a decentralized autonomous organization that

enables NFT holders to collateralize their digital collectibles to seize loans worth 30%-40% of the NFT’s floor price voted to change its protocol’s code to make its NFT collateral more liquid.

increased the importance of ETH-denominated loans in dollar terms as a result of this vote.

decreasing the value of the collateral held by BendDAO is the reason for the plummet in the NFT price.

the debt crisis is happening for BendDAO which means that due to

declining ETH prices borrowers can’t reimburse their dollar-denominated loans also it will be difficult for lenders to regain their loaned amount because of falling collateral valuations.

BendDAO has remained its decision about its NFT liquidation limit from 95% to 70%.

The time for browsers has decreased from 48 hours to 4 hours to attract more suggestions for their NFT collaterals.

if the market’s liquidity continues,

price of NFTs, comprising BAYC will deeply decline.

agreed, 2020-2021 was crazy get-rich-in-months & the DeFi-NFT-Web3 bubble is going bust now, turns out founders & VCs were scammers only in for the $$$.

But people said its over in 2018 too after ICOs.

The next bubble will come 100%, you just need to survive.

play the long game.

— on crypto (@DonCryptoDraper) August 29, 2022

Risks are always involved with trading and investment but investors should complete their search about each movement.

Leave this field empty if you're human: