Aftnic.fr the manager of the .fr (France) extension, published a pretty extensive report today. The report “The Domain Market in 2014″ takes a look back at 2014 and provides some interesting stats and graphs.

I will highlight one topic in this post and read the full report here

Legacy TLDs: highly contrasting performance in 2014

The Afnic Market Research Team has developed a methodology for measuring the performance of TLDs that the Council of European National Top Level Domain Registries (CENTR) has used in its annual studies for 2013 and 2014.

It consists, on the one hand in measuring the ability of a TLD to generate new registrations of domain names (the “Creation Rate”) and on the other in calculating the proportion of domain names present on 31/12 of the previous year, “preserved” in the portfolio at 31/12 of year N by applying the following formula:

Stock at 31/12/N = names created in year N + names maintained (or kept) in year N.

The “Maintenance Rate” is thus calculated by relating the number of names maintained in year N to the stock at the beginning of the period.

Another ratio measures the weight of deletions (or names not kept) compared with creations. When it is greater than 1, the TLD is losing stock.

These indicators are simple to calculate and are based on public data, at least with regard to gTLDs. They can be used to measure and benchmark fairly accurately the relative performance of each TLD in terms of sales momentum and the “robustness” of its domain name portfolio.

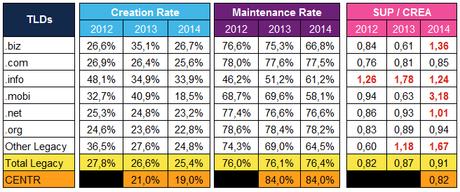

Table 3 shows the performance measurements for the six largest gTLDs in terms of volume, the other “Legacy gTLDs” being aggregated into an overall line.

First, it can be seen that in general the Creation Rate is trending down from 27.8% in 2012 to 25.4% in 2014. This figure means that 25.4% of the names in stock at 31/12/14 had created in 2014. It is natural that the Creation Rate should trend down, since in order to maintain it at the same level, creations have to grow at the same rate as the stock of names registered under the TLD in question. During a downturn in the momentum of creations, the Creation Rate is the first to be affected.

The strategies and situations of the various TLDs can be clearly seen, simply by comparing their Creation Rates, from the .info gTLD which is highly focused on gaining new names but is having increasing difficulty in doing so (48% in 2012, 34% in 2014), to the .mobi gTLD which clearly saw its demand plummet in 2014 (from 41% to 19%).

The Maintenance Rate focuses on the names retained. It therefore reflects the robustness of the TLD and its ability to retain holders that already have domain names. It is can be seen that on average the rate is on an upward trend for Legacy gTLDs, which can be explained by the increasing age of the domain names and which are therefore all the more likely to be kept. Here too, the momentum differs from one gTLD to another. The .com gTLD is slowly losing ground while the .info saw its Maintenance Rate jump by 10 points, a sign that its customer base consolidated in 2014 despite (or because of) a relatively severe loss of stock. Its ratio is also one of the lowest, while the .mobi is also facing extreme difficulty, its Maintenance Rate collapsing from 70% to 58%, unlike that of the .info gTLD.

A comparison with the CENTR figures for 2013 and 2014 shows that the ccTLDs that are members of this association on average outperformed the Legacy gTLDs in terms of their Maintenance Rates, but their Creation Rates were lower in 2013 as in 2014. We therefore need to look elsewhere, probably in the Asia – Pacific region, for the sources of the growth of 8.5% in ccTLDs in 2014. This situation, however, demonstrates the maturity and greater stability of the ccTLDs that are members of the CENTR, which also benefitted from Deletion / Creation rates nearly 10 points lower than that for Legacy TLDs in 2014.