From The Commonwealth Fund survey:

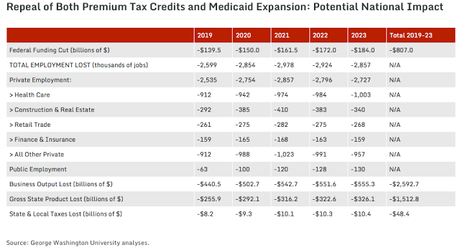

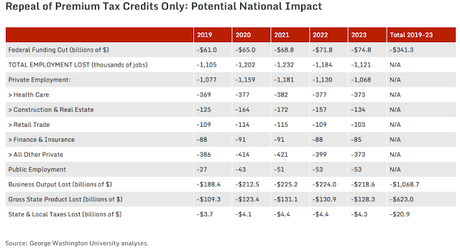

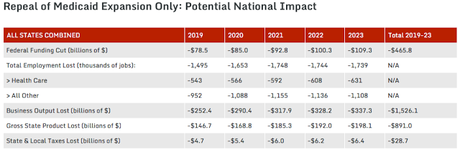

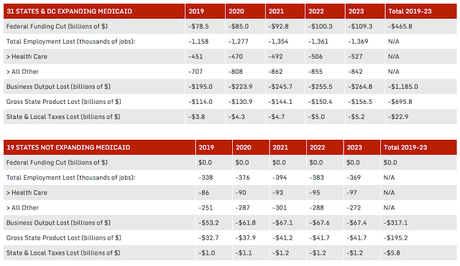

Repeal of key parts of the Affordable Care Act would lead to major cuts in federal assistance for health care, thereby triggering major losses in employment and serious economic dislocations in all states. These losses would not be limited to hospitals, clinics, and patients; they would have widespread repercussions for businesses and workers as well, affecting multiple sectors of each state’s economy. Because economic benefits and losses flow across state lines, even states that did not expand Medicaid would experience losses if Medicaid expansions were canceled. These findings are noteworthy in part because of the common (and debunked) concern that Obamacare has been a “job killer.” Evidence shows that job growth has been robust since the ACA was implemented and the economy has thrived. The economic burdens for states and health care providers will be particularly detrimental. Because they serve so many uninsured and Medicaid patients, safety-net facilities such as hospitals and community health centers could be especially hard hit. Recent studies demonstrate that Medicaid expansions are associated with lower uncompensated care burdens for hospitals and with increased capacity at nonprofit community health centers, signaling the adverse consequences of reversing them. In the end, states could be forced to choose between cutting vital services and raising tax rates. An important question post-repeal will be what policies might replace existing ones. Some conservatives have recommended the broader use of health insurance tax deductions, in lieu of tax credits, whether for all health coverage or specifically for tax-advantaged health savings accounts (HSAs). While tax deductions can lower costs for higher-income individuals, who have higher marginal tax rates and already are mostly insured, they offer little help to people with low or moderate incomes, who are far more likely to lose their insurance and access to health care if premium tax credits and Medicaid expansions disappear. Analyses by the RAND Corporation found that the broader tax deductions recommended by the Trump team during the presidential campaign would increase federal costs, with little gain in insurance coverage. Any savings would primarily help those with higher incomes. The ACA’s reforms, on the other hand, target assistance to low- and moderate-income families, who use the savings to meet basic needs like housing, food, and transportation. Moreover, such spending creates greater economic stimulus than tax deductions that disproportionately benefit wealthier individuals, who are likely to shift more money into savings, which is less stimulative.