From the age of 12 to about 38, I was fooling around in the stock market. I didn’t know I was fooling around, but I found out that I was after reading JD Spooner’s, Do You Want To Make Money Or Would You Rather Fool Around ? You see, I was buying round lots (100 shares) of several different stocks and selling them when I made $1000. Sometimes I’d really get lucky and have a stock go up 20 or 30 points, making $2000 to $3000. Sometimes, of course, I would take a loss of a few hundred to maybe $1500.

(Note, if you click on a link in this post and buy something from Amazon

One of the big lessons that Spooner taught me was that you need to buy in large enough quantities to really make a good profit when you are right. If you buy 100 shares of a company and it goes up $10 per share, you’ll make $1000. An increase of $10 per share is a pretty substantial move, yet you are only making $1000. Not exactly a life-changing gain.

But if you buy 500 or 1000 shares, you’re now making $5000 or $10,000. That is enough to pay for a year of college at a state school, a high-quality used car, or a new roof for you home. Now we’re really talking.

From Spooner to Serious Investing

I used Spooner’s idea as one of the tenants in what I call the Serious Investing methodology in my first book, the SmallIvy Book of Investing: Book1: Investing to Grow Wealthy. I add to it things like buying for long-term gains, rather than worrying about short-term profits, and buying like you are becoming an owner of the business (which you really are) and worrying about the fundamentals of the business rather than the fluctuations in the share price.

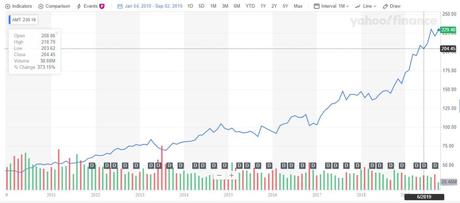

So, what have been the results since I took up this new way of investing about 10 years ago? Well, one example is my investment in American Tower (symbol AMT). This is a company that transitioned into an REIT (Real-Estate Investment Trust – like a mutual fund of real estate properties) since I started buying in. They buy land and put up cell phone towers, so they obviously have done well as we have all become deeply dependent on our phones and expecting them to work where ever we are.

I first bought into AMT in January of 2010 and have built up a position of 350 shares. I paid a total of about $21,300 for the position. The position is now worth about $80,000 and I have a profit of about $59,000. Now, that is life-changing. Note that the combination of buying a substantial position and holding it for a long period of time, over 9 years, is what has made the difference. I have doubled my money about 2 times during that period, meaning that I am getting an annualized rate-of-return of about 16%. Not bad.

This return is not linear, however. Take a look at the price history of AMT over the last ten years below. There are good periods where the stock soars, and bad periods where the stock sinks a bit. There are a lot of times where the stock just sits there, maybe for a year or more. But I really don’t need to do any work – I just sit there and wait for the company to earn more money and the stock to go up. It is a lot easier than the days when I was constantly monitoring the markets and trying to make money based on price movements. It’s nice to be an owner instead of a trader!

But what about the losers?

If anyone tries to sell you on an investing strategy and just shows you a few of their winners, walk away, fast. No one will make good picks all of the time. One of my bad picks was the women’s retailer Chicos FAS. One issue there was that I wasn’t really following my strategy of buying for long term growth. Here I liked the long term prospects, but also thought I’d sell some covered calls along the way.

I built up a position of 2525 shares in CHS. I planned to write calls on 1000 shares and then hold onto the rest of the shares for appreciation. Unfortunately, CHS has done badly, losing about 60% since I bought it. I’m currently down about $13,000. So, as you can see, when things go badly, you can see some significant losses when you buy large positions.

However, you’ll notice that winners like AMT more than make up for losers like CHS. I’ve found in general that I’ll tend to have loses when I don’t choose the right kind of stocks – growth stocks with a history of earnings increases and good prospects for growth. Still, even when I stick to the strategy, things can sometimes still go wrong.

Before you can start investing, you need money to invest. Please check out my latest book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early

Have a burning investing question you’d like answered? Please send to[email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.