You’ve undoubtedly heard about, you know the “get rich quick” stories of the dodgy guy at university buying £100 worth of bitcoin back in 2009 and now it’s your turn. How do you go about buying and trading a cryptocurrency?

Pick a cryptocurrency to trade

It sounds patronizingly obvious but to trade cryptocurrency, you at least need to pick one. Most will just summarise it as “Bitcoin” but if you see the link below, there’s plenty more. Be aware, most after a certain point are merely going to be a number on a Korean guy’s excel sheet all part of a scam so choose wisely. Do your research on what it is, why you’re buying i.e. its security, application and technology behind it. My personal advice – only consider the top 50 by market cap as a starting point.

Sign up for a cryptocurrency trading wallet

A wallet in cryptocurrency terms is a bank account really. A haven to receive, store and send your purchases. At the time of writing (it’s constantly evolving) there are 3 types. A software wallet is one for mobile or computer. Good for security but can be complicated to install and maintain and does feel like the “abyss”. Secondly, a web wallet. Hosted by a 3rd party you need to trust the source. Security in this instance is like oxygen or sleep, you only realize it, need it, appreciate it when it’s not there. Lastly, a hard wallet.

Not in the conventional sense like you probably have already. It will likely be with a USB of some sort and the superior option in terms of security but after a brief browse on Amazon, they can be up to $300. The top candidates are Coinbase’s offering but there are others, including Bitcoin Core, Electrum, and Breadwallet for mobile.

Add a payment method to your cryptocurrency trading account

The best way is to sync with your existing bank account but don’t worry, there are verification steps and after some annoying swapping between mobile and desktop versions of the same application you can get set up. This isn’t uncommon but the user experience across most providers is slowly becoming better and what should expect. Other options include linking to a PayPal account or a credit/debit card, but those come with some drawbacks, such as low purchasing limits, higher transaction fees and a longer verification process.

Select a platform or cryptocurrency exchange

This is like supermarkets. Stick to the big market players. You will get (generally) the best user experience, customer service, experience and fees from using a more “well known” provider rather than a startup based in the depths of outer China. There are numerous factors to take into account even from an established provider. Some of these include transaction fees, accessibility, liquidity conditions, reputation, transparency and the country where the exchange is located. When I did my own personal initial test of £100 worth, customer service and a direct link to a real person who would answer your question directly and comprehensively within 72 hours and notify you of when the funds had been deposited was invaluable.

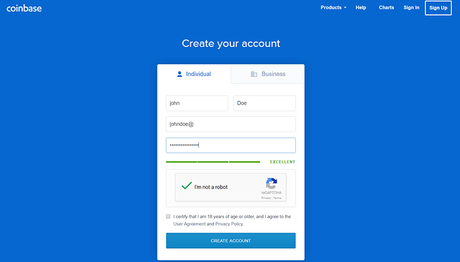

Then get registered. Use the most amount of authentication processes possible to protect from hacks, don’t use known emails or mobile numbers as these are a hackers dream and change it to something random as often as possible but write it down as if you forget it will be near impossible to get back in and likely the platform will make it a long, arduous process to gain access and prove identity. I mistyped and forgot part of my 2-part authentication process and lots of emails between customer service and myself ensued with numerous resetting and 448-hour waits.

Bitcoin newcomers will find a variety of exchanges competing for their business. Some of the most reputable and popular Cryptocurrency trading exchanges include U.S.-based Poloniex, Bittrex and Coinbase-owned GDAX, as well as Asia-based Bithumb and Bitfinex.

I personally use Kraken. Like any form of retail or tech, word of mouth is usually the strongest over marketing. My director had traded Ripple (4th largest by market cap) using Kraken and had experienced the process and explained it to me and put my mind at ease. I also found for signing up, transferring money in to the account, buying the currency and potentially withdrawing it, the larger companies have examples of how to do it not only on their website (typically under “frequently asked questions”) but by enthusiastic early adopters on YouTube. As you would with a normal bank etc due diligence, patience and thorough attention to detail is key.

You’re ready to trade cryptocurrency but…

In theory, you are ready to buy. I personally did a test £100 transfer in to the exchange and followed the process, I would advise you do the same before you take any more significant investments. I’m British so deposited in £. My £100 rapidly became £90 due to the £10 deposit fee which in this case was 10% but obviously it is normally just the net £10. Then the currency I wanted (Ripple) could only be bought via Bitcoin. This is common for trading bespoke or lesser known cryptocurrencies but it is getting more direct. I did a GBP/BTC trade then had to do a XRP/BTC. Essentially, I sold my pounds for Bitcoin, then sold my Bitcoin (BTC) for Ripple (XRP). Watch out for the exchange fees when trading cross currencies.

If you deposit in USD or EUR you can go more direct than GBP but the withdrawal process is similar going back via bitcoin so calculate your profits or loses carefully with the fees and costs in mind, usually 5% by the end of it. As time progresses this should be more direct. I’ve heard horror stories of £1000 profits becoming £600 after exchange rate fees and one person having to set up a bank account in Estonia!

There was a “basic” and “advanced” way of trading. A few weaknesses in user experience. Using basic you must type the amount of Bitcoin (or Ripple) you require and play about with the decimals until you reach the amount of GBP you have in your account rather than typing the amount of currency you have deposited and automatically populating how much you can purchase (hopefully this will evolve for the better). On the advanced, you can set stop losses, place market or limit orders and be more sophisticated about the trading.

In short, it’s not as difficult or as intimidating as you first imagine but by no means is it simple and quick. The shifting rules and regulations or lack of them, growing adoption and acceptance, investments in platforms, user experience and products being launched around the digital currency have pacified anxieties, grown confidence and made it more accessible for the average retail investor. With all its faults and frustrations, as they say in the lotto “you’ve got to be in to win it.”