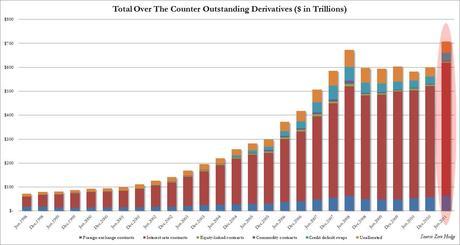

While everyone was focused on the impending European collapse, the latest soon to be refuted rumors of a quick fix from the Welt am Sonntag notwithstanding, the Bank of International Settlements (BIS) reported a number that quietly slipped through the cracks of the broader media. Which is paradoxical because it is the biggest ever reported in the financial world: the number in question is $707,568,901,000,000 and represents the latest total amount of all notional Over The Counter (read unregulated) outstanding derivatives reported by the world's financial institutions to the BIS for its semi-annual OTC derivatives report titled "OTC derivatives market activity in the first half of 2011."

A $107 trillion increase in notional in half a year.

Actually, if we look at the MORTGAGES CRISIS OF 2008 we also see a massive 'notional' spike! The 2011 figure could be an example of what is called, "Stepping it up a notch." How high will the banks push a TOTAL FINANCIAL COLLAPSE notional?