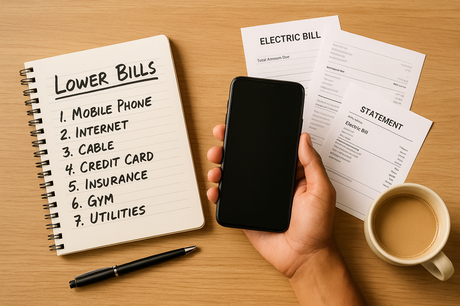

Ever get that sinking feeling when you look at your bank account right after all the monthly bills have hit? It feels like those amounts are carved in stone, leaving you with less money to save, invest, or just enjoy.

But here’s a secret most people don’t know: many of those bills are negotiable.

A simple, five-minute phone call can unlock discounts and better rates you never knew existed. You don’t need to be a master negotiator or spend hours arguing. You just need to be polite, confident, and know what to say. This isn’t about complicated financial theory—these are real, easy wins you can score today.

Ready to put some of that money back in your pocket? Let’s get started.

1. Your Mobile & Internet Bill: Ask for the “Loyalty” Rate

You know those amazing deals new customers get? Companies bet on you being too busy to notice you’re paying more for the same service. They spend a fortune attracting new people, but keeping a loyal customer like you is far cheaper for them. That’s your leverage.

Before you call, do a quick search for what competitors like Jio or Airtel are offering new customers. Then, dial your provider and use this simple script:

“Hi, I’ve been a customer for [number] years and I’m looking to lower my monthly expenses. I’ve seen some more competitive offers out there, and I was wondering if you have any promotional rates or loyalty discounts to help bring my bill down?”

This polite question is often all it takes to get you transferred to the “retentions department.” These are the people with the power to actually give you a better deal to keep you from leaving. A quick call like this could easily save you ₹200–₹500 a month.

2. Cable & Streaming Subscriptions: Cut the Creep

One for movies, one for shows, another for sports… it’s easy to let “subscription creep” drain your account. Start by auditing what you’re actually using.

For your DTH or cable provider, the strategy is the same as with your internet bill. Call them up, mention you’re looking to cut costs, and ask about moving to a more affordable package. Often, they’ll find a way to keep you.

With streaming services like Netflix, you can’t exactly negotiate, but you can still save. If you know you’ll be too busy to watch for a month or two, don’t just let the auto-payment run. Most platforms let you “pause” your subscription and restart it later without losing your watch history. It’s a smart move that stops you from paying for nothing.

3. Credit Card Annual Fees: Don’t Pay to Be a Customer

That annual fee on your credit card can feel like a penalty. But here’s an insider tip: banks would much rather waive a small fee than lose a good customer who pays their bills on time.

Many cards waive the fee if you spend a certain amount in a year, but even if you haven’t hit that target, a polite call works wonders. When the fee shows up on your statement, try this:

“Hello, I just noticed my annual fee was charged. I’ve been a happy customer for a while now and I’d love to keep using this card. Is there any way you could waive the fee for me this year?”

It might surprise you how often this works.

4. Insurance Premiums: Get Rewarded for Being a Safe Driver

Insurance feels complicated, but there’s one area where you have huge control: your No Claim Bonus (NCB) on car insurance.

Think of it as a reward for being a safe driver. For every year you go without making a claim, you get a discount on your premium that can go as high as 50% after five years. This means you should think twice before claiming for a minor scratch. Paying ₹2,000 out-of-pocket for a small dent could save you thousands on your next premium by protecting your NCB.

For health insurance, call your provider and ask about discounts for long-term policies (paying for two or three years at once) or for adding family members to a single plan. These are standard offers that can lead to easy savings.

5. The Gym Membership: Flex Your Financial Muscles

Paying for a gym you’re not using is like buying a treadmill to use as a clothes rack. Before you let that membership auto-renew, pick up the phone.

If you’re a long-term member, call the manager and ask if they can offer a better rate to keep you. They have targets to meet and often have the flexibility to negotiate.

And if you’re just going through a busy period, don’t let your money go to waste. Most gyms, like Cult.fit, have a “freeze” option that lets you pause your membership for a few months without canceling it entirely.

6. Your Electricity Bill: The Smart Timing Hack

This one isn’t about haggling, but it’s a clever hack. Many states in India are now using a “Time-of-Day” (ToD) billing system.

It’s simple: electricity costs less during “solar hours” (daytime, when solar power is abundant) and more during peak evening hours.

Call your electricity provider and ask if ToD tariffs are available in your area. If so, you can lower your bill just by shifting when you use heavy appliances. Run your washing machine, water pump, or dishwasher in the afternoon instead of at night, and you’ll see the difference on your next bill.

7. Loan Payments: A Lifeline for a Tough Month

Life happens. If you’re facing a tough month and know you’ll struggle to pay an EMI, the worst thing you can do is ignore it. A missed payment can hurt your credit score for years.

Instead, call your bank before the due date. Calmly explain your situation and ask if you can get a temporary “loan deferment”. This is a formal process where the bank agrees to let you skip a payment without marking it as a default. It’s not a free pass—interest still adds up—but it’s a crucial lifeline that protects your credit score and gives you the breathing room you need.

You’re in Control

The single biggest mistake is assuming your bills are non-negotiable. They’re not. Companies want to keep your business, and their customer service reps are often authorized to help you if you just ask politely.

Here are two simple phrases that work almost every time:

- The Budget Squeeze: “Hi, I love your service, but I’m trying to lower my monthly costs. Can you help me find a more affordable plan?”

- The Competitor Offer: “Hi, I’ve been looking at other options and saw [Competitor Name] has a better offer. I’d prefer to stay with you—is there anything you can do to match that?”

Pick one bill from this list. Just one. Make the call today. You’ll be surprised what a polite question can do for your wallet.