Amazon, the largest online marketplace, provides the facility of Amazon's fulfillment centers through their FBA agreement with the sellers. Under this FBA arrangement, you store your products in Amazon fulfillment centers. They take care of everything from packing, shipping, and customer service of the product.

It is comparatively difficult to run the complete process of online selling on your own. There are many crucial factors and things that you need to take care of even before you can register on Amazon.

Amazon helps by taking care of the entire selling process using its economies of scale. All you need to do is provide them with a product that is worth selling in the market.

What is the sales tax?Sales tax refers to the payment made to the governing body for the sale of specific goods and services. Sales tax is something that every seller has to pay barring certain exempted goods. The only silver lining for the sellers is that they can shift the sales tax burden on the buyers. But still, irrespective of anything, it is essential that every seller pays the required tax on time to avoid penalties.

What is the FBA sales tax?

FBA Sales tax is a type of sales tax paid by the sellers when they use Amazon as the selling platform. It is important to note that you pay the sales tax to the state with which you have nexus. Nexus, in more straightforward terms, means a vital connection. Some factors determine your nexus with a state. A few of them are listed below for your reference.

- The location of the store, office, warehouse, etc. is one of the critical factors pivotal in determining your nexus with the state.

- Your dominion of a particular state establishes your nexus with the state. This rule also works when you are working from home.

- Inventory that you hold also helps in establishing your nexus with the state.

- Dropshipping creates your nexus with the state as well.

These are some of the crucial factors which help establish your nexus with the state, but these are not the only factors. Before we proceed ahead, let's look at the basic components of sales tax management.

- Determining the dominion of your nexus

- Getting sales tax permit in all the states in which you have dominion

- Getting the number of sales from Amazon to determine the correct amount of sales tax

- Filing and remitting the sales tax

While it is important to note that Amazon collects and files sales tax on your behalf, choosing to do your taxes is a better choice. One can utilize many nuances and clauses to gain some benefits.

6+ Best Amazon FBA Taxes Automation Tools & Softwares 2020

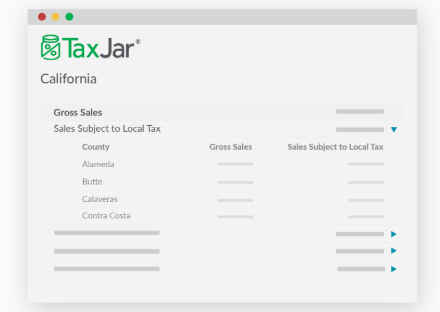

Taxjar is one of the best FBA tax automation software. It helps you in computing your sales tax, reporting your sales and tax, and also filling it. The best part about using TaxJar is that it takes care of all the tax-related formalities and functions within minutes, making it one of the most efficient tax automation software. TaxJar helps you automate Amazon FBA sales tax and benefits you across multiple platforms like Shopify, Paypal, Walmart, etc.

Used by over 15,000 businesses and developers worldwide, TaxJar helps you integrate your Amazon Seller Central Dashboard, organizing your sales tax data. TaxJar also enables you to create tax reports which are ready to use for your taxation purposes.

And this is not it. We have saved the best feature for the last. You only have to configure your TaxJar account once, and it will file your FBA sales tax report on its own henceforward. If you are still trying to find reasons to convince yourself to use TaxJar, have a look at key benefits and features of using TaxJar. These features and benefits of TaxJar should help you make up your mind.

Benefits and features of TaxJarThe biggest reason for us to hate filing our sales tax is the amount of data we need to organize and upload to compute our sales tax. TaxJar takes care of this for us. TaxJar doesn't need any sort of data upload to compute our sales tax. It automatically takes data from the Sellers Central and does the calculations as well.

TaxJar takes into account the warehouses where you hold your inventory to define the states you owe sales tax. With the help of this, TaxJar tells you precisely what you owe to which state, making filling FBA sales tax a lot easy.

TaxJar understands that there are other platforms to sell your goods as well. Amazon is not the only virtual marketplace. TaxJar supports other channels making it a one-stop solution for all your sales tax needs related to eCommerce.

TaxJar provides you detailed reports showing how much sales tax you owe to which state. You need not worry about missing the FBA sales tax payment related to any jurisdiction.

By paying a small convenience fee, you can avail of the services of the Auto filing feature. The auto file feature lets you configure automatic sales tax payment. These payments are defined quarter-wise, month-wise, or year-wise according to the business needs.

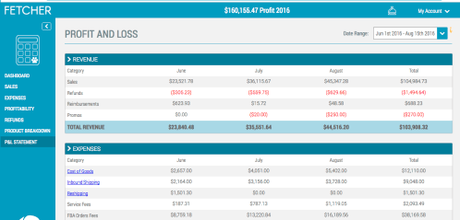

Fetcher is a financial reporting system that helps to calculate your profits, refunds, and fees accurately. Also, Fetcher provides PPC along with a host of other benefits.

Thousands of sellers on Amazon use this application to assist them by delivering analysis on ASIN based product breakdown, inventory dashboards, daily sales, Amazon fees, etc. The analysis report that they submit is accurate and insightful, supporting crucial decision making.

No service is complete without efficient customer service, and Fetcher also offers round the clock support for all EU stores. Some of these stores are located in Mexico, Canada, and the USA. The majority of sellers say that Fetcher is an indispensable part of their operations.

Key features and benefits of FetcherWith the help of ASIN based product breakdown, Fetcher provides you a detailed report of your financial sales related transactions.

Fetcher makes sure that you know how much stock you own and how much production you need to do.

Fetcher offers you round the clock customer support. No matter at what point of time a doubt arises, they will have a solution for you in no time.

Fetcher provides you with massive coverage through its presence in many European countries.

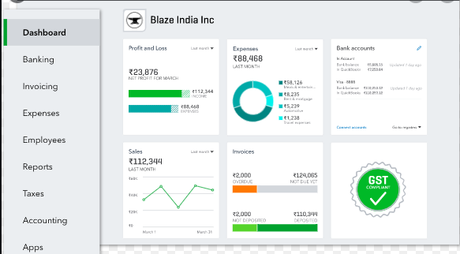

As the name suggests, this leading accounting software specializes in providing quick solutions in the form of financial books. They offer you custom reports which can be readily used by businesses.

One of the market leaders in accounting softwares, it is ideal for small business owners as it delivers customized reports and allows invoice delivery even when using the app on a smartphone.

QuickBooks app helps you to import your bank transaction details and sort them by tax categories when filing your tax returns. The platform is easy to use, and navigation is relatively simple. Even individuals without an accounting background do not face any issues.

QuickBooks boasts of a base of 5.6 million users worldwide. More than 90% of the apps customers find it an essential aid in making their business operations smoother, thus this tool needs to be in your kitty if you do your accounts for Amazon FBA.

Key benefits and features of QuickBooks

Quickbooks is ideal for small scale business. They have customized template solutions

that makes it perfect for small firms looking to file their Amazon FBA sales tax.

QuickBooks is unique because it is one of the few similar service providers which support mobile applications. This mobile application provides you access to your sales tax details on the go in the most convenient manner.

Quickbooks have a very user-friendly interface, which makes it perfect for those who do not have an accounting background. This need for technical knowledge and skills is one of the reasons why this software has gained popularity in recent times.

Understanding that no business is alike, Quickbooks provides customized reports which are ready for further uses.

A2X is accounting software that helps you account for your Amazon marketplace sales. A2X is accurate, quick, user friendly, and allows Amazon sellers and accounting firms all over the globe. A2X supports the top 11 Amazon marketplaces helping you keep track of almost everything from sales, fees to inventory.

It is important to note that A2X automatically fetches and works on any new settlement file which Amazon uploads. It does all the calculations and gives you the sales-related figures like sales amount, expenses, and other transactions.

There are many reasons why A2X is a trusted source for AMazon FBA related parties like sellers, developers, accountants, etc. Here is a list of some key benefits and features of A2X, which makes it so efficient.

Key benefits and features of A2XA2X provides simple accounting solutions that enable you to concentrate on other business functions.

With the help of automation function, A2X helps you save a lot of valuable time. You just have to configure this function once, and it will automatically file the sales tax periodically without any miss.

A2X makes sure that you get the most accurate and reliable data based on which you can make business decisions. It is important to note that you do calculations according to the standard formulas with efficiency.

A2X allows you to import your inventory data every month. It also helps you in the stock evaluation and saves you from a lot of technical work.

A2X supports the calculation of your profitability. Provide your cost per unit, and A2X will create a clear picture of your current financial status.

Perfect for small scale businesses, Bench.co specializes in turning your data into easy to understand and tax ready financial statements. This availability of readymade templates makes this service ideal for those who do not understand the nuances of filing tax returns or simply do not have the time.

They have an in house, dedicated team of accounting professionals who respond to your query within one business day. These quick responses ensure that you get a resolution to your problem in the most timely manner possible.

With the human factor's involvement, they make sure that you get simplified accounting books saving you precious time. Bench.co provides the best Amazon FBA sales tax solutions with the right harmony of human touch and technology.

They have their business process sorted to the notch. Let's have a quick look at how Bench.co works.

- Understanding your business needs

- Giving you an overview of

- Dedicating a book-keeper to your business

- Monthly procurement and analysis of your data into easy to read financial statements

- Delivery of reports

They have simplified the accounting process to the maximum extent possible. Now that we know how Bench.co works, let's look at key features and benefits of using Bench.co.

Key benefits and features of Bench.coBench.co dedicates one book-keeper to your account. This dedicated resource allocation helps in calculating accurate financial statements. Book-keeping can be a long and tiring process. Bench.co makes sure that you don't have to struggle with it.

Filling of FBA sales tax returns can be a tedious task. It is also essential that you don't commit any errors when computing the amount of sales tax that you owe to the government. Because even a slight mistake can cause legal action against the business. With the help of expert book-keepers, Bench.co provides ready-to-use and accurate financial statements prepared.

By taking into account every minute transaction on a real-time basis, Bench.co provides financial reporting solutions. They generate easy to understand and use financial reports.

They provide you with a direct line to your book-keeper who will readily offer you answers to all your questions in no time through their advanced platform. These book-keepers are very well trained and experienced in the financial domain.

Avalara is one of the most efficient FBA Sales Tax filling software out there. Avalara synchronizes with Amazon Sellers Central and obtains all the necessary data on its own. You don't need to manually upload your files to the software, which saves a lot of time.

The process of sales tax computation is lengthy and needs a lot of effort. This complexity in filing the sales tax is a crucial reason why these automation software have found a need in the market. Avalara makes sure that the only thing you have to worry about is your product's sales. The Amazon FBA sales tax will be taken care of by Avalara on your behalf.

Allowing you to have control over your data, Avalara will enable you to tag respective locations with the transactions. This tagging of locations helps in determining the amount of sales tax owed under different jurisdictions.

With the help of local experts, Avalara supports FBA Amazon sales tax filing in many countries. They specialize in automation of tax and VAT reporting, VAT registrations and tax returns filing, and eCommerce taxing solutions.

Their software is highly efficient and automates your financial reporting, providing reports which are ready for tax-related uses. In addition to AI-based FBA sales tax calculations, they also have an in-house team of expert accountants. This team of experts also does the filing for you.

Key benefits and features of AvalaraThrough the synchronization of sales figures with the software, Avalara provides automated financial reports without any scope of error.

Avalara supports multiple virtual shopping platforms like Amazon, Shopify, etc. They support various formats like CSV data files, which helps its functionality across multiple servers enabling it to provide tax solutions.

Once you register with Avalara, they will make sure that you never miss any crucial sales tax-related deadlines by sending you regular notifications and reminders. This service of providing notifications is possible because of a sizable in-house team that takes care of everything for you.

Connecting with your Amazon Sellers Central account, Avalara helps you keep track of all your FBA inventory. Not only just an inventory tracker, but Avalara also reports detailed state wise sales providing you real-time status of your business.

No matter the season or the time of the year, their prices remain the same throughout the year.

There is so much that softwares can do for you. With the help of expert support, they make sure that nothing bothers you when it comes to filing your FBA sales tax.

Need for Amazon FBA sales tax software and service

Few amongst us have accounting and tax degrees, and they can certainly do their taxes. The majority of us are laymen and will flinch on some basic accounting principles, let along laws and regulations. This lack of expertise makes it essential that we hire an expert on this matter.

This point where an expert is needed is where this Amazon FBA sales tax software comes in. These softwares are specially designed on the algorithms which help you calculate the amount of sales tax that you owe. Some of these applications even pay the sales tax for you.

Here are some of the primary features and benefits of these Amazon FBA sales tax software and service providers.

All these softwares help you automate the process of sales tax calculation. Some of these softwares also host in-house accountants that are readily available for your sales tax queries.

By synchronizing these softwares with Sellers Central, you can get easy access to detailed various reports. These reports provide you with important insights enabling you to make essential business decisions.

Making financial statements is not an easy task. It takes proper education and training if you want to make your financial statements. These softwares use the data which you can provide through various channels to create your financial statements.

The calculation of the sales task is the primary function of all these applications and services. However, some of these software companies and service providers also file the sales tax on your behalf. Naturally, you have to pay a small convenience fee for it.

By keeping a real-time track of the sales and other transactions, most of these software helps you keep track of your inventory and supplies.

Now that we know why these sales tax resources are important, let's have a look at some of them.

Quick LinksConclusion: Best Amazon FBA Taxes Automation Tools

While this is no rocket science, it is not very simple to file your Amazon FBA sales tax. If you have a basic know-how of accountancy, you can still consider doing this by yourself. But, there is no guarantee that you will be able to generate accurate reports.

This need for accuracy and efficiency makes it essential that you refer to professional software or service. There is no dearth of these services and software out there. It is crucial that you take your time to finalize which software or service you should use. Consider all the features and services that all of these are providing. Then, try to compare these services with your needs. Only finalize on an Amazon FBA sales tax software after you have compared the services that this software have to offer with your business requirements.