-Brought to you by www.stockflock.co

As a beginner in investing, it can be hard to understand complex financial statements. But in fact, there are only a handful of key points you should take note of.

Here are 4 simple steps for you to have a good picture of a company's health.

1.Valuation. Is the stock too expensive?Just like when you do your shopping, you want to find the cheapest store to buy from. The same principle applies for investing. You wouldn't want to buy a company that is too expensive.

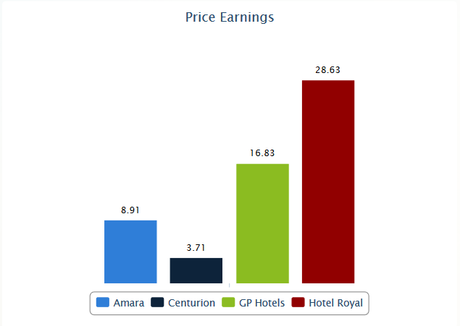

Here is the chart of Amara, a hotel operator of the luxurious Amara Sanctuary Resort in Sentosa. First, we look at the Price-earnings of Amara. It runs at 8.91, the lowest among the 3 competitors. That makes Amara the cheapest company to invest in as compared to its competitors.

2.Earnings growth. Is the company growing?

We want to invest in companies that are growing. Amara's growth has been stagnant for the past 5 years, hence it does not have an exciting growth story. However, that could pick up once Amara Signature Shanghai opens in China.

3.Returns for investors. How much can you make as an investor?

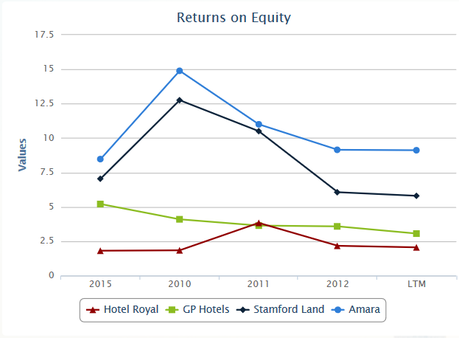

There are two important things we look at. We want to know how much returns can the company generate for its shareholders, and of course, the more the merrier. For that, we look at Return on Equity, also known as ROE.

Amara definitely generates the best returns for its investors as compared to its peers. Over 8% returns for the past 5 years? That is a good business to be in. If they keep this up, the share price should increase year after year.

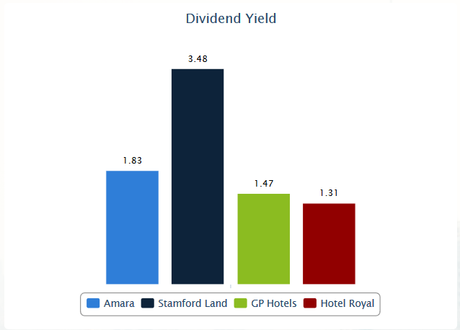

The second factor to look out for is dividend yield. Amara gives only 1.87% dividend yield. If you are looking for passive income, then this stock is probably not for you. In fact, all 4 hotel companies give low dividends so investors should be looking for capital gains from rising share price.

Insolvency risk. Will the company go bankrupt?

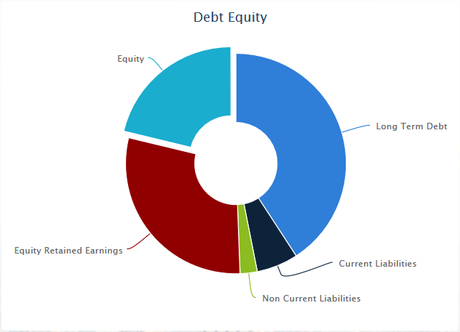

No matter how fast the company is growing, you must always pay attention to the risk of a company not being able to pay its debt. History has proven that fast growing companies often borrow too much and when they fail, investors suffer. Therefore you should stay clear of companies that borrow excessively.

As seen from the pie chart above, Amara has almost 50% debt and 50% equity (slightly more equity). This is on the high side. A safer proportion will be 30% debt and 70% equity. Nonetheless, it is manageable for now but investors should be mindful if Amara's debts keep rising.

Access to all the information on Singapore listed companies are now available for you to help you invest better. Simply log on to www.stockflock.co for a full suite of resources you need.

*This is a sponsored post brought to you by the Stockflock Team