The web 3.0 ecosystem has proven time after time that predictions and projections are only sometimes bound to happen. And one cannot necessarily predict that a current good year will translate to a good next year. Even though Web 3.0 is still in its infancy, it plays a significant role in global economies.

Non-Fungible Tokens, or NFTs, are one of the most prominent use cases from web 3.0. It is unbelievable that three years ago, barely anyone knew what NFTs were or what they could do. Despite the massive adoption amongst celebrities, many people still saw NFTs as mere JPEGs or an over-hyped technology. But NFTs have proven to be more than that; this year, it took that a step further.

This year heralded NFTs into one of the space’s best rallies ever witnessed. Coming off a strong performance in 2021, 2022 started on a similar footing and maintained a strong performance through the first half of the year. During that time, investments flowed into the NFT community, and the technology slowly crept into significant sectors of the global economy, such as sports, gaming, and entertainment.

For brands and celebrities, it was an unmissable chance to become a part of what many consider the future. Popular brands such as Nike, Instagram, Reddit, and Starbucks forayed into the NFT space with varying results. Celebrities who missed the 2021 chance dived into the NFT market. For oldtimers like Snoop Dogg, it was a question of what could be done with the technology. We got a glimpse of that when the rapper, alongside Eminem, debuted the Bored Ape Yacht Club NFTs in his music video. It was the world’s first and an indicator of more to come.

More than any other thing, NFT brought more mainstream attention to cryptocurrencies in general. Users hoping to buy an NFT had to first get acquainted with cryptocurrencies and how they worked. Not only that, but users also had to understand the underlying technology behind blockchain and what differentiates one blockchain from the other. After all, many users opted into the space to flip for profit or invest. Logically, they would want to know which blockchain or platform favored them better.

The success stories were, however, short-lived. From the start of the second half of this year, the NFT ecosystem witnessed extreme volatility, reduced user activity, and trade volume. Are NFTs to blame? No. But the crypto world co-interacts and users predominantly see danger in an aspect of the crypto world as danger in all. Several institutional collapses in the larger crypto world reduced trade volumes and user sentiment. Compared to 2021, it became evident that users are more prudent with their spending.

Without further ado, here is the NFT market report for 2022.

NFT market performance in 1st. Quarter of 2022

The year 2022 started with a mixed performance. The rallying performances recorded from Q3 2021 lost steam, and the entire market took a breather. With several media outlets predicting that the NFT bubble could burst in Q1 2022, a slowdown was expected.

The result was less NFT speculation and stability, which was good for the market. The percentage of resales at losses also reduced too. The slowdown, however, elicited mixed responses from those who hoped for the peak performances of 2021 to continue. From the metrics considered, the number of short-term resellers increased significantly.

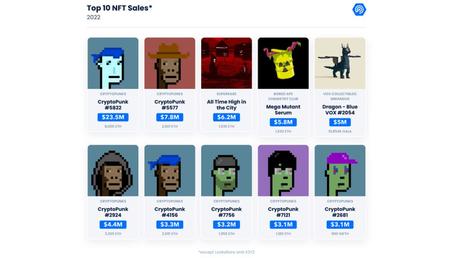

Despite this slow start, Q1 2022 had the highest trade volume ever recorded in a quarter. NFT collectibles enjoyed a good run and an increased trade volume. In addition, the largest profit margin was recorded following the sale of a CryptoPunk four years after the seller got it.

NFT Market hits its new records – highest market capitalization ever

The NFT market lost steam following the rapid increase in the price of cryptocurrencies, which made many NFTs expensive. According to data from NonFungible, the cost of NFTs between Q4 2021 and Q1 2022 increased by almost 80%.

The number of new projects introduced into the market slowed down. Instead, users focused on popular projects already in circulation. Blue-chip NFTs such as Bored Ape Yacht Club enjoyed increased trade volumes and attention. Overall, sales in the NFT market slumped by almost 50%.

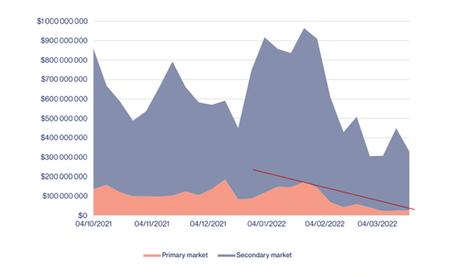

On the primary market, trade volumes declined due to a slowdown in the introduction of new assets to the market. The secondary market, however, had a good run, comprising about 70% of the sales volume. Compared to 2021, when the secondary market represented 47% of transactions, the decline in primary sales showed that the frenzy around new NFTs has dropped.

The number of active wallet addresses also declined too. This was probably due to the price of NFTs, which were too expensive for the average user. Also, the market stabilized to an extent, forcing short-term sellers who were expecting price pumps to sell at a profit to sell at a loss. Data from NonFungible point to 150,000 active wallets per week. Compared to 280,000 in October and 380,000 in November, the data shows that active users in the NFT market declined significantly.

Yuga Labs dominates the market.

Yuga Labs, the company behind top NFT collections Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC), acquired CryptoPunks and Meebits. CryptoPunks was one of the earliest PFP (profile pictures) and a leading NFT collection in trade volume and sales. The acquisition of CryptoPunks, in addition to the BAYC and MAYC collections, made Yuga Labs the dominant name in NFT collectibles.

According to DappRadar, Yuga Labs acquired 423 CryptoPunks and 1,711 Meebits from Larva Labs. At that time, CryptoPunks had an average price of $177,000, and Meebits was going for about $16,000. While the deal details were not made public, DappRadar estimates it could be up to $100 million.

NFT collectibles take center stage in the NFT market

NFT collectibles were the leading segments of the NFT market for the quarter. Collectibles made up most of the trading and sales volume recorded. After months of training behind, BAYC finally toppled CryptoPunks as the most active project in the NFT market.

The Yuga Labs superstar collection raked in $1.2 billion in Q1 2022. Azuki, a new project, came in second, while previous market leader CryptoPunks took the third spot. BAYC topped profits with $500 million in profits in the first quarter. However, the collection also had the highest losses, with $90 million.

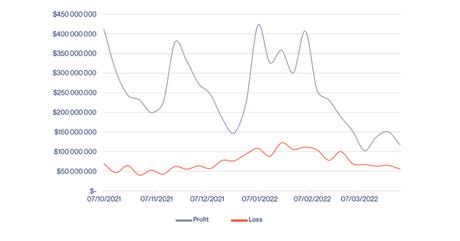

Many NFT traders in Q1 2022 sold in profit. In February, led by speculative trading, collectibles and PFPs resellers reached a peak profit of $268 million. The NFT market also recorded its most profitable sale ever. CryptoPunk #5822 holder sold the NFT after more than four years, making over $23 million in profit.

The gaming segment of the NFT markets struggled to hit high trade volumes. Instead, the segment sustained losses reaching over $14 million weekly. Many NFT game traders were reselling at a loss as attention turned to collectibles.

Art NFTs, however, enjoyed a stable run, although quiet. Resellers had a good quarter, with close to $28 million made collectively per week on resales. The metaverse segment dragged along, although with low losses on resales.

NFT market performance in 2nd Quarter of 2022

The second quarter of 2022 saw more trade and sales volume declines than the first quarter. This decline was caused by the bear market that started in the second quarter. As a result, cryptocurrencies fell in value, and so did NFTs.

The war in Ukraine and other macroeconomic factors within the global economy and the crypto world affected NFT performance. Of importance is the Terra Luna crash, which wiped $17 billion off the market. While the stablecoin isn’t used directly in NFT trading, its collapse nonetheless led to a liquidity crunch.

Individual collectors and institutional investors held back on their money. The majority of NFT resales ended in losses, with minimal profits.

NFT Market suffers liquidity crunch

The NFT market slipped further into a bear market. This quarter kickstarted the bear market that would shape the rest of 2022. Primarily, the decline happened due to the fall in the price of cryptocurrencies. Following Terra Luna’s collapse, users and investors became weary of risky assets. Ether, the most widely used cryptocurrency in NFT trading, lost 66% of its value between April and June.

According to Nansen’s Blue Chip-10, an index that tracks the ten largest collections by market cap, the prices of the top ten NFTs reached an all-time high in May. Also, data from NonFungible show that the volume of NFT sales dropped from over 12 million in quarter one to 10 million in the second quarter.

The volume of resale profits fell from $3.5 billion to about $1.8 billion, representing a significant 50% drop. Secondary sales volume also lost steam from its first-quarter performance, representing just 48% of total sales in the second quarter.

The primary market, however, picked up pace courtesy of project drops during the quarter. Sales volume remained high and peaked at 600,000 in June. That showed that creators introduced new projects into the market but at relatively low prices.

OtherSide Launch puts Metaverse in the limelight

Yuga Labs launched their highly anticipated gaming Metaverse OtherSide. The launch was one of the biggest this year, with the company generating over $300 million from primary sales. On secondary marketplaces, resales of the NFT broke the 24hr trading on OpenSea.

The launch singlehandedly drew more attention to Metaverse NFTs. As a result, Metaverse NFTs performed better after a silent Q1 2022 and Q4 2022. At the end of the quarter, Yuga Labs had four collections on the top five NFTs by trading volume – BAYC, CryptoPunks, MAYC, and OtherSide.

NFT Collectibles trades declined

NFT collectibles fell in trading volumes as people avoided risky assets. The liquidity crunch also meant that users chose to hold unto their money rather than invest it into crypto or NFTs. As a result, the quarter experienced a mixed performance.

Of all the NFT segments, collectibles suffered the most significant decline in the quarter. Gaming NFTs continued their descent from the previous quarter. Metaverse NFTs, on the other hand, increased by almost 25%, courtesy of the OtherSide 100,000 NFT plots. Utilities NFT also registered a positive performance and experienced a 40% increase between the start and end of the quarter.

Yuga Labs finished the quarter with another strong performance. Two of its collections – BAYC and OtherSide – raked in $2 billion in trade volume. Added to the trade volume of CryptoPunks and MAYC, Yuga Labs collections generated 30% of the trade volume recorded in the entire NFT market during Q2 2022.

NFT market performance in 3rd. Quarter of 2022

The third quarter of 2022 saw more turbulent collapses, which caused more fear in the market. These institutional collapses further slipped the market into a deeper bear marker, with little hope of a fast recovery. Despite the liquidity slowdown, many promising projects emerged, offering new applications and use cases.

On the downside, the FTX collapse further complicated the bearish state of the market. It also placed more regulatory watch on digital assets as countries sought to protect their citizens.

NFT Market struggled against the Crypto winter

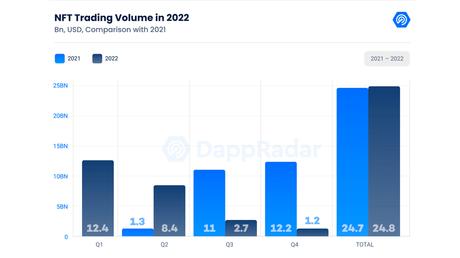

The NFT market continued its fight to hold its weight above the crypto winter. The third quarter marked a continuous decline in sales volume, which started in the second quarter of 2022. According to DappRadar, NFT sales slipped to $3.4 billion from $8.4 billion in the second quarter and a peak of $12.5 billion in the first quarter of the year.

Sales of NFTs dropped too, as users became weary. Falling cryptocurrencies meant a fall in NFT prices, which forced a lot of short-term sellers to sell at a loss. At this point, only long-term investors were confidently holding on to their digital assets. As the bear market waged on, people avoided speculative and risky assets.

Blue Chip NFTs trade volumes drop

Blue chip NFTs considered by many as safe digital assets were not spared too. While the top 11 blue chip collections maintained their floor price, trade volumes dropped drastically. At the end of Q3, blue chip NFTs recorded a trading volume of $334 million, an 88% decline from the previous quarter. A trading volume that low was last recorded in the second quarter of 2021.

Nonetheless, Yuga Labs continues to dominate, with its collections charting top in trade and sales volume. At the end of the third quarter, Yuga Labs NFT collections made up 46.21% of the whole NFT market cap. On the other hand, the newcomer Azuki collection experienced a month-to-month increase of 43.18% in its floor price.

OpenSea sales volume dropped

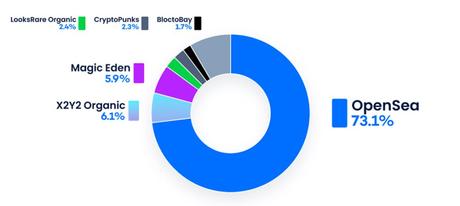

OpenSea, the largest NFT marketplace in the world, faced new competition from emerging NFT marketplaces. Sales on OpenSea also tanked for a fifth consecutive month in September. According to data published by market analytics platform Cryptounfolded, sales on OpenSea plummeted by 60% in the third quarter compared to the second quarter of 2022. Data from Dune Analytics also showed that sales volume on Opensea dropped from $5.2 billion in January to around $349 million in September.

NFT market performance in 4th. Quarter of 2022

NFT market activities stabilized in the final quarter of 2022 after a run of two turbulent quarters. The trade volumes are down from the peak in January, and the user activities are yet to pick up.

New projects and collections entered the market, and new NFT marketplaces picked up the pace, posing a threat to OpenSea’s dominance. Yuga Labs ended the quarter as the clear leader in NFT collectibles and metaverse NFTs.

NFT market stabilizes as the year closed

The market capitalization of the NFT market picked up steam, but the FTX collapse continued to hurt the market. Ailing ETH prices meant NFT prices decreased during the quarter. As of November, the market cap was at 3.87 million ETH, approximately $5.4 billion at an ETH price of $1,389. The market cap stayed the same in December, but ETH had dropped to around $1,274, leaving the market cap at around $4.7 billion.

Despite the crypto winter, trading volumes at the end of 2022 topped 2021 by 0.41%. Considering the pace at which the NFT market moved in the first quarter of 2022, the data shows that the space experienced massive drops in trade and sales volume.

However, the sales count dropped in the fourth quarter, as was recorded during the third quarter. On-chain metrics show that the fourth quarter recorded 10.91 million sales, a 58.15% drop from the sales count in Q4 2021.

Yuga Labs assets continued to dominate, ending the year strong

Yuga Labs rallied through the fourth quarter the same way it started the first quarter. While people generally avoided risky assets, most traders still opted for blue chip collections which they believed wouldn’t lose value out of the blue.

Yuga Labs NFT collections retained the top spot and dominated the market in sales and trade volume market. At the end of Q4 2022, the company’s NFTs represented 55% of the $15 billion market cap of the top 100 most valuable NFT collections.

OpenSea faces challenge from new NFT marketplaces

The last quarter in 2022 ushered new participants into the NFT marketplace space. New marketplaces that also launched during the year picked up the pace, posing a threat to OpenSea’s dominance.

Blur, a marketplace launched in October, was a top 10 NFT marketplace by trading volume by December. Within two months of its launch, Blur recorded over $205 million in trading volume. Similarly, X2Y2, a new entrant to the NFT marketplace space, experienced over $1.5 billion in trading volume in its first year. The trading volume puts X2Y2 among the top 10 NFT marketplaces in the world.

To draw users to their platforms, the new marketplaces offer lower commission fees and optional royalty fees on secondary sales of NFTs. While there is an ongoing debate on whether royalty fees should be made optional or removed, some marketplaces are leveraging it as their selling point.

Nonetheless, OpenSea continues to dominate in terms of trade and sales volume. Reddit NFT marketplace, another newcomer, dethroned OpenSea as the leader in user count.

Leave this field empty if you're human: