I intend to add back on the core long position anything that goes towards the 2000 pivot support with a stop at SPX 1980 for long and intermediate term. This consolidation could take a while, but I want to have the core position on to protect against the melt up scenario. I want that position for the run to SPX 2400. As long as this bull wave is right, the next significant pullback would not be until March 2015.

Now, there is always a bear path and a bull path as I say. I have one indicator that has a bearish analog on it. It would put us roughly at the late July 2011 time frame, which would mean a huge 2 week drop from this week into the November cycle lows. I have zero confirmation of that happening from any other indicators so I am ignoring it. The SPX 1980 stop would protect me anyway.

There is always a bull path and bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

I intend to add back on the core long position anything that goes towards the 2000 pivot support with a stop at SPX 1980 for long and intermediate term. This consolidation could take a while, but I want to have the core position on to protect against the melt up scenario. I want that position for the run to SPX 2400. As long as this bull wave is right, the next significant pullback would not be until March 2015.

Now, there is always a bear path and a bull path as I say. I have one indicator that has a bearish analog on it. It would put us roughly at the late July 2011 time frame, which would mean a huge 2 week drop from this week into the November cycle lows. I have zero confirmation of that happening from any other indicators so I am ignoring it. The SPX 1980 stop would protect me anyway.

There is always a bull path and bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

Business Magazine

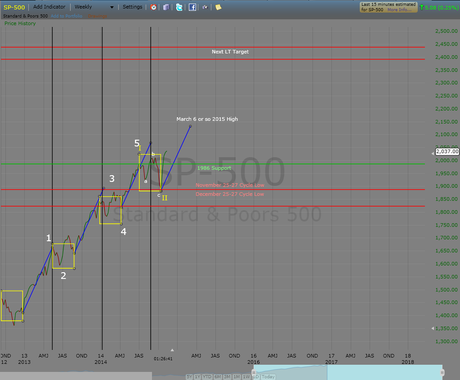

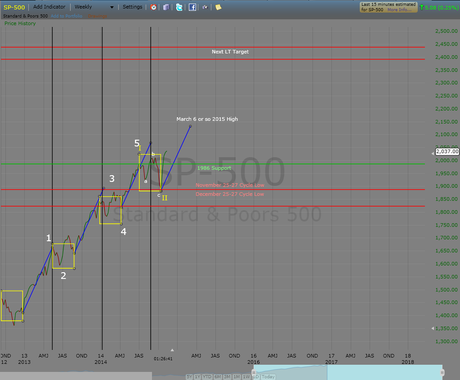

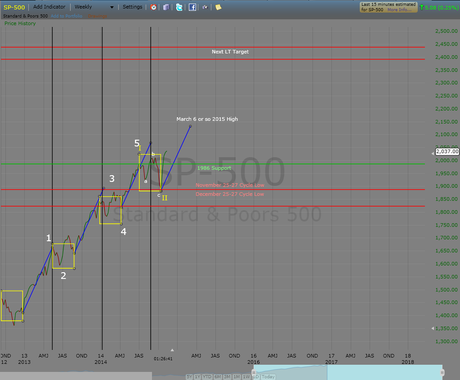

As you know, I have been bullish off the October 15 Bullish reaction and confirmation. October 15. We have harvested along the way. Harvested and Harvested. Staying with the bullish wave as the primary thesis I am looking for the next dip to buy. The Next Dip Buy. I recently laid out the most extreme scenario for the bullish case just so I would know what it looks like. Deep Pullback Scenario.

That Deep Pullback scenario is possible, though I doubt it. I think at the most likely worst the bull market would likely find support at the 1986 level either on the November or December cycle low. Here is the chart:

I intend to add back on the core long position anything that goes towards the 2000 pivot support with a stop at SPX 1980 for long and intermediate term. This consolidation could take a while, but I want to have the core position on to protect against the melt up scenario. I want that position for the run to SPX 2400. As long as this bull wave is right, the next significant pullback would not be until March 2015.

Now, there is always a bear path and a bull path as I say. I have one indicator that has a bearish analog on it. It would put us roughly at the late July 2011 time frame, which would mean a huge 2 week drop from this week into the November cycle lows. I have zero confirmation of that happening from any other indicators so I am ignoring it. The SPX 1980 stop would protect me anyway.

There is always a bull path and bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

I intend to add back on the core long position anything that goes towards the 2000 pivot support with a stop at SPX 1980 for long and intermediate term. This consolidation could take a while, but I want to have the core position on to protect against the melt up scenario. I want that position for the run to SPX 2400. As long as this bull wave is right, the next significant pullback would not be until March 2015.

Now, there is always a bear path and a bull path as I say. I have one indicator that has a bearish analog on it. It would put us roughly at the late July 2011 time frame, which would mean a huge 2 week drop from this week into the November cycle lows. I have zero confirmation of that happening from any other indicators so I am ignoring it. The SPX 1980 stop would protect me anyway.

There is always a bull path and bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

I intend to add back on the core long position anything that goes towards the 2000 pivot support with a stop at SPX 1980 for long and intermediate term. This consolidation could take a while, but I want to have the core position on to protect against the melt up scenario. I want that position for the run to SPX 2400. As long as this bull wave is right, the next significant pullback would not be until March 2015.

Now, there is always a bear path and a bull path as I say. I have one indicator that has a bearish analog on it. It would put us roughly at the late July 2011 time frame, which would mean a huge 2 week drop from this week into the November cycle lows. I have zero confirmation of that happening from any other indicators so I am ignoring it. The SPX 1980 stop would protect me anyway.

There is always a bull path and bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

I intend to add back on the core long position anything that goes towards the 2000 pivot support with a stop at SPX 1980 for long and intermediate term. This consolidation could take a while, but I want to have the core position on to protect against the melt up scenario. I want that position for the run to SPX 2400. As long as this bull wave is right, the next significant pullback would not be until March 2015.

Now, there is always a bear path and a bull path as I say. I have one indicator that has a bearish analog on it. It would put us roughly at the late July 2011 time frame, which would mean a huge 2 week drop from this week into the November cycle lows. I have zero confirmation of that happening from any other indicators so I am ignoring it. The SPX 1980 stop would protect me anyway.

There is always a bull path and bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester