With the world going digital and businesses getting online, digital and online payments have become unavoidable. In fact, the day and age we live in literally ask us to have digital solutions ready for almost everything, then why not payments!

To be able to transact online is a boon for many of us who are not too fond of carrying cash everywhere or paying a visit to the ATM now and then. Swiping a card or simple transacting with internet banking comes much more comfortable for our generation. Although internet banking is a lot simpler now than when it started off years ago, some of us still find it cumbersome and look for alternatives.

This is where Paypal and tools like it come and fill in the gap for us.

To give a brief of what exactly Paypal is- it is an online payment method that lets you make your payments for various merchants, big and small, such as Amazon and eBay. All you need to do here is fill in and store your bank details and reuse it whenever you would like to make a purchase online. This payment method helps you save time by letting you skip the step of filling in your credit card details everytime you decide to make a payment.

The process is password protected, ofcourse with robust security screening before you can proceed to make a payment.

Owing to the ease of operation, many other tools have come up in competition to Paypal. There is no doubt that Paypal is the pioneer in this domain. However, the other, newer solutions that have popped up are not far behind either.

Let's take a look at some of the competitive alternatives of Paypal that you should give a shot to-

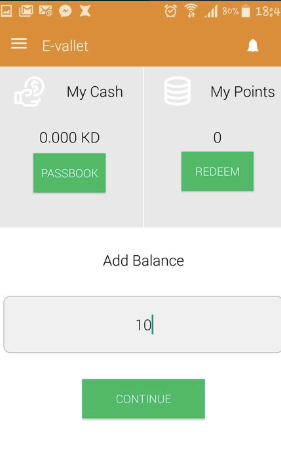

1. Venmo:Venmo is a digital wallet that lets you transact and make payments in a secure environment. You can either choose to transfer and store some amount of money in your Venmo wallet keep making payments until the money is all used up or you can also link your debit and credit cards to make your payments directly.

A fun fact that a lot of people are not aware of is that Paypal and Braintree own Venmo. So you do not have to worry about the safety and security of this particular platform as reliable names of the industry and strongly associated with it.

Let's talk a little bit about the operating of the product:

As you enter the platform, your first step would be to scan your fingerprint, or you can also choose to enter the PIN. You will then be asked to fill in details for the person you are about to pay- their username, email address, or their Twitter handle to ensure you are filing in the right person's details.

Then you need to confirm, whether you are paying the person or requesting a payment from the said person. After choosing the relevant option, you will then be taken to another screen to specify the amount. After all of these steps, you can select to transfer the money post which you will receive a confirmation for the same. A confirmation message will also be sent to the other party to notify them of the payment made at your end.

The app is available for iPhone, Android, and BlackBerry. You can also access Venmo's services through their official website.

Another exciting feature that Venmo offers is the 'Business' side of it. If you are a business and you wish to provide an online payment capability to your customers, you can sign up on Venmo as a business too. By doing so, you will not only make the entire payment more simplified for your users but also make it easier for yourself to be working with them.

Again, all financial and bank related information is encrypted and kept confidential from all parties involved.

2. Dwolla

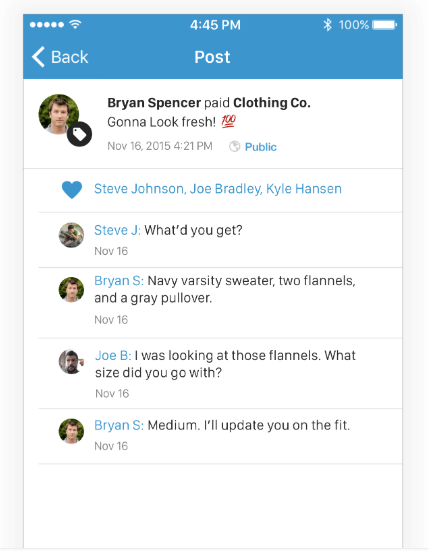

Another platform to move money and make transactions seamlessly, Dwolla is also a reliable name in this domain. They were founded in 2008 and began with a mission to transform the electronic payment industry. Much on the lines of Paypal, Dwolla serves as an excellent alternative in case you are not keen on using Paypal so much.

Although their features are very much similar to a Paypal or Venmo, their marketing strategy mostly focuses on the developer community. While keeping all the financial details and other user information private and safe, the platform gives a chance to the developers to scale the platform as required.

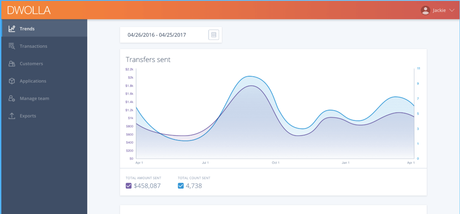

User Interface: Apart from the regular features, Dwolla is primarily known for its excellent User Interface and their precise focus o delivery a good user experience on the platform. The Dashboard, in particular, has been praised for its concise summary of information that is shared for the user to look at. It not only gives you a quick look at all the payments made, and transactions are processed but also an overall view of the business trends. Here, you can even manage users and see the payments they are a part of.

Integrations: Dwolla has also gone the extra mile and made integration with other reliable platforms to enhance the security and efficiency of its platform. Their integration with Plaid takes care of bank verification. They help you quickly verify and authenticate your customer's bank funding sources. Other than this, they also have integration with Sift Science for Fraud Monitoring. It enables you to stop fraudsters in real time by collecting data on a global scale.

3. Google Wallet:

Another virtual wallet in the industry, Google Wallet is also a highly reliable platform. Coming from Google itself, it allows the users to make payments and transfer money straight from their devices. However, an interesting fact here is that the bank information and other confidential user data is not available on the device. Instead, it is sent on the Google servers. As a result, the transactions take place between the Google server and the merchant directly.

Although they do have a mobile app, they also provide a Google Wallet physical card, which you can use as a debit card or even a gift card! To mention a limitation, Google Wallet was seen discontinuing their payment processes for certain digital goods such as ebooks and online games and music, but on the other hand, they are also planning to expand in the hardcore e-commerce sector, primarily focusing on physical goods merchants.

Another interesting feature available here is 'Split.' On taping this button, you will be asked to choose up to 5 friends to split the bill. You get the option to edit the amount for each of these people and accordingly lets you pay. There is no fee charged for using these services, except for the amount charged by your bank on using a credit card linked to Google Wallet.

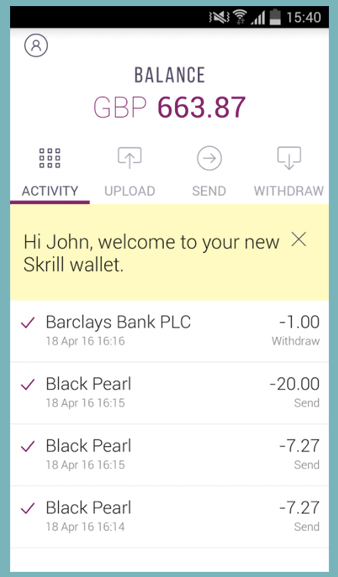

4. Skrill:

Skrill has positioned itself a little differently in this market. Probably to beat the competition, such positioning was required. They go all out in saying that Skrill and it's platform is not just about making payments and transferring money but staying connected to people in some way or the other.

The platform ensures the 'connecting' factor by offering features and functionalities like betting online, online gaming and even transferring funds internationally! Not just this, there is also a way to go shopping while using this platform.

Other than these features they have two programmes by the name of VIP and Ambassador.

VIP Programme: With this programme, Skrill makes sure that you transact a minimum amount in a certain period to maintain the VIP status. In exchange, you get some benefits like special offers, more security and some other added advantages which you reap as you go.

VIP Ambassador Programme: This particular programme is sort of like one level up from the VIP Programme. You achieve this over a period and in return there are tonnes of benefits that are pretty tempting. IP Ambassadors receive an increased revenue share, more commission and have direct access to the VIP Ambassador team. The revenue share you earn is credited daily to your Skrill account.

Note that even though most transactions on Skrill are not chargeable, however, there might be some transactions that would require a certain amount of fee. You will get the explicit notification before you make any purchase through the platform.

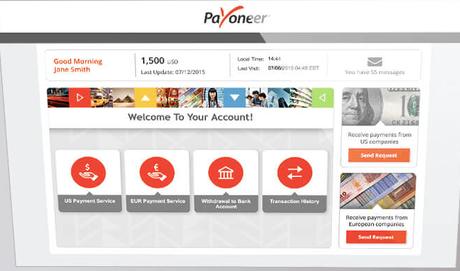

5. Payoneer:

Headquartered in New York, Payoneer is a financial services company founded in the year 2005. The platform facilitates transactions and money transfers both internationally as well as within the user's country. The platform can now easily boast of more than four million users all spread across over 200 countries around the world.

Now that you've got an idea of the establishment and popularity of Payoneer let us move on to knowing a bit more about this platform's features and their pros and cons. Firstly, it is essential to understand that Payoneer's USP lies in their seamless capability of fund transferring, not making payments. USers tend to avoid making payments via their cards on Payoneer as they charge a right amount of fee for it. Hence, it is useful for businesses who are into transferring funds more often and require B2B payments now and then.

Mobile App: They offer a seamless mobile application for both Android and iOS where you can quickly check your account balance, multiple transactions, and fund withdrawals. But, you will not be able to make payment through Pioneer mobile application, which is a considerable drawback of the product. And many users have shared missed responses for this particular missing functionality.

eCheck Processing: As per this functionality, you can make payments online through Payoneer, and there are as such no charges for availing this feature. However, each transaction is a paid one and might incur a fee as per your bank regularities.

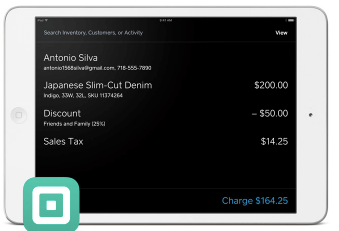

6. Square:

Probably one of the most popular out of the lot, Square has won its share of popularity because of the ease of transaction fee it provides. There is no monthly fee, no need to maintain a minimum amount, and merchants get spectacular deals without having them to be old users.

Among its many advantages, there is also a shortcoming that most people are happy to ignore. Since the platform is a third party processor, it usually ends up terminating accounts if the risk departments detect something fishy. Although the account creation on Square is instant, you would be under high scrutiny for any suspicious behavior, which we feel, is a good thing!

Customer Database: If you a merchant account, you will have access to this particular feature. Under this feature, you can get a quick look at your customers' usual behavior, their visits, and purchase preferences, as well as the frequency they visit.

You can further divide these customers and segment them by their behavior for your email marketing campaigns which is a massive help in this case. This database quickly also integrates invoices, customer feedback as well as any appointments made.

Advanced Reporting: Square is currently offering some of the nest online reporting services in this domain now. These reports are generated in real-time if required, by the hour, day, week, a month or even year. The online dashboard on Square anyway keeps giving you a wholesome view of the all activities and revenues for your business, but these reports dive deeper down in the number to provide you with some great actionable insights.

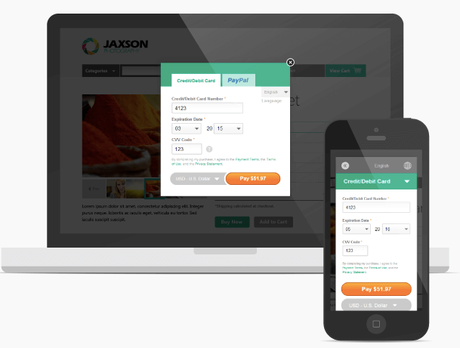

7. 2Checkout:

To give you a background of 2Checkout, it has been around since the early 2000s as a third party payment processor, specifically for e-commerce merchants. As you checkout and pay, the platform's job was to help you get the payment processed and completed for your online purchase.

But, in 2017, 2Checkout was bought over and acquired by Avangate, an e-commerce platform. Going forward, they decided to take the name of 2Checkout, going completely against the trend of dropping the acquired company's name. Anyway, this is how 2Checkout got a revamp on its platform, let's discuss its features:

Shopping Cart Integration: Amongst an entire list of integrations on 2Checkout, the shopping cart integration is probably one of the most effective integration. The shopping cart integration number has crossed over a 100, making it easier for the customers to make their purchases online. Apart from this, 2Checkout supports integrations for quick invoicing, bookings and lots more.

Recurring Billing: This is another helpful feature for the customers. For those of you who might have recurring bills every month, you can also choose to sign up for a subscription accordingly.

Developer Resources: Apart from all the features and integrations, you also get access to some documents and code faqs to refer. You can choose to customize the platform as per your needs and have it work to your ease. Since customization is a big part of the smooth user experience, this particular offering is quite an extraordinary one.

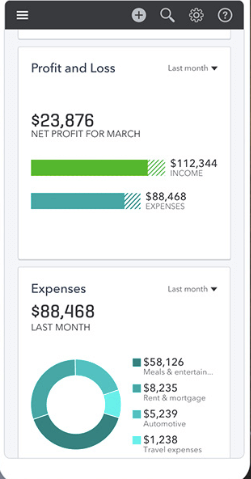

8. Intuit:

Intuit has a range of financial services products listed under them, but in this article, we are going to stick to online payment processors. In Intuit's case, it is going to be QuickBooks Payments.

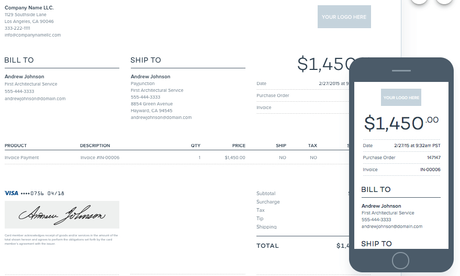

To begin with, let's say, there's almost nothing that Quickbooks payments cannot do- from its app you can manage everything. Once you have your account set up, you can quickly send invoices, set up recurring payments, and lots more. You can also generate invoices and sales receipts, pull out your customer list and populate your invoices accordingly, for future reference.

Invoicing with Gmail: Here's an impressive integration. You can directly use Gmail to generate invoices, in fact, you can further choose whether you would like to accept credit cards or bank transfers or if you would like to go with both. But before getting access to any of the features, you will first have to create a free account with Intuit.

The pricing and fee structure of Intuit and Quickbooks payments is quite confusing. They have a separate pricing structure for each product that they offer. In fact, every version of QB payments also comes with its pricing chart, and the differences are too minute to be noticed. Which is why users must go through all the pricing points thoroughly before choosing anything on the platform.

9. ProPay:

On their website, ProPay claims that they have a solution for every kind of business that you may have. They offer financial support and processing services as per the type of business you would like them to cater. On the website, you will be easily able to see their services listed under categories such as- Small Business, Enterprise, and Industries.

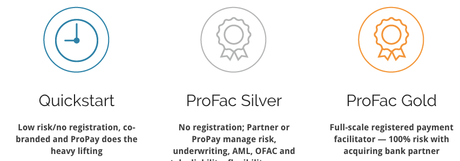

Further, they also offer three types of 'payment facilitators,' namely- QuickStart, ProFac Silver, ProFac Gold.

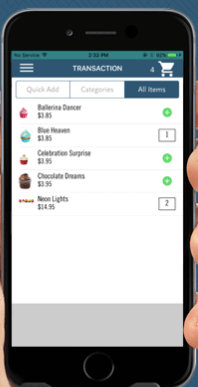

Propay also has a mobile version which is available for most phone devices and tablets. Other than the mobile app, they have another exciting offering which is the ProPay JAK Mobile Card Reader. With this particular card, you can seamlessly process credit cards in real time on your Android and iOS device, even without a data coverage on the device.

Apart from all the features, ProPay has stuck partnerships with specific target industries. If you go to their website, you will see many pages dedicated only to this, listing out perks that you get other than small business set up.

10. WePay:

On WePay's website, you will see that they stress a lot on integrated payments and easy onboarding. Going by their claim, the platform is available for smooth operations, quick and straightforward onboarding.

The WePay ecosystem offers a range of products, which you will see has been designed to target different segments of their target audience:

Merchant Onboarding: On the platform, their foremost priority is to get the reluctant customers on board most easily and quickly possible. To eliminate friction, they ensure ample support on common issues such as checkout forms, instant signup, and KYC compliance.

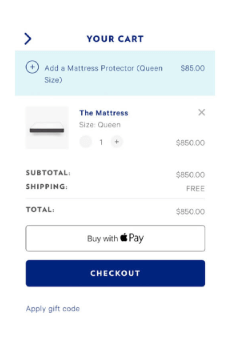

Payment Processing: Since payment processing is their core functionality, they have made it extremely simple and flexible. They share a payment API that makes the process much more flexible for everyone in need. They also offer modern gateway features such as account updater and even Apple Pay.

Risk/ Compliance: The platform shares everything that is needed to ensure a prosperous and secure integrated payment processing. By understanding fraud exposure and risk issues along with compliance issues, WePay excels in taking care of the overall security of payments.

Support: A lot of payment providers do not go all out to support their customers and fail to keep them happy. However, WePay claims to keep all their customers happy with a robust support infrastructure and services.

International: If your business is already operating internationally and have a good number of international customers, then WePay should be your go-to platform. They have an offering of features that work globally and even extend support across different countries.

11. Authorize.net:

Here's another tool which is one of the oldest in the industry. Operating since 1996, Authorize has gained good popularity and credibility over the years. After a couple of acquired by other companies, Authorize has been serving customers across the globe.

Other than the regular features and functionalities, here are some you might like to know about:

Advanced Fraud Detection Suite: This particular functionality comes included for free with your account and carries a set of 12 filters that you can alter any time you like, to suit your business needs. You can also go ahead and flag fraud transactions to keep in your records and to prevent any inventory loss in the future.

Customer Information Manager: This is probably the most potent and reliable feature on Authorize, which you would love working with. Under this feature, you can quickly and securely store customer information such as their billing address, shipping address and their payment method information. The data collected is encrypted and kept safely for easier transactions for your customers in the future.

12. Braintree Payments:

Braintree is probably one of the most sophisticated payment processing platforms in the market. Despite a big bunch of features offered on its plate, they have been enabling services and operations to be smooth and seamless.

But the fact that there are so many features available a user usually takes at least two days to understand the product. Not only the number of elements, but the product also offers flexibility to a reasonable extent as it is pretty customizable.

Sandbox: If you are not sure about the product, you can also choose to test it before you implement it for your business. They offer a sandbox for developers to go and try the product, for free.

Integrations: Braintree has been made compatible with a set of third-party services, covering everything from shopping carts and recurring billing functionalities to invoicing tools.

13. PayJunction:

Payjunction is a platform which allows merchants to receive credit card payments from their customers seamlessly.

Electronic and Email Signature: They follow paperless processing system, which means the requirement of minimal hardware and minimum setup expense. With this functionality you can efficiently collect digital signatures from your customers, eliminating the need to store receipts completely.

Developer Friendly: They offers a full stack API which is developer friendly and gives the merchants a chance to make their platform more customizable as well as flexible in case the need arises.

Callin Processing: In case you can not send your payments on the mobile app, you can also avail the Call-in processing method. All you have to do is make a call through the automated system and have your transaction recorded in no time!

14. Stripe:

Stripe is full of some features that will help you get your work done almost instantly. These features appear to be extremely simple and straightforward; however, once you start using them, you will see a layer of other functionalities within each of them.

Subscription Solutions: There a couple of subscription plans offered by Stripe. These are mostly for merchants who are either one time users or heavy users. The additional features in the higher tiered solutions are primarily provided at no extra charge.

Stripe Connect: A highly useful tool for businesses that operate internationally, Strip Connect lets you verify sellers and merchants who are located in international locations. It also enables you to create a repeat payment schedule for them.

15. Paymate:

An Indian product, Paymate has a bunch of features that are regular but also a couple of them that might be more specific to business needs in India. For example, they offer a mechanism where a merchant can make their GST payments via credit card on their system.

Cloud-Based and Secure: Paymate stresses on its security level and their ability to operate on Cloud. The fact that it is on Cloud ensures highest levels of international security as well as quick and easy upgrades without an extra charge.

Partnerships with Banks: Paymate also boasts of helpful tie-ups with leading banks in India such as BI, IndusInd Bank, Yes Bank, HDFC, Kotak, Axis Bank. They also have a partnership with Visa.