Are you a salaried person!! if yes, then you must be holding an Employee Provident Fund (EPF) Account with the EPFO. It is mandatory to own an EPF account if you are in a job and draws a salary of up to Rs.15,000 per month. EPF is optional for individuals drawing a salary of more than Rs.15,000 per month.

The EPF is maintained solely by the Employees Provident Fund Organization of India (EPFO) and any organization employing more than 20 persons is necessarily required to get registered with the EPFO.

The main purpose of the EPF account is to encourage employees to save & invest money for future needs like education of the child, marriage and of course retirement purposes.

Answers to Top FAQs on Employee Provident Fund

#1. Is Contribution to Employee Provident Fund Mandatory?

Yes, It is mandatory to have an EPF account by the employer for the employees who have a basic salary plus dearness allowance is up to Rs.15,000. And those who are earning above Rs.15,000 is not compulsory but may contribute voluntarily.

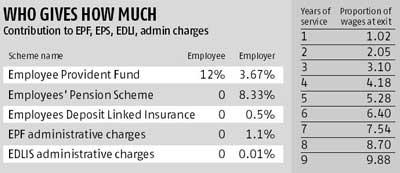

The employee contributes 12% of basic salary along with dearness allowance (DA) in the EPF account. There’s a provision of lower contribution of 10% in case the organization has less than 20 employees or if the organization comes under specific industries such as Beedi, Brick, and similar ones.

The employer also contributes a similar amount (12% of employee’s basic salary plus DA) but divided into 3 parts-

- 8.33% of such employer contribution goes towards Employee Pension Scheme (“EPS”)

- Rest of 3.67% is added to the EPF account of the employee. Max. amount of Rs. 1,250 per month if the salary of the employee is 15,000 or more.

- The employer also contributes 0.50% towards Employees’ Deposit Linked Insurance (“EDLI”) account of the employee.

Let’s calculate EPF contribution with the following example in which the salary of an employee is Rs. 20,000.

Basic Salary + Dearness Allowance = Rs. 20,000

Employee’s monthly contribution in EPF = 12% of Rs. 20,000 = Rs. 2,400

Employer’s monthly contribution in EPS (subject to the limit of 1,250) = Rs. 1,250

Employer’s monthly contribution in EPF = ( 2,400 – 1,250) = Rs. 1,150

Total EPF monthly contribution = 2,400 + 1,150 = Rs. 3,550

#2. What is Universal Account Number?

Universal Account Number (UAN) is a 12-digit number that the Employee Provident Fund Organisation (EPFO) provides to an employee. UAN of an employee remains the same throughout life irrespective of the number of jobs he/she changes.

Every time an employee switches job, EPFO allots a new member identification number (ID), which will be linked to the UAN. You can get a new member ID by submitting the UAN to the new employer. Once the member ID is created, it gets linked to the UAN of the employee.

You can also read- Everything about UAN for PF account.

#3. What are the Tax-Benefits of EPF contribution?

You can get a tax benefit of up to Rs. 1.50 lakh u/s 80C of Income Tax Act, 1961. EPF investment is a completely tax-free income including the contribution, interest accrued and withdrawals are exempted from the income tax.

However, premature withdrawal (withdrawal before 5 years of continuous contribution) is taxable.

#4. What is the Break-up of EPF Contribution

As per the EPF Act, 1952, the monthly contribution of employee and employer would be divided in the following way:

So if your basic salary plus dearness allowance is Rs.15,000 than the contribution would be proportioned in the following way:

SchemeEmployee

ContributionEmployer

Contribution

Employee Provident FundRs.1,800Rs.550.5

Employees Pension Scheme0Rs.1,249.5

Employee Deposit Linked Insurance0Rs.75

#5. What is the current interest rate on EPF

The current rate of interest is 8.50% p.a. for the year 2020-2021. The interest is compounded yearly.

The point to be noted here is that the interest is calculated only on the EPF part, not on EPS. So if your contribution towards EPS is Rs.1,800 (12%) and your employer contribution towards EPF is Rs.550 (3.67%) and Rs. 1250 (8.67%) towards EPS, then the interest of 8.65% would be calculated on the amount of Rs.2,350 (1,800 + 550).

#6. Which one is better – EPF Vs. PPF?

Employee Provident Fund is only for salaried person and Public Provident Fund is for everyone despite his earning source. A salaried person can enjoy the benefit of both EPF as well as PPF while a self-employed person can only take the benefits of PPF.

S.No.Comparison ParameterEPFPPF

1Who can Invest?Only Salaried person.Any Indian, except NRIs.

2Quantum and Frequency of InvestmentStatutory is 12% of basic +DA.

Can voluntarily increase the contribution.

Frequency is monthly from the salary itself.

Any Amount between Rs.500/- and Rs.1,50,000/- per year.A maximum of 12 contributions can be made per year subject to a minimum of Rs.100 per transaction.

3Current Returns (w.e.f 1st April, 2015)8.65% p.a.7.90% p.a.

4Loan OptionsPartial Withdrawal.Up to 50% of the balance. Loan facility available from the 3rd year till the completion of 6th year.

5Period of InvestmentAt the time of retirement or resignation, whichever is earlier.

Can transfer account to new company till retirement.

In case of death, the amount is paid to nominee/legal heirs.

Initially, 15 years which can be extended indefinitely in the blocks of 5 years after that.In case of death, the amount is paid to nominee/legal heirs.

6Tax benefitsTax exemption under section 80C of Income Tax Act.

Maximum Limit of Tax Benefit is up to Rs. 1.50 lakh.

Maturity is also tax-free if the contribution is withdrawn after completing 5 years of continuous service including jobs changed.

Tax exemption under section 80C of Income Tax Act.Maximum Limit of Tax Benefit is up to Rs. 1.50 lakh

Maturity is also tax-free.

The unique aspect of PPF

The other unique feature of PPF is that in case of insolvency, the PPF account cannot be used to pay off debts in the settlement process.

Also read – What is Salary Slip

#7. How to Check my EPF Balance Online?

There are multiple ways to check EPF balance online.

1. Go to EPFO portal. Click on the “ePassbook” option available on the homepage. A login page will appear. Fill your UAN and password to log in. After logging in, you will find all the member IDs linked to your UAN. This passbook will provide EPF account balance and contribution details made by you and your employer.

You can also register for ePassbook (if using for the first time) but make sure your employer has activated your UAN number and password. The ePassbook will be made available after 48 hours of the request.

2. The second method to check EPF balance is via SMS. All you have to do is click on the link below: http://www.epfindia.com/site_en/KYEPFB.php

- Select your PF office state and then your Regional PF Office.

- Enter your alphanumeric EPF account number (like RJ/UDR/123456/000/1234), your name and the mobile number on which you would like to get the EPF Balance Message.

As soon as you hit the submit button, you would get the balance message on your mobile screen.

3. Using UMANG App.

Step 1: Download and install the application UMANG from Google Play Store or the App Store.

Step 2: Open the UMANG app on your mobile and select EPFO.

Step 3: Click on the “Employee Centric Services”.

Step 4: Click on the option View Passbook to check your EPF balance.

Step 5: Enter your UAN and then click Send OTP to send an OTP to your mobile number. Enter the OTP you receive and click Login.

Step 6: Select the Member ID for which you want to check the balance.

Step 7: You passbook will be displayed on the screen along with your EPF balance

For more details, you can read my article – How to check EPF balance.

#7. How and when can I withdraw my EPF account money?

You can withdraw your EFP money for various reasons but only by fulfilling certain conditions, non-compliance of which would result in levying of penalty charges.

Apart from the above-stated conditions, if a person is taking a VRS at the age of 54 and above, then he can take out EPF money only up to 90% of the balance.

#8. How Premature Withdrawal from EPF account is taxed?

Understand the terms first of all.

Premature withdrawal means taking money out from the EPF account before 5 years of continuous service.

Continuous service means a continuous contribution for 5 years.

You (being an employee) can get tax exemption only if you contribute to the EPF account for 5 continuous years. If there’s a break in the 5-year contribution then EPF will be considered taxable for that financial year.

For example, if you left the job after 3 years but withdraw EPF corpus after 5 years, even then you would have to pay tax on the amount accrued.

Premature withdrawal attracts TDS if the amount exceeds Rs.50,000. TDS is 10% if you produce your PAN card details, otherwise you will get a TDS cut of 30%.

#9. What is Illegal Withdrawal of EPF Money

As per EPF rules, withdrawing of EPF money at the time of switching jobs is illegal.

You can withdraw a 75% amount after 1 month of unemployment. And withdraw complete corpus only and only if you have not joined a new job within two months of quitting the previous one.

It’s illegal to withdraw complete money by hiding about your employment information.

The Indian government, however, has added a new clause to prohibit the illegal practice. An employee has to produce an unemployment certificate (duly attested by a gazetted officer) after completing 2 months of unemployment if he wants to withdraw the complete amount.

#10. Can I contribute more than 12% towards EPF

As per EPF Act, 1952, the minimum contribution of employee towards EPF account should be at least 12% but one can contribute up to 100% of your salary plus DA. This extra contribution from employee does is called VPF (Voluntarily Provident Fund) but remember this does not bound employer to contribute more. Employer can continue to contribute up to statutory limit of 12%.

However, many employers do not allow the extra contributions of the employee towards EPF. So you have to file an application with the Regional Provident Fund Commissioner.

#11. Is there any other benefit of EPF?

Another benefit of keeping EPF account is that the account holder gets a life insurance cover of Rs.2,50,000 (earlier Rs. 60,000). Maximum cover is capped at Rs. 6,00,000.

You get life cover under the Employees Deposit Linked Insurance (EDLI) Scheme and the employer has to contribute 0.50% of your monthly basic pay as premium for your life cover.

But if your company is providing life insurance benefits or group insurance policy to you then it is exempted from contributing to this scheme.

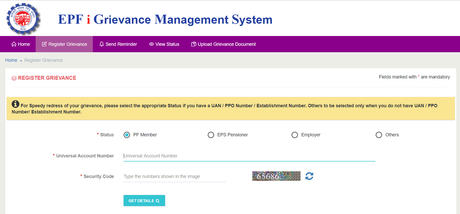

#12. How to make any grievance of EPF?

Employees can use the EPF grievance system to file a complaint against any kind of issue regarding their EPF account.

The easiest way is to register a grievance on the EPF portal.

Here are the steps to register a complaint-

- Open the EPF grievance portal and click on ‘Register grienance’.

- Enter UAN number and security code. Click on ‘Get Details’.

- Fill the complaint form and select the category under which your complaint falls.

- You can upload supporting documents for better understanding.

- once submitted, you will get a unique registeration number to track your complaint status. You can also send reminders in case of delay in getting solution using the same unique number.

The other way to file a grievance is by reaching to the regional office and file a complaint or you can post a grievance letter to the regional office through registered post.

I have tried to cover all the major questions asked about EPF account. Let me know if you have more queries about EPF, I would like to add more queries to help out people.