In perfect isolation here behind my wall

Waiting for the worms to come – Pink Floyd

We're going to skip all the socio-economic commentary while we wait for our beloved Central Banksters to make their statement at 2pm, followed by The Bernank's penultimate press conference this afternoon at 2:30, followed by wild market gyrations that, likely as not, will all reverse themselves by next Tuesday, when all of this will be forgotten and we're off to specualte about the next Fed meeting (Jan 29) and what they might say.

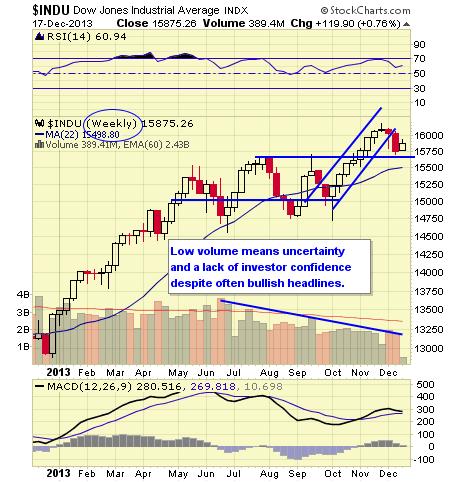

We haven't had a meeting since October 30th, when the market was topping on near-certainty the Fed would not be tapering and they only talked about it very briefly. First the S&P dropped from 1,772 to 1,755 on Nov 1st, but then we jumped back to 1,772 on the 6th, all the way down to 1,747 on the 7th and up and up and up for 6 of the next 7 sessions – all the way to 1,800, which is, of course, the 12.5% line on our Big Chart (ie – a normal "overshoot" of the 10% run from 1,600).

We had a bit of a pullback since, but still haven't re-tested 1,760 though we know the pattern and, in Monday's "Bouncy Pre-Fed Edition," during Member Chat we laid out our expected bounce levels for the indexes into the Fed meeting, which were (and still are):

We had a bit of a pullback since, but still haven't re-tested 1,760 though we know the pattern and, in Monday's "Bouncy Pre-Fed Edition," during Member Chat we laid out our expected bounce levels for the indexes into the Fed meeting, which were (and still are):

- Dow 16,100 to 15,750 is 350 points so 70 more is 15,820 weak and 16,000 strong (rounding)

- S&P 1,810 to 1,775 is 35 points (hmm, computers synching much?) and 7 more is 1,782 weak and 1,790 strong

- Nasdaq 4,075 to 4,000 is 75 points and 15 more is 4,015 weak and 4,030 strong

- NYSE 10,200 to 9,950 is 250 points and 50 more is 10,000 weak and 10,050 strong

- RUT 1,140 to 1,100 is 40 points and 8 more is 1,108 weak and 1,116 strong.

It should be noted that the Russell Futures are right on the 1,116 line, so we're not overly impressed just yet. In general, we need to see 3 of 5 of our STRONG bounce levels taken back in less time than it took to fall (2 days) so…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.