%%bloglink%%

Full disclosure: I’ve been a long-term owner of both index and actively managed funds over the years; I just haven’t been the long-term owner of the same number of index funds over that time frame.

Sometimes it seamed my entire account was in index funds while other times I may have owned only one or two.

Here are four issues I consider when deciding if I should not buy an index fund for a particular piece of my portfolio.

I have too much skin in the game

I sold out of my S&P 500 index fund for about five years in the early 2000’s and moved to an actively managed fund that held a lower level of financial stocks as compare to the index. I had no idea if owning financials was a good or bad idea, but at the time I worked for a major bank and I didn’t want my livelihood as well as my investments all tied to the same sector.

I want more skin in the game

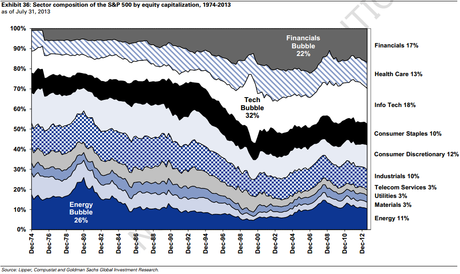

Goldman Sachs put together this piece showing how the S&P 500 sector composition has changed over the past 40 years.

Looking at this graph made me remember how I wanted to sell my 500 Index fund during the dot com boom because it ONLY had 30%+ of its holdings in tech stocks. I don’t remember why I didn’t sell, but it worked out in the end.

Today, my U.S. stock exposure looks very different from this chart. I have almost triple the exposure to consumer discretionary stocks because I feel the consumer is stronger and more willing to spend than people expect.

I hope I picked the right door.

I don’t like the current risk/reward of the index.

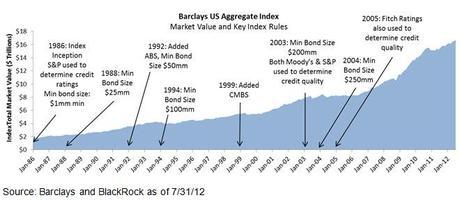

The Barclays Aggregate Bond Index is most commonly used index for U.S. fixed income investors. This index, as with most index funds, rarely remains fixed for long. Here are some of the major changes to the Barclays Aggregate over the past 25 years.

In addition to these rule changes, the underlying ratio of holdings has also changed drastically over time. U.S. government bonds made up 47% of the index in 1994 but had fallen to 22% by 2002 and now accounts for 36% of the index. Note – when combined with government-affiliated mortgage bonds this figure jumps to almost 78%.

The current duration of this index is now just over 2 years and is yielding just over 2%. I just don’t feel comfortable essentially lending my money out for two years to hopefully earn 2% per year.

I found a better place for my money

I started noticing semi-trucks with air deflectors under their trailers a few months ago. I can only imagine how the first sales pitch went: “I want you Mr. and Mrs. Truck Owner to spend your hard earned money to put more weight on your trucks and I promise it will actually increase your profits and improve your fuel economy.”

Sounds like the typical actively managed mutual fund pitch to me: “I want you Mr. and Mrs. Investor to spend your hard earned money to add an additional layer of expenses to your investments and I promise it will actually increase your profits and improve your returns!”

Well, turns out some sales people actually deliver on their promises. The trucking industry calls these “trailer skirts” and they have been shown to increase fuel economy by 7-8% at highway speeds.

Certain mutual fund managers have consistently shown they are worth the additional expense and I am not willing to bypass these managers simply for the sake of lower fees.