There are three main investment fears that can cause the price of a corporate bond to fall:

Fear that the company behind the bond may not be able to keep up with their interest payments.

- Fear that the company behind the bond may not have the financing in place to pay the bond off at 100 cents on the dollar at maturity.

- Fear of missing out on better returns by investing in something other than this bond.

I refer to the first two fears as a Liquidity Crisis.

Does the company have enough sales/profits to keep the interest payments flowing?The last fear I refer to as a Popularity Crisis.

Popular investments attract more money. Popular investments may or may not pay off in the long run, but that doesn't stop people from doing the fashionable thing of following the crowd into or out of certain areas of the market.

I am much more afraid of a Liquidity Crisis than Popularity Crisis.During a Liquidity Crisis, bond holders may or may not get their money back.

During a Popularity Crisis, bond holders get their money back they just may or may not have made as much money as other investments.

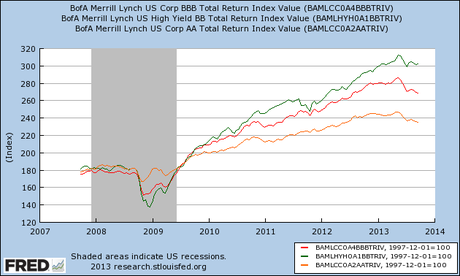

This chart shows three sections of the U.S. corporate bond market (AA, BB and BBB or rather high investment grade to low investment grade) and their returns over the past few years.

Returns have fallen almost in unison starting in May 2013. The last time these three sectors fell like this was late 2008 to early 2009.

Then, bond prices fell because due to a Liquidity Crisis (a return OF my money).Now, however, it's not a fear of not being paid that is spooking investors but rather a Popularity Crisis or fear of being left behind as other investments are doing better (a return ON my money).

Consumers Economy Employment Stock MarketCompanies

[i] St. Louis Federal Reserve. Data series CP

[ii] St. Louis Federal Reserve. Data series DIVIDEND

[iii] St. Louis Federal Reserve. Data series ALTSALES

[iv] St. Louis Federal Reserve. Data series NPTLTL

[v] St. Louis Federal Reserve. Data series BOPXGS

[vi] St. Louis Federal Reserve. Data series NEWORDER.

[vii] St. Louis Federal Reserve. Data series IC4WSA

[viii] St. Louis Federal Reserve. Data series NPPTTL

[ix] St. Louis Federal Reserve. Data series SP500