Punch cartoon (1906); Free Trade triumphs over Protectionism as policies favoring free trade were adopted throughout the British Empire. (Photo credit: Wikipedia)

Allegory of the Fredom of Trade (Photo credit: Wikipedia)

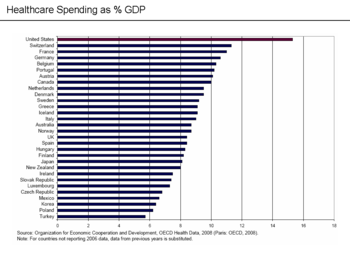

English: Extract from the text of the original document: “figure shows the fraction of gross domestic product (GDP) devoted to health care in a number of developed countries in 2006. According to the Organization for Economic Cooperation and Development (OECD), the United States spent 15.3 percent of its GDP on health care in 2006. The next highest country was Switzerland, with 11.3 percent. In most other high-income countries, the share was less than 10 percent.” (Photo credit: Wikipedia)

Free trade thumb (Photo credit: Wikipedia)

English: Free trade areas are a difficult subject. It is impossible to map all the existing free trade agreements on one map, and still make it readable. Here are presented FTAs with three or more participants. (Photo credit: Wikipedia)

“International Trade is the exchange of capital, goods, and services across international borders or territories.[1] In most countries, such trade represents a significant share of gross domestic product (GDP).”

Learning objectives

- Understand why nations trade with each other.

- Summarize the different theories explaining trade flows between nations.

- Recognize why many economists believe that unrestricted free trade between nations will raise the economic welfare of countries that participate in a free trade system.

- Explain the arguments of those who maintain that government can play a proactive role in promoting national competitive advantage in certain industries.

- Understand the important implications that international trade theory holds for business practice.

This chapter presents the major theories of international trade. Scholars first began to offer explanations for trade in the fifteenth century. Since then, various trade theories have developed, along with efforts to refine them.

Here’s my Trade theories Pinterest Board: http://www.pinterest.com/socialmediaevie/trade-theories/

Approaches to trade range from support for free trade to managed trade, to mercantilist approaches, to controlled trade, and even, in extremely rare cases, to no trade.

Free trade, with no government interference, is certain to hurt some domestic industries that are not competitive globally. Workers in the U.S. textile industry, for example, may lose jobs to workers in lower wage economies.

Free trade is a policy in international markets in which governments do not restrict imports or exports. Free trade is exemplified by the European Union / European Economic Area and the North American Free Trade Agreement, which have established open markets. Most nations are today members of the World Trade Organization (WTO) multilateral trade agreements. However, most governments still impose some protectionist policies that are intended to support local employment, such as applying tariffs to imports or subsidies to exports. Governments may also restrict free trade to limit exports of natural resources. Other barriers that may hinder trade include import quotas, taxes, and non-tariff barriers, such as regulatory legislation.

Free trade refers to a situation where a government does not attempt to influence through quotas or duties what its citizens can buy from another country or what they can produce and sell to another country.

Smith, Ricardo and Heckscher-Ohlin show why it is beneficial for a country to engage in international trade even for products it is able to produce for itself.

The historical “Patterns of International Trade” allows a country to specialize in the manufacture and export of products that it can produce efficiently, and import products that can be produced more efficiently in other countries; Saudi Arabia exports oil, the United States exports agricultural products, and Mexico exports labor intensive goods.

Various Trade Theories have different ideas for Government Policy and involvment in trade. Mercantilism advocates government involvement in promoting exports and limiting imports. Smith, Ricardo, and Heckscher-Ohlin promote unrestricted free trade.

Porter’s theory of national competitive advantage “justify limited and selective government intervention to support the development of certain export-oriented industries.”

English: Zhuhai Free Trade Zone (Photo credit: Wikipedia)

“Mercantilism suggests that it is in a country’s best interest to maintain a trade surplus — to export more than it imports, and advocates government intervention to achieve a surplus in the balance of trade.”

It views trade as a zero-sum game – one in which a gain by one country results in a loss by another. An interesting perspective of how the mercantilist philosophy may be driving current trade negotiations between nations is available at {http://www.businessweek.com/globalbiz/content/aug2008/gb20080813_489963.htm }.

Adam Smith argued for absolute advantage. Since countries differ in their ability to produce goods efficiently, they and should specialize in the production of the goods they can produce the most efficiently. If Britain were to specialize in textile production and Spain in wine production, Smith argued that both Britain and Spain could consume more textiles and wine than if each only produced for their own consumption. Thus, trade is a positive sum game.

David Ricardo proposed the idea of comparative advantage. He asked what might happen when one country has an absolute advantage in the production of both goods. Ricardo’s theory of comparative advantage suggests that countries should specialize in the production of those goods they produce most efficiently and buy goods that they produce less efficiently from other countries, even if this means buying goods from other countries that they could produce more efficiently at home.

The example of comparative advantage in Table 6.2 on page 184 in the text makes a number of assumptions: only two countries and two goods; zero transportation costs; similar prices and values; resources are mobile between goods within countries, but not across countries; constant returns to scale; fixed stocks of resources; and no effects on income distribution within countries. The general proposition that countries will produce and export those goods that they are the most efficient at producing has been shown to be quite valid.

Opening an economy to trade is likely to generate dynamic gains of two types. First, trade might increase a country’s stock of resources as increased supplies become available from abroad. Secondly, free trade might increase the efficiency of resource utilization, and free up resources for other uses.

An overview of the ideas and philosophies of David Ricardo, from which his theory of comparative advantage emerged, is available at {http://www.econlib.org/library/Enc/bios/Ricardo.html}. Students should also consult {http://www.newschool.edu/nssr/het/profiles/ricardo.htm}.

PaulSamuelson argues on page 187, that in some cases the gains from trade may not be so beneficial. “He argues that the ability to off-shore services jobs that were traditionally not internationally mobile may have the effect of a mass inward migration into the United States, where wages fall.”

The Heckscher-Ohlin theory on page 190, predicts that countries will export those goods that make intensive use of factors of production which are locally abundant; importing goods that make intensive use of factors that are locally scarce. It focuses on differences in relative factor endowments rather than differences in relative productivity.

A more complete description of the Heckscher-Ohlin theory is available at {http://www.newschool.edu/nssr/het/profiles/heckscher.htm}.

The Leontief Paradox on page 191, uses the Heckscher-Ohlin theory. Leontief postulated that since the United States was relatively abundant in capital compared to other nations, the United States would be an exporter of capital intensive goods and an importer of labor-intensive goods. ”To his surprise, however, he found that U.S. exports were less capital intensive than U.S. imports. Since this result was at variance with the predictions of the theory, it has become known as the Leontief Paradox.”

A more extensive description of the Leontief Paradox is available at {http://www.newschool.edu/nssr/het/profiles/leontief.htm}.

The Product Life Cycle Theory on page 191, was originally proposed by Raymond Vernon. He suggested that as products mature, both the location of sales and the optimal production location will change, affecting the direction and flow of imports and exports. Globalization weakens this theory.

The New Trade Theory on page 194, suggests that because of economies of scale and increasing returns to specialization, in some industries there are likely to be only a few profitable firms. Firms with first mover advantages will develop economies of scale and create barriers to entry for other firms. New trade theory does not contradict the theory of comparative advantage, but instead identifies a source of comparative advantage.

A nation may be able to specialize in producing a narrower range of products than it would in the absence of trade, yet by buying goods that it does not make from other countries, each nation can simultaneously increase the variety of goods available to its consumers and lower the costs of those goods.

The pattern of trade we observe in the world economy may be the result of first mover advantages (economic and strategic advantages that accrue to early entrants into an industry) and economies of scale.

The Implications of New Trade Theory suggests that nations may benefit from trade even when they do not differ in resource endowments or technology. The theory also suggests that a country may predominate in the export of a good simply because it was lucky enough to have one or more firms among the first to produce that good.

Michael Porter’s Theory of National Competitive Advantage on page 197,hypothesizes that “a nation’s competitiveness depends on the capacity of its industry to innovate and upgrade. Porter’s study tried to explain why a nation achieves international success in a particular industry. This study found four broad attributes that promote or impede the creation of competitive advantage: factor endowments, demand conditions, relating and supporting industries, and firm strategy, structure, and rivalry.” These attributes form Porter’s diamond shown on page 198.

1. Factor endowments are the nation’s relative position in factors of production. They are divided into basic and advanced.

2. Demand conditions refer to the nature of home demand for the product or service, and influences the development of production capabilities. Sophisticated and demanding customers pressure firms to be competitive.

3. Related and supporting industries refer to the presence in a nation of supplier industries and related industries that are internationally competitive, and can spill over and contribute to other industries.

4. Firm strategy, structure and rivalry refer to the conditions in the nation governing how companies are created, organized, and managed, and how the nature of domestic rivalry impacts firms’ competitiveness.

5. Firms that face strong domestic competition will be better able to face competitors from other firms.

6. Government policies and chance can impact any of the four factors in the diamond. Government policy can affect demand through product standards, influence rivalry through regulation and antitrust laws, and impact the availability of highly educated workers and advanced transportation infrastructure.

7. It makes seconomic ense for a firm to disperse its various productive activities to those countries where they can be performed most efficiently.

8. Businesses should work to encourage governmental policies that support free trade.

9. If a business is able to get its goods from the best sources worldwide, and compete in the sale of products into the most competitive markets, it has a good chance to survive and prosper.

For more information about foreign governments and their approaches to international trade, visit the Electronic Embassy at {http://www.embassy.org/}. This site provides links to all of the foreign embassies located in Washington D.C.

The Balance of Payments Accounts are described in the Appendix of Chapter 6 on page 207.

1. The balance of payments accounts keep track of the payments to foreigners for imports of goods and services, and receipts from foreigners for goods and services exported to them.

2. There are three main accounts: the current account, the capital account, and the financial account shown on page 208.

3. In the United States, the current account deficit has been growing because of its imports of physical products, but the country runs a current account surplus in trade in services.

The textile industry in Bangladesh has benefitted from trade barriers designed to allow the industry to grow. In 2005, those barriers were eliminated. For more information on why the barriers were erected, and the situation in Bangladesh after they were dismantled, go to {http://www.globalpolicy.org/component/content/article/220-trade/47246.html}.

English: A North American Free Trade Agreement (NAFTA) Logo. Español: Logotipo del Tratado de Libre Comercio de América del Norte (TLCAN). Français : Logo de Accord de libre-échange nord-américain (ALENA). (Photo credit: Wikipedia)

Related articles

- Giant low-hanging fruit

- Term of the Day gross domestic product (GDP)

- My International Trade reading list

- Foreign Direct Investment Decisions for International Business

- What was mercantilism?

- International Business and Trade Theory