Interesting linguistic point first, to lighten the mood: no European language has a proper word for "tax", because the concept of having to hand over X per cent of your earnings or output or wealth to the government every year is a relatively new and unnatural one. So each language just uses a word at random.

For example:

English "tax" actually means estimate and "duty" means what it means,

German "Steuer" is not actually derived from their word for steer (as in steering wheel), it is derived from an old word for support or prop,

French "impôt" and Italian "imposta" mean imposition,

Dutch "belasting" means burden,

Danish "skat" and Norwegian "skatt" mean treasure.

---------------------------

Right, down to business. The Scottish government can now, in theory, set its own income tax rates, i.e. abolish it by setting a rate of zero. Somebody who's campaigning for LVT in Scotland (to replace income tax) asked me whether I knew of any official or semi-official estimates of the deadweight cost of taxes.

He himself got a curt reply from HM Treasury years ago saying they thought is was about 30p for ever £1 (thirty per cent) of the amount raised in tax. To my mind, this is good start. The overall average marginal tax rate on income and output (taking income tax, National Insurance, VAT, corporation tax and working tax credit withdrawal into account) is around fifty per cent. Thirty per cent of fifty per cent is fifteen per cent, so that's the bare minimum amount by which the size of the economy is depressed (chances are it is much higher, especially if you factor in faster future growth). So if Scotland were to scrap income tax, that would reduce the overall average rate to about 35%.

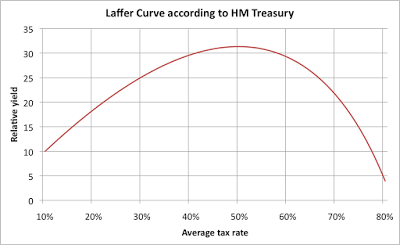

The only official Treasury nod towards the existence of deadweight costs and the Laffer Curve was a couple of years ago, which I posted about at the time. The point being that the Laffer Curve looks specifically at tax revenues, but the fact there is a curve tells us that the economy is more depressed the higher tax rates are; obviously, with a 100% tax rate, revenues are nil and the size of the economy is zero.

We can turn their calculations into a chart and then work backwards. I shall assume that they are not completely stupid and that 50% is indeed the revenue maximising tax rate:

So at a tax rate of 50%, (relative) revenues are £31, so GDP must be £62. If the tax rate were 35%, revenues would be £28 so GDP would be £80. It it is only once the tax rate is down to 15% or lower that the dead-weight costs are barely measurable.

So there's your answer: if Scotland got rid of income tax, its economy would grow by up to thirty per cent (80 compared to 62). That's a heck of a lot. Out of the original £31 revenues, Scotland was getting about £12 in income tax (about 20% of GDP), which it can now collect in LVT instead (about 15% of GDP). So people in Scotland end up overall about £10 better off (some of that extra £18 GDP is lost in VAT and National Insurance.