Looking for PocketSmith Pricing, Don't Worry I got you covered.

Personal and business finances are all intertwined through the use of many types of financial instruments.

When it comes to managing your own money, it's easy to become paralyzed by all of the variables. The goal of PocketSmith is to simplify your life by providing everything you require in one place.

Personal financial software, on the other hand, isn't confined to your current situation; it can also forecast your future finances.

Using the software's Google-like calendar, you can see your present account balances as well as forecasted earnings in the near future.

This feature, which syncs with your accounts and your budget categories, is a major selling point for the platform." However, some of its features need a fee.

Our PocketSmith review explains how this budgeting program works, how much it can cost, and the benefits and drawbacks to help you determine if it's worth your time.

We have done a detailed PocketSmith Review 2022, Click Here to Read the In-depth Review.

What Does PocketSmith Do?

If you want to keep track of all of your financial accounts, transaction history, and budgets in a single location, then PocketSmith is the software for you.

New Zealanders Jason Leong, James Wigglesworth, and Francois Bondiguel formed the company in 2008. They wanted a calendar-and-event-based system for keeping track of and disseminating financial data.

PocketSmith, on the other hand, is a budgeting app that stands out from the others. In contrast to Mint and Personal Capital, it's not free unless you want a very basic edition with limited functionality, which is one of the most noticeable distinctions.

Advertising is used to help these rivals. Although PocketSmith is free of ads, most of its essential features require a paid subscription.

Although PocketSmith offers a few advantages over the competition, one of them is that it allows you to make a budget whenever you want, for as long as you want.

In contrast to the usual monthly budget, which begins on the first of the month, this system allows for greater flexibility. Budgets can begin on any day of the week, month, or year with PocketSmith.

The Good and the Bad

Pros- Even if your bank accounts are located in separate countries, you can link them together

- The use of a budgeting calendar is really useful for staying on top of your finances

- Financial forecasting aids in long-term planning

- Create many budgets that can each be customized differently

- In order to access all of PocketSmith's features, you must pay

- Spends much of its time on budgeting rather than investing

PocketSmith Pricing

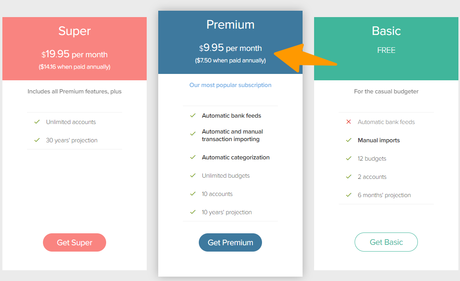

PocketSmith has three pricing tiers: free, basic, and premium.

Free - You can only add up to two accounts with the free plan, and you must manually enter your bank information. This plan, which contains up to 12 budgets and six months of estimates, should be avoided unless you wish to follow your funds manually and export them from each bank, and input them into PocketSmith.

Additionally, you may utilize their "what if" recommendations to see what would happen if you were to lose a percentage of your income or change your spending patterns.

A lot more is included with the $9.95 per month (or $90 annually) Premium subscription. Automatic bank feed updates, automatic transaction import, and automatic transaction categorization are available to users that reach this rung in the corporate ladder.

Get 10 years of predictions, 10 budgets, and 10 accounts. The maximum number of accounts you can have in this category is 10. If you use the coupon code 50OFFPREMIUM-F4RG for the first two months of the PocketSmith Premium Monthly plan, you'll save 50%.

It costs $19.95 a month or $169.92 a year to subscribe to Super. There is no limit on how many accounts you can have with this package. In addition, a 30-year projection can be accessed with this key.

Quick Links: Best PocketSmith Alternatives PocketSmith Coupon Code Rich Dad Poor Dad ReviewConclusion

Start A Finance WordPress BlogA 5-star product with a 1-star price is PocketSmith. If Pocketsmith's features weren't available for free somewhere else, it'd be a truly remarkable financial tool. However, Pocketsmith's high cost makes it less attractive than some of its competitors.

PocketSmith is one of the best-featured financial aggregators available if you don't mind paying for it.

All of your financial accounts, such as bank and credit card balances, loans, and student loans, can be tracked in PocketSmith's calendar. There are only two calendars available in the free edition of the app: one for tracking a checking account and the other for tracking a credit card account.

The average person has a slew of accounts they'd like to keep tabs on and get future estimates for. Premium or Super accounts are required in this situation.

Their "best value subscription" is the Premium account, which costs $9.95 a month.