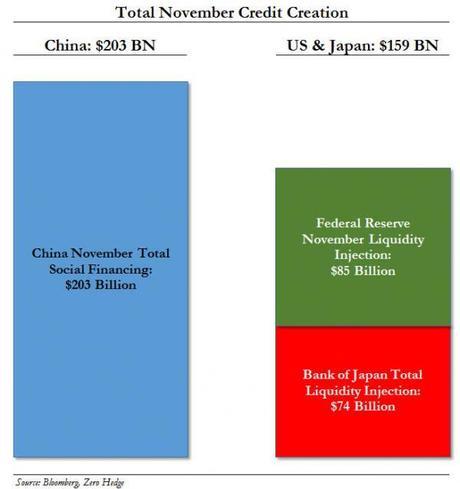

Courtesy of ZeroHedge, this diagram provides the background:

I have mentioned before my surprise at the number of reports from a variety of observers warning that Chinese banks are in trouble. By that, they mean, the smaller fringe banks which have a degree of latitude from central government which controls the big banks absolutely. However, what happens when the central bank gets into trouble? I hasten to say that is not happening now, nor is it likely in the short-term but it is worth pointing out that the yield demanded by the money-lenders for Chinese debt has risen to the highest in a decade and a top analyst in BoA has advised customers to take out Credit Default Swaps (CDS) which are, in effect, insurance contracts against Chinese debt.

According to Ambrose E-P in The Telegraph:

Short-term debt issuance by trust companies has jumped to $320bn from almost zero two years ago. A new study by the China Academy of Financial Research warned that the trusts face a redemption shock after promising returns of 10pc to 15pc that may be impossible to deliver.

The pattern has echoes of what happened to Icelandic banks and Northern Rock, which relied on fickle capital markets during the credit boom. They were caught in a vice when funding suddenly dried up. The Academy said Jilin Trust, AsAc, and Taipingyang Municipal, are among the most overextended. All three have had trouble rolling over debt or covering payouts over recent days.

The Chinese, dazzled by their sudden 'wealth', are doing what Europeans and Americans have done, and are borrowing up to and over the hilt in the mystical belief that the price of everything will rise forever. Hence, for example, all those creepy, empty cities built on some other sucker's cash! Apparently, the Chinese Central Bank is attempting to cut back on the money supply and whilst A E-P thinks that they will avoid a crash he also thinks that a long period of stagnation is likely.

I have also noted reports, but alas I failed to bookmark them, that the outflow of Chinese money is reaching torrential levels. Don't stand still for too long or some Chinese chap, desperate to safeguard his savings, might buy you!