By now it's probably no surprise: people love to drink at brewery taprooms.

The opportunity to get fresh, from-the-source beer is always a big draw, but there's certainly an additional layer of excitement about visiting the physical space itself. It's a deeper connection to the liquid in the glass.

In many places, it's also simply part of the drinking culture.

Recently, the Alcohol and Tobacco Tax and Trade Bureau (TTB) released a new set of statistics related to beer: the aggregated data of sales state-by-state. The information includes numbers from 2010 to 2015, highlighting the breakdown of sales related to bottles and cans, barrels and kegs and "premise use," the stuff that's sold on-site and tracked by the TTB. This particularly relates to the "rise of own-premise" business models I wrote about for Good Beer Hunting.

Because of the qualitative and quantitative evidence that consistently appears related to greater customer interest in on-site drinking, I wanted to see if parsing the numbers might offer any new insight into how things look on a state-by-state basis.

Programming note: because of quirky interpretations of policies, business practices and state law, numbers reported to the TTB may not always be 100 percent, guaranteed accurate. In conversation with Bart Watson, the Brewers Association's economist, he pointed out to me that reported premise use numbers are likely lower than reality. All the same, I'm taking the figures at face value for purposes of this post because it's the data presented.It's impossible to deny that in several states, the act of going straight to the source for beer has become part of the culture for local residents. We often hear about people living in San Diego, for instance, taking advantage of the more than 100 beer-making businesses in the county alone. To put actual numbers to this, I pulled the information for states we may most closely associate with this behavior, using Brewers Association-defined craft breweries..

For example, here's the data from California:

Perhaps it should come as no surprise that Golden State drinkers keep California as the top premise-use sales state in the country, a number that is certain to grow as it surpassed 700 total in-state breweries this past summer.

But what's really interesting is California's comparison to another beer-loving state. Despite having roughly half the number of breweries in 2015, Colorado had nearly identical on-site sales:

Maybe it's all those biking trails that lead straight to breweries?

Those state figures may not come as anything new, but what really interested me were states that might also attract a large number of tourists. In a previous post, I highlighted the very real financial impact of beer tourism, which is most definitely felt in states like Oregon:

In the most recent (2014) survey by Travel Portland, a tourism office for the Oregon city, results showed that 11 percent of US adults visited Portland for a leisure trip in 2013 or 2014 ... Among those who visited, 68 percent participated in some beer-related experience.

Despite just a 5.5 percent growth in number of breweries from 2014 to 2015, own-premise sales more than doubled:

You can also find this kind of drastic contrast in Vermont, land of Hill Farmstead and Heady Topper:

And to a lesser extent, Washington:

A common denominator for all these states would certainly be their unique beer cultures, which are deep and ingrained in each state's connection to food, beverage and "what's local." Some of these brewery numbers are so large, the percentage growth remains relatively low, but there's no denying how impressive the actual sale of pints looks.

Programming note: Because some of the jumps in on-site sales seem drastic from 2014 to 2015, I emailed the TTB to ask if any reporting or data collection changed. If I hear back, I will update this post with that info.While some states have always had great interest in their own beer scene, it's easy to see that kind of attention spreading to other areas across the country. The number of breweries is growing everywhere and with it, the number of people checking out these new additions to their community.

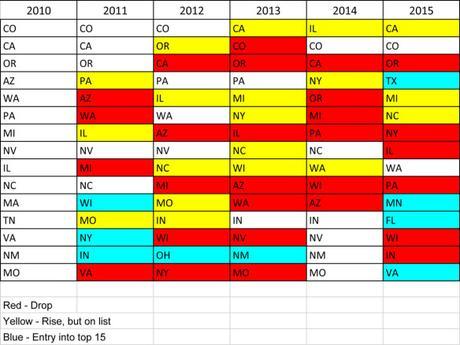

To better understand this change, I tracked the top-15 states for on-site sales based on numbers reported to the TTB. Using all six years of data offered by the organization, here's what a year-to-year chart looks like, highlighting the up-and-down shift of states. Note the key of this chart, which uses red to indicate a year-to-year drop, yellow to show an increased rank, but one for a state already on the list, and blue to show a new appearance in the top 15:

Obvious note on the quirkiness of reporting, as mentioned above, as Illinois somehow took over the top spot from California and Colorado solely for 2014. I have a note in with the TTB communications staff to help clarify this instance.

Aside from that, I'd like to draw your attention to the column for 2015, where we see four new states appear in the top-15. This is an important aspect to recognize, as it clearly helps illustrate the new brewery and beer cultures expanding in states like Texas, Florida and others.

To help reinforce this idea, I pulled two collections of states to focus on the increased number of breweries, as reported to the Brewers Association, and the total barrels sold on-site at breweries.

From 2014 to 2015, here are some of the top states in terms of percentage growth of breweries, according to numbers collected by the Brewers Association:

Additionally, here are the same states with percentage growth of own-premise barrels sold, using figures from the TTB:

For fun, a look at those two lists side-by-side:

The key here is to better identify the places that are making the jump toward where long-tenured beer loving states may be. In the past couple years, Texas has certainly been a state to keep an eye on and these stats certainly emphasize that. As you go down the list, consider the states shown with new, hot breweries you've heard about.

The Pacific Northwest and West Coast have long been known as big beer places, but this collection of states helps to show why so many people are talking about just about every region of the country as something to offer. New breweries are doing some pretty great things, which is attracting plenty of people to not only open and expand these beer communities, but bringing beer lovers to the source. A lot of this has to do with growing interest, but it certainly also deals with modernizing laws in many of these states that for a long time impeded aspects of industry growth.

In the end, that final note will continue to play a pivotal role in how these kinds of stats grow and change in the years to come.

In case you were interested in finding the data for certain states, the full list is pasted below. Note that the number of breweries per state, as shared on the Brewers Association website state-by-state, goes back five years. The TTB data goes back to 2010. In some cases, like Mississippi, data for a year may be missing.

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac