Tech savvy and internet savvy people are well aware of the term e-payment or electronic payment. This is a specially designed service that helps people, business owners, non-government and government organizations to make virtually cashless payments. Such payments for buying various services and products are done by means of debit or credit cards, the internet and mobile gadgets.

Several advantages are associated with using this system like lower transaction cost, time saving and increased sales. However, sometimes it is seen to make extra business expenses.

Electronic money also known as e-currency, e-money or digital cash is basically script or money that is exchanged electronically. Electronic payment systems are successful in making people accept electronic commerce by keeping insecure systems like the internet at bay. In the e-commerce business-to-business world people are showing increasing interest in payment processing online.

Welcome ePayments for safe transfer

At present the market of services and goods bought and sold across the internet has become large and is growing continuously. Receiving or making online payments is becoming a problem day by day. Using credit and debit cards for any online payments might not solve the problem totally.

This is because now people carry on trade and business with almost all parts of the world. Some developing countries are there who do not accept standard debit or credit cards. While doing business with any such country people have to use digital gold as an alternative to credit card. The risk associated with internet payment had been reduced to some extent with the coming of these digital currencies.

But, people tend to face various other problems like faulty payment, extended payment time and a lot other issues. To keep all such issues at bay there is ePayments, an online platform to solve all your online money transfer woes.

Access the features

This is a one of its kind platform created professionally that allows secure and fast payment in a cost effective way. Moreover, it also functions as an e-wallet where you can keep your money and make payments using the same in a safe and quick manner.

In addition you can also get an app that allows you to manage your ePayments cards and e-wallet from any part of the world using just your phone.

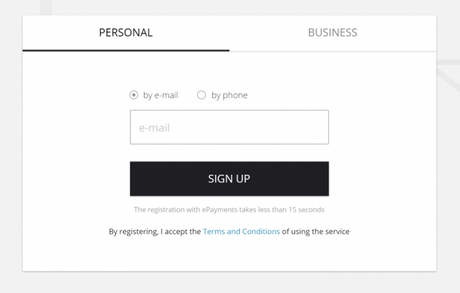

This electronic payment system is private, safe and comes with a very simple sign up procedure. To sign up for the same initially, you need to choose the type of user you want to be. You can either choose a business account or a personal account. Once you are done with the same, the next step is to login simply either by using your mail id or your phone number.

Opening an account with ePayments is absolutely free. Some nominal charges will be charged afterwards depending upon your account and card usage.

Attention : Interview Of Mike Mann Who Owns SEO.Com: Why Domaining Is Lucrative Business

Working with any kind of online payment is made easy with the coming of ePayments. You can also avail ePayments Prepaid MasterCard that allows you to pay for services or goods online in some store. Moreover, you can use these cards to withdraw money from ATMs.

Know more about personal account

As said earlier, ePayments offers you to open two types of accounts- personal and business. The very name makes it clear that personal accounts are meant for private use. Personal account owners can use the e-wallet securely to receive payments through wire transfer from friends, partners or relatives and also from legal bodies like business partners or advertisers.

Best part is almost all the incoming transfers are either free or charged with a nominal fee like 1% to get your funds deposited from other online wallets to ePayments.

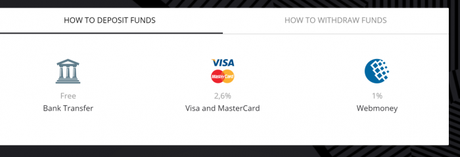

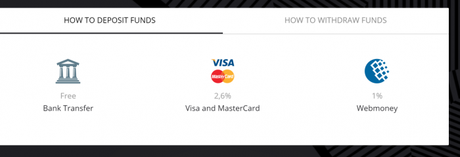

Funds that you have received can be withdrawn from the same to your own bank account. You can deposit or withdraw funds through bank transfer, using a MasterCard or Visa card, Web money or cryptocurrency like Bitcoins. Moreover, you can also withdraw funds using the ePayments Prepaid MasterCard. Best part about ePayments is that it functions without any hindrance allowing instant and safe transfer.

Fees charged for withdrawal, transfer or availing any service is very reasonable and cost effective. Charges that generally comes your way are-

- A minimal account opening charge.

- Withdraw funds by using Maestro, MasterCard or VISA card by paying just $3.5.

- Withdraw funds using litecoin or Bitcoins for free.

Apart from receiving payment from some third party, you can add money yourself either to your ePayments e-wallet or to the Prepaid MasterCard.

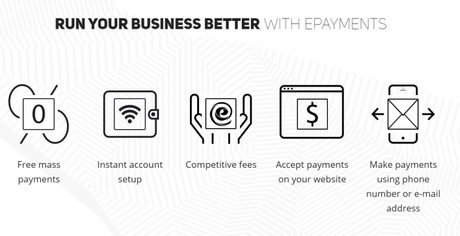

Account for business professionals

The second type of account-the business account is meant for business professionals or any other legal entities like a company. Using the business e-wallet you can pay clients or partners across the globe, receive individual support through API and transfer money to alternate payment systems. Business account holders can take advantage of the easy process to add money to their e-wallets through bank transfer, using EPayments cards, or transferring money using cryptocurrency.

Moreover, business account owners have the opportunity to make mass payment as well as the opportunity to accept some payment on their website. They can also make payment using a mail address or phone number. But, for this, the recipient needs to have an ePayments e-wallet to manage their money.

As said earlier, ePayments have also designed their own prepaid MasterCard that comes with a magnetic strip and chip. It functions the same way a MasterCard performs using the contactless payment technology. An attractive contemporary design is offered to the prepaid card and it holds on to all types of modern card requirements.

These cards can be used easily on any ATM worldwide where you see the Maestro, MasterCard or Cirrus symbol. Moreover, you can also use the card for any purchase online. To use the card however, you need to make certain minimal payments. You will be charged with

Use prepaid MasterCard- Yearly card maintenance fee that is $35.

- In case you use the card for ATM withdrawals, you will be charged $2.6/transaction.

- You need to pay $5 if you are using the card to deposit funds from Webmoney to ePayments wallet.

Numerous advantages are there offered by ePayments. It functions by taking advantage of the data encryption process using SSL encryption. You are also protected from fraud as it has a modern fraud monitoring system. Any unsanctioned access attempts to your account is prevented with a two-factor authentication system. Your client's funds will be defended in other ways too.

This means freelancers can use ePayments without being worried about their funds getting blocked midway. To conclude, ePayments offer you one of the most suitable ways to add money to your account by keeping account maintenance fees to the lowest.

CLICK HERE TO SIGN UP FOR ePAYMENTS FOR BUSINESS & PERSONAL ACCOUNT NOW