In Chapter 6 of The SmallIvy Book of Investing, Book 1: Investing to Grow Wealthy, I provide details on how to setup what I call a “cash flow plan.” A better description might of been to call it a “wealth flow plan” because it is really a plan to manage how your money flows to become wealthy over time. People who stay out of debt but never really grow wealth have a budget. People who become wealthy have a cash flow plan. This is because a budget just balances income with spending. A cash flow plan does this, but it also purposefully allocates money to assets to grow wealth. From the book:

The SmallIvy Book of Investing, Book 1 BUY A COPY

“ Developing a cash flow plan is the first step to ensure a reasonable amount of your income is going towards investments. It is in this plan that you look at your income and expenses and pare back on expenses until you have some money left for investing. In particular, you want to direct some of your income to required investing (paying for retirement and college for your children) and your optional investing (that which builds assets that will give you additional income in your forties and beyond) before it gets obligated to other things. The steps for building a cash flow plan are as follows:

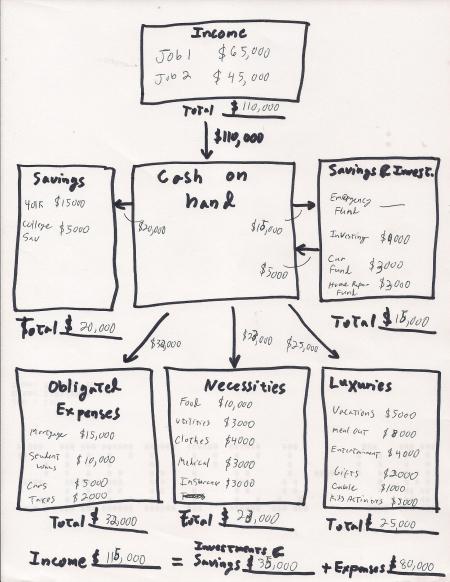

a) Start by listing all of your yearly income from work at the top of a sheet of paper. Find the total and write this below the income sources. Form a box around this area and label it “Income.”

b) Below the income box, in the middle of the page, draw an empty box and label it “Cash-On-Hand.”

c) Next, on the lower left side of the sheet below the cash-on-hand box, list your obligated expenses. Include things like rent or mortgage payments, insurance, utilities, and car payments and other legal obligations. This is money that you are legally obligated to spend or it damages your credit, puts you in jail, puts you on the street, or leaves you in the dark. Draw a box around these, total them at the bottom, and label the box “Obligated Expenses.”

d) In the bottom middle, below the cash-on-hand box, list your necessities like food, gasoline, and clothing. Estimate a yearly amount for these items and total it at the bottom. Draw a box around these and label it “Necessary Expenses.”

e) On the bottom right side, below the cash-on-hand box, list luxuries. These are things you could do without but like to do, like hobbies, kid’s activities, eating out, and vacations. Make an estimate for each of these and write a total at the bottom. Box these in and label it “Optional Expenses.”

f) On the left side of the page, next to the cash on hand box, list required saving accounts such as retirement accounts (401k’s and IRA’s) and college savings accounts. Allocate 10-15% of your income for retirement savings and fund college accounts at least $2,000 per year per child. Label this box “Required Investing.”

g) Finally, draw a box to the right of the cash-on-hand box and label it “Saving and Investing.” Place a line for an emergency fund account and one for an investing account.

At the bottom of the page, create lines for the totals of the income box, the expenses boxes, and the investing boxes. In the end your income will match the sum of the expenses and the investing. Note that all of the money needs to go somewhere because otherwise it will be wasted. There can be no slush funds.

Draw an arrow from your income to the cash-on-hand box. Draw one from the cash-on-hand box to each of the expenses boxes and to each of the investment boxes. Draw an arrow from the saving and investing box back to the cash-on-hand box. This shows how money will flow from you income to cash-on-hand (when you bring home the check), then to either expenses or investments.

Note that your savings and investments also generate income which comes back to your cash-on-hand, which is represented by the arrow from savings and investments back to the cash-on-hand box. This is the difference between the cash flow diagram of a person who will grow wealthy and one who will be average. The average person will not have this income from assets adding to their cash-on-hand. Instead the average person will only have income from work. The number of obligated expenses will also be larger, including interest on debt, so income will simply flow into cash-on-hand and flow right out again into expenses. There may or may not be required investments to fund things like college and retirement. His income may increase and he may be able to buy nicer luxuries, but he will always be dependent on his job to meet all of his needs – a tenuous position.

At the bottom of your cash flow diagram, subtract the total of your obligated expenses, necessary expenses, and required investing from your income. This is your free cash flow – money that you are free to obligate to optional spending or investing as you wish. Figure out which of your optional expenses are most desirable, fund those, then allocate a reasonable amount based on your free cash flow to saving and investing (at least $200-$300 per month if you can). Divide the remainder of free cash flow to optional spending and saving and investing as desired until the sum of your saving/investing and expenses matches your income.”

An example wealth flow diagram for a couple making $110,000 in income from work and $5,000 from investment might look like this:

Wealthflow Diagram

Note that they are currently reinvesting all of the money they are making from investments to allow that income to grow. Also note that they have car payments and student loan payments. Once those are paid off they will have another $15,000 per year to invest or spend on other things if they do not take on new car payments.

Note also that they have a car fund included in their investments. At $3,000 in savings per year, they will be able to replace their two cars with quality used cars worth $9,000 each every six years or so. (You can get a very reliable Toyota or Honda for this price.). After they buy the first used cars and get rid of the car payments, they could put that extra $5,000 into the car fund with the $3,000 they are saving already and get two $20,000 used cars every five years for cash. That could be a really nice car if they buy 2-4 year old.

Contact me at [email protected] or leave a comment.

Disclaimer: This blog is not meant to give financial planning advice, it gives information on a specific investment strategy and picking stocks. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.