First section of my technical analysis course – which is still a work in progress; page URL: http://technicalanalysistalk.wordpress.com/technical-analysis-course/definition-of-technical-analysis/

There are many definitions of technical analysis that you can read from books and online material. When I was at the beginning stage of my technical analysis journey, I devoured book after book on technical analysis. The first few pages usually started off defining technical analysis. I leave you to read those books and other online material if you want some kind of “official definition” of technical analysis.

Is it important to know the meaning of technical analysis? Yes, but not in a rote sense. I think the best way is to gain experience in analysing charts – reading between the lines, getting a feel of the market’s pulse through a chart – then stepping back and telling yourself what technical analysis means to you.

What does technical analysis mean to me?

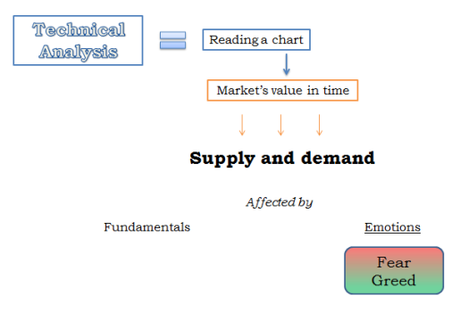

Technical analysis is chart-reading. A chart represents the value of something (a market) as it moves along in time. What, then, impacts the value? Supply and demand of the particular market. Supply and demand is affected by a whole lot of factors that I consolidate as “fundamentals” and emotions. Fundamentals include the following: company financials, news, economic data, economic health – various barometers, forecasts, forecasts comparisons, and many others.

In the small chart that I created above, you can see the category called emotions followed by two sub-points: fear and greed. It seems like emotions are insignificant but emotions can be blasted into a huge subject on the psychology of trading. There are books on that realm of trading, and I will not cover much of it here. Briefly, there are two ways of looking at psychology of trading: one, how it affects the market as a whole; two, how it affects traders individually. I believe psychology only affects the market in short-term scenarios.

If you view technical analysis through the same lenses that I do, you will see that my definition of technical analysis is that it is a way of interpreting the fundamentals and traders’ psychology that drive the market. If you are looking for “golden rules” to take away from my course in technical analysis, the first is probably this: “a chart is a way of analysing the fundamentals”.

Technical analysis is like looking at the stars

Quite a number of people I talk to discredit technical analysis on the grounds that it is not academic (in the first place, if you look at the definition of academic, technical analysis fits the bill too), it has absolutely nothing to do with the underlying market, and so on. Basically, people who do not believe in technical analysis think it is something independent of the market and economics – like looking at the stars to see what your future holds; no correlation between the two.

Let me explain what a chart means again – or what it does not mean. A chart is not a graph plotted by a machine that is churning out random numbers; a chart is not something that a bank prints out daily based on whatever data that the bankers feel like using as chart inputs; a chart is not like what completely anti-technical analysis people think of a cow going through one side of a machine and lumps of unrecognisable matter coming out the other side (even then, it came from somewhere).

A chart derives its data from the market. This simple concept is the exact same one as a company’s cash inflow or outflow being the sum total of all monies received minus monies coughed out – and you see it on the financial statement. (We actually see how financial books nowadays suffer the risk of unethical but legal “manipulation”, or even outright illegal doctoring.) No one can manipulate your chart (unless your broker decides to print out a different chart from the exchange’s data, which I have never come across or heard before). Every candle or bar or centimeter of line that prints on a chart stays there forever – embedded in history.

Now that I have established what a chart shows, I shall proceed to what chart data means; where does the underlying data of a chart get meaning from?

“The STI (Straits Times Index – barometer of the Singapore stock market) opens the day with more bidders than sellers – because US markets closed favourably during the previous night – news of the Fed clearly reaffirming an expansionist policy for the next half a year. Nearing lunch, prices are relatively flat. Germany’s manufacturing data points to strong prospects – promising start to European markets drive the STI even higher before ending 47 points above the previous day’s close.”

What we then get is a bullish-looking, “healthy” green candle on a candlestick chart. This is a simple example of how a chart is a depiction of the market. When we extend this example into more than a day in the life of the market, we get into trends – short-, mid-, and long-term; and much more than that.

A chart is not a depiction of fundamentals? A chart of a small company’s stock price increasing by ten-fold in three years because of securing patents and making good inroads into developing markets is rubbish? The company is a scam? The market – no, the chart is unreliable? At this juncture, some of you may bring in the debate of whether market participants – humans – are perfectly rational creatures or not. We do not always have to pitch tents in the extreme ends of polarizing issues. Briefly, I will say that humans are obviously not totally irrational creatures – would you rather park ten metres away from the shopping center and pay four dollars or park fifty metres away in a multi-storey carpark with an elevator and pay one dollar fifty cents? Yes, I gave such a safe answer: “not totally irrational”; I will change it: “nearly rational most of the time”.

Conclusion (total beginners, do not skip this)

All in all, I want to promote technical analysis as the way to analyze a market and, subsequently, trade it. The reason is that I value a chart more than how some people do. A chart has meaning – as I have explained above. And because the chart is meaningful, I can develop theories and techniques on analysing the market and use this analysis to trade.

At this point, the sharper ones among you will probably say this: “Yes, a chart is obviously based on real market data. You do not need to go around the world – the universe – to explain that. But trading off a bounce from a trendline still has nothing to do with an uptick in the Baltic Dry Index.”