Virus, what virus?

Virus, what virus?

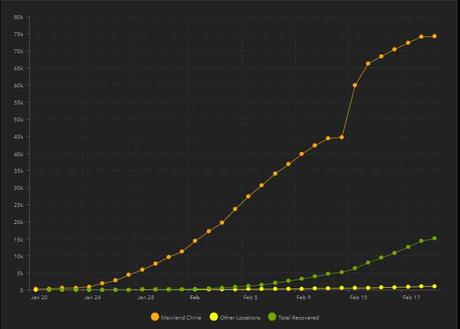

75,282 infected, 2,012 dead, 15,030 recovered and last Wednesday we were at 45,204 infected, 1,116 dead, 5,085 recovered and the Wednesday before that it was 24,607 infected, 494 dead and 988 recovered so, in the past two weeks infections jumped 83.7% and 66.5% and deaths jumped 126% and 80% and recoveries surged 414% and 195%. Overall then, it does look like we're SLOWLY getting things under control but even "just" 33% more infections next week brings us over 100,000 – I would not say we're out of the woods by any means.

Nonetheless, if more infections is bullish for the markets, we need to learn to play the market that way, right? So far, the more people are infected, the more stimulus China provides and that's what's lifting stocks this morning as China’s Ministry of Industry and Information Technology said the government would connect factories with technology companies to identify weak links in their supply chains.

What does that actually mean? No one knows but it SOUNDS good and that's all it takes these days to rally the markets. “‘There will always be someone to save us’--that is the outlook from investors at the moment,” said Lewis Grant, a portfolio manager at Hermes Investment Management. That seems to be the typical attitude of people who are managing other people's money – just keep buying!

The Nasdaq (/NQ) Futures are back at 9,680 and 9,687.5 was our high on Monday and, in our Live Member Chat Room yesterday afternoon, I said:

The Nasdaq (/NQ) Futures are back at 9,680 and 9,687.5 was our high on Monday and, in our Live Member Chat Room yesterday afternoon, I said:

That's why I went flat earlier but time to short 2 /NQ again at 9,638. We fell from 9,675 on Friday and I'm happy to DD if we test 9,700 to average around 9,660 on 4 short. But yes, shorting is a fool's game in this market.

As you can see, we're down $1,685 so far (can't win them all) and it's very tempting to double down here at 9,680 but that makes the commitment too heavy ahead of the Fed minutes this afternoon so we'll stick with the plan and patiently wait for 9,700 and we'll see how things are going this afternoon, when we have our Live Trading Webinar at 1pm.

We'll be reviewing our Member Portfolios this week and…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!