So what is behind the title of my latest book, FIREd by Fifty? For those of you who are not in the FIRE community, FIRE is an acronym like DINK (Dual Income, No Kids) and SAHM (Stay-At-Home-Mom). It stands for Financially Independent, Retired Early. It is a rallying cry by those who would like to reach financial independence before they are old and gray. For some, this is so that they can travel the world without needing to bring oxygen with them on the plane, but for many others, it is just so that they can pursue their passion as a career rather than needing to do what they need to in order to support the common, middle-class lifestyle. If you’d like to learn more about the FIRE movement, check out a book that has been the inspiration for the movement, Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018.

Many in the FIRE community are trying to retire way before age 50. They would like to say bye-bye to their day jobs by their mid-forties or even their thirties. Some of their heroes like Michelle Schroeder-Gardner of Making Sense of Cents even retired in their twenties and now travel the country in RV

(Note, if you click on a link in this post and buy something from Amazon (even if you buy something different from where the link takes you), The Small Investor will receive a small commission from your purchase. This costs you nothing extra and is the way that we at The Small Investor are repaid for our hard work, bringing you this great content. It is a win-win for both of us since it keeps great advice coming to you (for free) and helps put food on the table for us. If you don’t want to buy something from Amazon or buy a book, how about at least telling your friends and family about our website as a great place to learn about investing and personal finance. Thanks!)

Do you really want to sleep in your car for 50 years?

I would rather see people get to the point where they can live comfortably rather than just where they need to be to survive. Sleeping in your car may be fine when you’re 25, but it gets a bit old when you’re in your sixties. I would also want them to have the gotcha’s, like medical events and major home repairs, taken care of rather than seeing them just living along, thinking everything is great, but then end up in the hospital for a few weeks and not be able to pay the bills because they’re living on a $20,000 per year income. Even worse than if they simply had to skip out on the bill, leaving it to others to pay, would be if they had to fork over a lot of that nest egg they had built up, thinking it would last forever, to the hospital and then needing to find a job again when they are 20 years out of college and having done nothing to maintain their skills for ten years or more.

I’d also like to see more people saving up to send their kids to college so that maybe we can start to undo this student loan crisis we’ve put ourselves into. In fact, I’d love to get rid of loans entirely, both so that students wouldn’t start life with a mountain of debt and so that colleges would be forced to charge what people could pay, rather than what they can finance over fifty years or more. (If you’d like to hear more of my thoughts on this, check out this article.) Getting to that point isn’t something most people can do within ten or fifteen years. It takes a good 25 to 35 years, so age fifty seemed like a good target. Sure, there are some high earners who could get there faster if they lived a middle-class lifestyle when they retired, but most people only have a few hundred dollars they can put away each month without extremely sparse living.

Putting the “flow” in cash flow

When I started writing my second book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early

What would a rich dad do

Getting to FIRE without sleeping in your car requires a different sort of cash flow, one that Robert Kiyosaka in Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! brilliantly laid out where instead of having all of the money come in and then flow out while trying to increase your income to grow wealth in spite of your high spending, you direct some of your income to buying assets. This creates a circular cash flow where money from your job is used to buy assets, which then, in turn, generate additional income. If you then use some of the additional income your assets are creating to buy additional assets, you set up a circular feedback loop that will cause your income to grow exponentially. Once you have enough assets to generate all of the income you need to pay your expenses, presto, you now no longer need to work to survive.

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

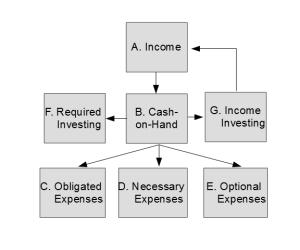

In FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early I expand upon Kiyosaki’s work and really develop a cash flow plan as shown below. I break expenses down into Obligated Expenses – things you are forced to pay for like taxes and your mortgage, Necessary Expenses – things you need to live like food and clothes but of which you can control the cost to an extent, and Optional Expenses – things like meals out and massages, luxuries. I then break investing into Required Investing – things like retirement and college investing that you really “must” do and Income Investing, which is investing done to increase your income. It is this last box that allows you to reach FIRE since this is the income generator that feeds upon itself and gives you income that you can use now, as opposed to retirement accounts that don’t kick in until you reach retirement age. It also includes savings for the gotchas like that air conditioner that will break in ten years and send you into a HELOC if you don’t start piling up cash now.

The Cash Flow DIagram

By developing a cash flow plan, readers can actually determine how much they need to be putting away towards investments each month to reach financial independence on their schedule. They might find that reaching FIRE at age 35 is virtually impossible or would require sacrifices beyond what they could sustain, but just a few trade-offs would allow them to get there by 45 or 50. They can then go into their cash flow plan, make those adjustments, then use a monthly budget to help them stick to the plan and reach their goals. Because this is a long-term effort, just like the way it is with maintaining a healthy weight, the financial lifestyle you choose must be something you can live with as a lifestyle or you’ll probably fail. The nice thing about finances, however, is that you can slowly add to your lifestyle as your income from assets increases. You can’t slowly add doughnuts and fried foods back into your diet if you want to maintain a healthy weight. Too bad.

Its all about helping out

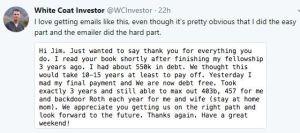

So I’m hoping that those who are interested in becoming financially independent by their early fifties, both to allow them to pursue the work they love and because as you get into your fifties and sixties it becomes increasingly difficult to replace a job if you are downsized, will check out Fired by Fifty. It would be great to be getting emails like the one White Coat Investor gets from people who have read his book and it has changed their lives:

I hope to hear from people who have gone from living paycheck-to-paycheck to having a fully-funded 401k, funded college IRAs, an income investing portfolio, and a paid-off home. Long before you get to financial independence, just having that sort of security means a lot in terms of peace in your life.

Become a wealthy investor while you’re at it

Lastly, if you are already on the road to FIRE and would like to learn more about investing from someone who’s been doing it for more than 35 years now, check out my other book,

Have a burning investing question you’d like answered? Please send to [email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.