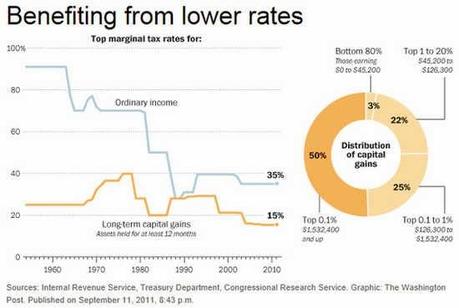

The chart above is slightly out of date, since the capital gains tax has been raised to 20% (instead of 15%) and the top earned income tax rate is 39.6% -- but the point of view is still valid. And that point is that the rich get a special lower tax rate than workers can get. They only have to pay a 20% tax rate on long-term capital gains income (investment income), instead of the top tax rate of 39.6% on earned income (income that derives from work performed). It is this provision (in addition to loopholes) that allow the rich to pay a smaller tax rate than middle class workers (and a perfect example is the 13% tax rate paid by Mitt Romney on an income of over $20 million).

The chart above is slightly out of date, since the capital gains tax has been raised to 20% (instead of 15%) and the top earned income tax rate is 39.6% -- but the point of view is still valid. And that point is that the rich get a special lower tax rate than workers can get. They only have to pay a 20% tax rate on long-term capital gains income (investment income), instead of the top tax rate of 39.6% on earned income (income that derives from work performed). It is this provision (in addition to loopholes) that allow the rich to pay a smaller tax rate than middle class workers (and a perfect example is the 13% tax rate paid by Mitt Romney on an income of over $20 million).The idea of taxing those who let their money work for them at a less rate than those who must work for their income is a Wall Street-inspired Republican idea. The idea promotes the notion that capital (money) is more important than labor (work). This is a ridiculous idea. The truth is that capital could produce exactly nothing without labor, and labor could do little with capital. In other words, both are necessary for the production of any product/service.

And since both capital and labor are necessary, the income derived from each should be taxed at the same level. It is ludicrous to think the rich should be able to save 19.6% off their taxes simply because they didn't have to work for that money. That defeats the whole purpose of having a progressive tax structure (which says that those who make the most should pay a higher tax rate).

It is time to eliminate the special long-term capital gains tax rate (and other special tax rates that allow the rich to pay less than others). It is time to tax all income as earned income, regardless of how it was earned.