And just like that we're failing at the Bounce Lines.

And just like that we're failing at the Bounce Lines.

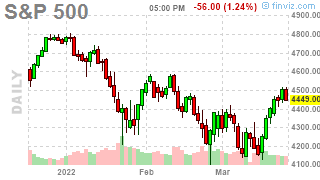

4,512 is the weak bounce line on our bullish Bounce Chart (see yesterday's PSW Report for more details) and the S&P Futures (/ES) topped out at 4,514.75 before being rejected at the exact spot our Fabulous 5% Rule™ predicted way back in January. More to the point, for you TA fans – see that "W" that's formed since mid-February? If we can't break higher (4,500), then we're beginning to form a consolidation pattern that's likely to break LOWER, not higher.

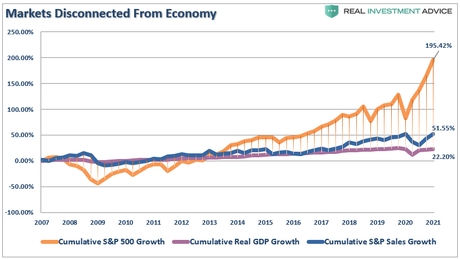

At the beginning of 2017, our GDP was $18.9Tn and now it's $24Tn so that's up 27% in 5 years – very impressive but the S&P 500 is up over 100% – 4x more than the economy has grown and, as we know, $11Tn of that $5.1Tn in growth was Stimulus coupled by low rates from the Fed – not exactly giving us a genuine reading, is it?

We have to ask ourselves, what is more likely to happen first? Are sales for the S&P going to double or are the prices we pay for stocks going to come down? At the moment, the bond market is crashing and housing is too expensive and commodities are out of control so the stock market still looks pretty attractive BUT,…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!