It's ultimatum time.

It's ultimatum time.

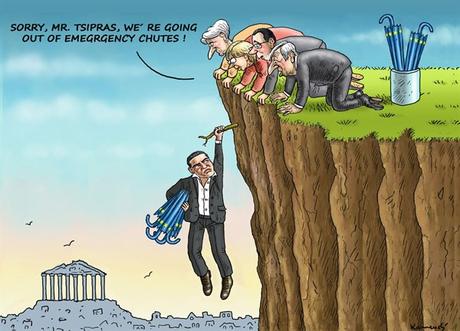

Greek Prime Minister, Alexis Tsipras, heads to Brussels after finding himself boxed into a corner as creditors prepare to deliver a final proposal to end the stalemate over a financial lifeline. After European leaders and the head of the IMF held secret talks in Berlin on Monday night (without Greece), creditors agreed on a document designed to avert a default that will be presented to Greece. Tsipras, who said the only plan on the table was one his government submitted, will meet European Commission President Jean-Claude Juncker later today.

“I will explain to Juncker that today, more than ever, it’s necessary that the institutions and the political leadership of Europe move forward to realism,” Tsipras said in a broadcast statement in Athens before traveling. He said there had been no feedback on the Greek proposal. Four months of sparring and missed deadlines have given way to a greater urgency to decide the fate of Greece, which has about 310 billion Euros ($346Bn) of debt outstanding. Good luck Alexis – you're going to need it!

You thought the leaden winter would bring you down forever,

But you rode upon a steamer to the violence of the sun.Her name is Aphrodite and she rides a crimson shell,

And you know you cannot leave her for you touched the distant sands

With tales of brave Ulysses; how his naked ears were tortured

By the sirens sweetly singing. - Clapton

“The need for a deal is so big, after such a prolonged liquidity crunch, that the relief for the wider public will eventually trump the cost of compromise,” said George Pagoulatos, a professor of European politics and economy at the Athens University of Economics and Business. This is, perhaps, wishful thinking as the Greek Government has said they can no longer budge on issues like Pension Reductions, Wage Decreases and even tighter Budgets – which are really the only places left to cut at this point.

“The need for a deal is so big, after such a prolonged liquidity crunch, that the relief for the wider public will eventually trump the cost of compromise,” said George Pagoulatos, a professor of European politics and economy at the Athens University of Economics and Business. This is, perhaps, wishful thinking as the Greek Government has said they can no longer budge on issues like Pension Reductions, Wage Decreases and even tighter Budgets – which are really the only places left to cut at this point.

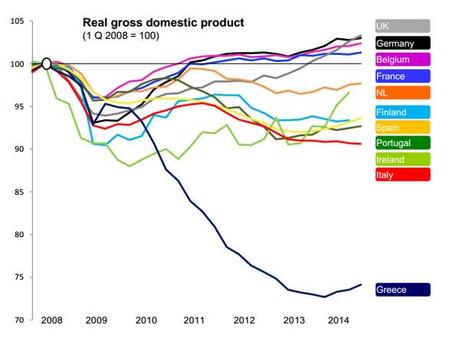

Greece's GDP is down 25% over the last 7 years and the GDP of the whole country is just $220Bn, about $21,000 on a per capital basis (11M population). This is like New York City being $346Bn in debt, except NYC's GDP is $1.5Tn, which is 7 TIMES more than Greece so a real comparison would be if Detroit, which is $18Bn in debt with a GDP of $225Bn were, instead, $346Bn in debt. Detroit is totally F'd now – how would 20x more debt be for them? What would be the likelihood that could be fixed seeing as we still haven't fixed Detroit's $18Bn inside of the World's richest economy?

The $346Bn that's being argued over is what the Greeks owe to EU creditors (mostly the IMF and ECB) but, internally, they are dead broke with no funding for pensions or even next week's Government payroll yet the EU insists they pay those debts first. From the EU's perspective, letting Greece off the hook sends a dangerous message to Cyprus, Latvia, Italy, Ireland, Portugal and Spain, who collectively owe about $2Tn and would also much rather not pay.

The $346Bn that's being argued over is what the Greeks owe to EU creditors (mostly the IMF and ECB) but, internally, they are dead broke with no funding for pensions or even next week's Government payroll yet the EU insists they pay those debts first. From the EU's perspective, letting Greece off the hook sends a dangerous message to Cyprus, Latvia, Italy, Ireland, Portugal and Spain, who collectively owe about $2Tn and would also much rather not pay.

Of course the US, with our $18Tn debt, laugh at the little problems of the European Union. Why don't they just have their Central Bank buy all the debt that the Treasuries issue at 2% rates so we can continue to just pay interest on the debt and pretend everything is fine, even as we borrow another $50Bn a month from ourselves? Extend and pretend has worked for Japan for over 20 years now – especially for the Bankers, who keep lending money to high credit risks at high rates (their reward) while never suffering the risk of their poor lending decisions.

If you want countries to practice austerity – STOP LENDING THEM MONEY!!! Don't lend them more and more money and then demand austerity so they can pay back your loans. If you didn't lend them the money in the first place, they wouldn't have racked up all that debt. Now we have a situation is which 35% of Japan's Government Revenues go towards paying just the interest on their debt (250% of GDP). What happens to Japan if their 10-year notes go from 0.474% to something more like the US's 2.286%? That would make their interest payments alone 175% of Government Revenues!

Don't laugh at Japan, the US is already spending 18% of their Government Revenues in interest payments alone and, between 1960 and 2007 there was only one year in which the 10-year rate was lower than 4% with double digits being paid in the early 80s. THAT is "normal" – what we have now is a fantasy and, like all fantasies, it will come to an end one day and we'll be forced to deal with reality. Low rates are economic heroine – they are helping us escape reality while making us addicted slaves to something that is ultimately killing our economy.

The only difference between Greece and Japan, China or the US is that Japan, China and the US get to print their own money and make their own rules. Greece has an external reality they are forced to deal with and the ECB is staging a sort of 3-year intervention but it may be too late to save Greece at this point – not unless the family is willing to make sacrifices to help them.

The only difference between Greece and Japan, China or the US is that Japan, China and the US get to print their own money and make their own rules. Greece has an external reality they are forced to deal with and the ECB is staging a sort of 3-year intervention but it may be too late to save Greece at this point – not unless the family is willing to make sacrifices to help them.

The ECB had their policy meeting today and they decided to keep their rates on hold and the EU markets are up about 1% on that news and our own Futures are up about half a point as well (but we're shorting here – 8:30 am). We have US PMI and ISM just after the bell and oil has already crashed back below $60 – giving yesterday's Live Webinar Attendees a nice $1,500 per contract winner on our oil short (/CL at $61.30). I called that trade done in Twitter earlier this morning, but we got a nice spike to $61 for a reload already.

We're waiting to see what Draghi has to say for himself but our assumption (shorting /YM at 18,100, /TF at 1,255, /NQ at 4,540 and /ES at 2,120) is that whatever he says won't keep the Dollar down at 96 and a stronger Dollar will weaken the indexes as will the fall in oil – especially if it can't hold $60 after inventories this morning (10:30). We'll also be watching /NKD for another chance to short at 20,600 – that's been a great trade recently, but not while the Dollar is going up, of course.

We're waiting to see what Draghi has to say for himself but our assumption (shorting /YM at 18,100, /TF at 1,255, /NQ at 4,540 and /ES at 2,120) is that whatever he says won't keep the Dollar down at 96 and a stronger Dollar will weaken the indexes as will the fall in oil – especially if it can't hold $60 after inventories this morning (10:30). We'll also be watching /NKD for another chance to short at 20,600 – that's been a great trade recently, but not while the Dollar is going up, of course.

It's going to be an exciting day and the Fed's Beige Book is out at 2pm, which will give us another look at the overall economy, which we already know isn't that great so – still shorting into these BS Futures pump jobs.

Be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!