The last Fed statement came out on January 29th and, as you can see from Dave Fry's Dow chart on the right from Feb 3rd, it was not INITIALLY well-recieved. We had already been heading lower into the announcement and we fel another 400 Dow points in the next 3 sessions (see our February Trade Review for details).

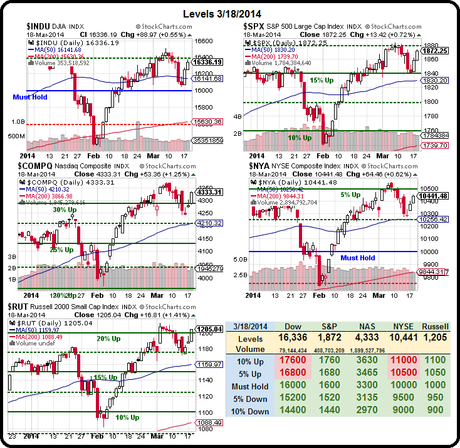

This time is already different as the Dow is already UP 300 points this week, back at 16,336 as we survive another round of tapering (first was Dec 18th and we rallied after selling off into the meeting). This will be the first time since the taper began that we rallied INTO the meeting so we set ourselves up to be disappointed with a TZA hedge (see replay of yesterday's Live Trading Webcast), but that didn't stop us from picking a lot of great, bullish, bottom-fishing trades (also see Webcast).

In fact, that's what a hedge is for – to lay the groundwork for more buying – in case we are tempted to move our cash back from the sidelines.

In fact, that's what a hedge is for – to lay the groundwork for more buying – in case we are tempted to move our cash back from the sidelines.

Tempting though it may be, we're still "Cashy and Cautious" into the Fed Meeting this afternoon (2pm with Yellen speaking at 2:30) and we're also shorting the Russell Futures (/TF) below the 1,200 line, Nasdaq Futures (/NQ) below 3,700, Dow Futures (/YM) below 16,300 and S&P Futures (/ES) below 1,865. Generally we look for 2 of the 4 to be under and then we short one of the laggards when they cross - simple and effective.

We already picked up $100 of Egg McMuffin money with a long play on oil (/CLK4) as the May contracts are a full $1 below the April contracts (/CLJ4), which is a bit stretched as the NYMEX crooks only have two sessions left to roll their fake 58M barrels worth of April orders into fake May orders – so we expected a spike in demand for May contracts today but only playable over the $98.50 line with tight stops and we're still liking SCO at $30 as an overall short on oil because they still have to dump it eventually. The April $30 calls are just .90 and SCO was at $31.27 on Monday.

Click for

Chart

Current Session

Prior Day

Opt's

Open High Low Last Time Set Chg Vol Set Op Int

Apr'14

99.53

99.71

99.34

99.58

07:26

Mar 19

-

May'14

98.60

98.75

98.39

98.54

07:26

Mar 19

-

Jun'14

97.68

97.88

97.55

97.64

07:26

Mar 19

-

Jul'14

96.77

96.96

96.59

96.70

07:26

Mar 19

-

This is the normal pattern of fake, Fake, FAKE orders at the NYMEX and notice there are already 323M barrels (1,000 barrels per contract) of fake orders stuffed into May despite the fact that May, just like April, will finish the contract period with less than 20M barrels actually delivered. ALL THE REST OF THE ORDERS ARE FAKE! They are simply there to create a false demand for oil and to drive up the prices – Rex Tillerson of XOM estmated that oil prices would be $60-70 per barrel without this despicable con game, which was has been allowed since Bush took office in 2000 – back when oil was $20 per barrel.

This scam costs the American Sheeple (who never write to Congress or take any action to stop this – like voting out GOP Congresspeople) $200Bn a year – and that's just the straight cost of the oil, the mark-up on refined products makes it much worse (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark!").

This scam costs the American Sheeple (who never write to Congress or take any action to stop this – like voting out GOP Congresspeople) $200Bn a year – and that's just the straight cost of the oil, the mark-up on refined products makes it much worse (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark!").

Fortunately, there's 200M drivers in the US and 100M homeowners so they're only getting each of us for $500 in the cars and $1,000 in the home to support their cause – why would we complain about that when such fine Capitalists are making so much money?

Sure that extra $200Bn could be used to feed children or house the homeless or fix the infrastructure that makes Corporate America possible. We could educate our children or fund research into alternate energy or we could pay down or debt or spend that money locally instead of shipping half of it overseas to countries that turn around and fund terrorists, which then causes us to spend even more money on a military to look for terrorists that we fund.

Instead, we give that money to Rex Tillerson, who uses it to buy an 83-acre horse ranch in Texas and then gives some more money to his lawyer, who sues to prevent the construction of a water tower to be used by a local fracking operation, which might spoil Rex's view. Ironic, isn't it?

The suit, filed in Denton County District Court, also noted that the tower could encourage the town of Bartonville to sell "water to oil and gas explorers for fracking shale formations leading to traffic with heavy trucks… creating a noise nuisance and traffic hazards."

Imagine how this must make the 21 families who had to evacuate their homes in Arkansas last year when one of Tillerson's piplines sprang a leak in their back yards….