“I’m not going to interfere with their critically important work.”

“I’m not going to interfere with their critically important work.”

That's what President Biden said yesterday when meeting with Jerome Powell and Janet Yellen, the current and former heads of the Federal Reserve. This is a strong indication of support for the upcoming Fed Rate Hikes with 2 0.5% hikes expected over the next two meetings.

In theory, that is already baked in by the market and Biden's support is just another way of showing Wall Street the Administration is serious about tackling Inflation, despite any potential market consequences. The Fed is trying to cool demand to moderate price pressures. But Mr. Powell has conceded that the central bank’s ability to do that without forcing the economy into a recession depends on developments outside the central bank’s control, including global energy markets that have been badly disrupted by Russia’s war in Ukraine and supply chains snarled by the Covid-19 pandemic.

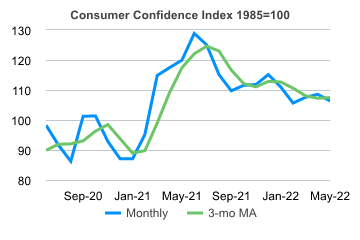

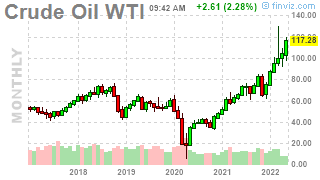

Consumer confidence has slumped amid rising prices of food and gas. Gasoline prices have risen in recent months even as the Biden administration has tapped oil supplies from the U.S. Strategic Petroleum Reserve, releasing one million barrels of Oil (/CL) a day yet oil is still at $116 as of this morning and wholesale Gasoline (/RB) is still over $4/gallon.

Consumer confidence has slumped amid rising prices of food and gas. Gasoline prices have risen in recent months even as the Biden administration has tapped oil supplies from the U.S. Strategic Petroleum Reserve, releasing one million barrels of Oil (/CL) a day yet oil is still at $116 as of this morning and wholesale Gasoline (/RB) is still over $4/gallon.

Throughout the 1970s, the Federal Reserve both misread the U.S. economy and didn’t believe it had the authority to fight inflation – if that required pushing the economy into a recession. In 1970, President Richard Nixon put a loyal, longtime adviser, Arthur Burns, in charge of the Fed and made clear his low regard for the institution’s autonomy. “When we get through, this Fed won’t be independent if it’s the only thing I do in this office,” he said at the time. Those mistakes prompted the Fed, under Paul Volcker in 1979, to raise interest rates to punishingly high levels, sparking a double-dip recession in the early 1980s that sent unemployment up sharply.

We can certainly afford more Unemployment at the moment as our current problem is not enough workers for the jobs that are available and yes, if you remove Oil increases, food would be lower…

We can certainly afford more Unemployment at the moment as our current problem is not enough workers for the jobs that are available and yes, if you remove Oil increases, food would be lower…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!