Let's talk Fundamentals.

Our guest today in our 1pm (EST) Live Trading Webinar will be Bill Olsen of Newsware and he's going to show us lots of tricks to get the most out of his platform, which is better than a Bloomberg Terminal for bringing you the headlines before they become headlines. While I'm mostly a Fundamental, Long-Term Trader, who doesn't like to get a jump on a quick trade because you know something that's not generally known yet?

As Gordon Gekko said in "Wall Street": "I don't throw darts at a board, I bet on sure things." Information is power and we're living in the information age but, unfortunately, like everything else, you have to learn to read and filter the news and, while Bill has many pre-set filters you are going to love – you are still going to have to put your 10,000 hours in if you want to get your Gekko on.

Just this morning, for example, the following alert popped up at 6:14:

Ant Said to Reach Agreement with Regulators on Overhaul – Bloomberg

(Street Insider 02/03 06:14:06)

Perhaps that headline by itself isn't helpful but we know that Jack Ma has been out of favor with the Chinese Government and that AliBaba's (BABA) stock price has suffered because of it. We also know Amazon (AMZN) just knocked it out of the park on earnings so BABA should also do well and that means we BUYBUYBUYU on that news.

Perhaps that headline by itself isn't helpful but we know that Jack Ma has been out of favor with the Chinese Government and that AliBaba's (BABA) stock price has suffered because of it. We also know Amazon (AMZN) just knocked it out of the park on earnings so BABA should also do well and that means we BUYBUYBUYU on that news.

BABA is already up $10 pre-market at $264 but that's down from $319 in October and the best way to play it is to say we WOULD like to own it for $200, so we can sell 5 2023 $200 puts for $33 (perhaps $30 if we open higher, so call it a $15,000 credit) and then we can buy 15 of the 2023 $250 ($70)/300 ($50) bull call spreads for net $20 ($30,000) in our Long-Term Portfolio (LTP) and that's net $15,000 on the $75,000 spread so there's $60,000 (400%) of upside potential at $300 and, as our Members know, we can look forward to selling short calls like (but NOT YET) 5 March $290s for $5 to collect $2,500 using 44 of the 716 days we have to play.

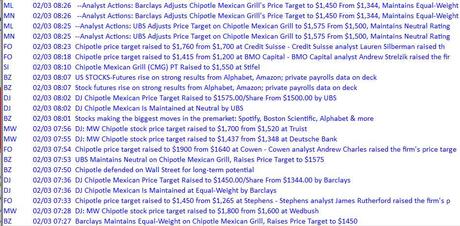

If we pay net $15,000 for the spread, we only have to sell $2,500 worth of premium every 100 days to more than pay for the whole thing and then we have a free 2023 $250/300 bull call spread on BABA. Our downside risk is being assigned 500 shares of BABA at net $200 ($100,000) but, fortunately, we already have an FXP spread in our Short-Term Portfolio so we already have a downside hedge on the Chinese market. That coupled with the fact that we recover our investment making just 1/3 sales against our long position makes me REALLY like this trade idea! You know who else is liking my trade idea? Analysts – who are running in like sheep to upgrade BABA this morning – also very easy to find on NewsWatch (part of NewsWare):

If we pay net $15,000 for the spread, we only have to sell $2,500 worth of premium every 100 days to more than pay for the whole thing and then we have a free 2023 $250/300 bull call spread on BABA. Our downside risk is being assigned 500 shares of BABA at net $200 ($100,000) but, fortunately, we already have an FXP spread in our Short-Term Portfolio so we already have a downside hedge on the Chinese market. That coupled with the fact that we recover our investment making just 1/3 sales against our long position makes me REALLY like this trade idea! You know who else is liking my trade idea? Analysts – who are running in like sheep to upgrade BABA this morning – also very easy to find on NewsWatch (part of NewsWare):

INFORMATION – That is how we trade. We don't need to follow the sheep who run into momentum stocks on Reddit boards. We can make good money (400% is good money, right?) by simply using the proper tools (which we PRACTICE using until we are experts) and putting in the real work it takes to consistently make money in the market.

We are, for example, short Chipotle (CMG) in our Short-Term Portfolio as we bought the $180,000 short spread for net $25,017, so plenty of upside and we think CMG won't hold up in a bad market and that it's so over-priced, it won't hold up in a good one either. Last night they did indeed have disappointing earnings but the analysts have been running in to support it so far but it only takes one small boy to point and shout that the Emperor has no clothes and suddenly opinions can change.

We are, for example, short Chipotle (CMG) in our Short-Term Portfolio as we bought the $180,000 short spread for net $25,017, so plenty of upside and we think CMG won't hold up in a bad market and that it's so over-priced, it won't hold up in a good one either. Last night they did indeed have disappointing earnings but the analysts have been running in to support it so far but it only takes one small boy to point and shout that the Emperor has no clothes and suddenly opinions can change.

Our target for CMG in Jan of 2022 is below $1,100 and you can currently buy that $180,000 spread for a net $725 credit. That means we're currently down $25,742 but it's a hedge – we expect to lose money when the markets are strong. Like the BABA play above, we're making short-term money selling short-term calls and our March calls should be looking good this morning as CMG tumbles back to $1,485:

CMG Long Put 2022 21-JAN 1,400.00 PUT [CMG @ $1,523.05 $0.00] 6 12/17/2020 (352) $124,542 $207.57 $-43.57 $192.40 $164.00 $0.00 $-26,142 -21.0% $98,400

CMG Short Put 2022 21-JAN 1,100.00 PUT [CMG @ $1,523.05 $0.00] -3 10/28/2020 (352) $-39,525 $131.75 $-66.25 $65.50 $0.00 $19,875 50.3% $-19,650

CMG Short Call 2021 19-MAR 1,400.00 CALL [CMG @ $1,523.05 $0.00] -5 1/14/2021 (44) $-60,000 $120.00 $38.95 $158.95 $0.00 $-19,475 -32.5% $-79,475

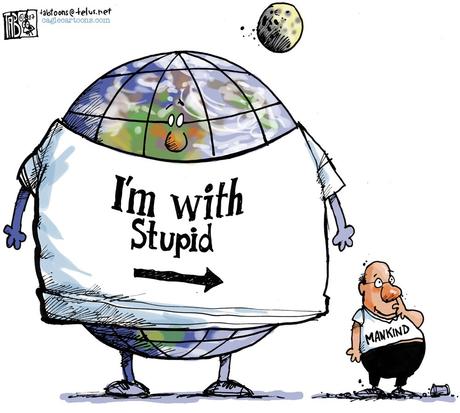

Chipotle's earnings were $3.48/share vs $3.72 expected and that's finished them at $10.72 for the year but that's $10.75 per $1,500 share – that's a p/e ratio of 140 times earnings – that is RIDICULOUS! They sell burritos people, not Teslas!!! And this is not a new business, CMG spun out of MCD in 2006 and CMG has 2,700 locations in the US and Europe while Big Daddy, MCD only gets a p/e of 33 yet MCD made $6.05 per $210 share this year – only about 50% less than CMG yet CMG is valued 5 TIMES more than McDonald's – now that's just stupid!

Betting against stupid is our job at PSW but it takes a lot of research to make sure we're on the right side of these bets and for excellent research, you need excellent tools.

Betting against stupid is our job at PSW but it takes a lot of research to make sure we're on the right side of these bets and for excellent research, you need excellent tools.

Another stock we follow at PSW is Pfizer (PFE) and they had disappointing earnings yesterday but, as I told the Members, they are going to be selling $15Bn worrth of vaccine this year and, the way it looks, forever after that and that's what they call a blockbuster in the drug business. Combine that with a search on NewsWatch and we see no analyst lowering their price target below $40 and $35 looks like a Hell of a bargain so we take advantage of the dip with the following options spread (from yesterday's Live Member Chat Room):

- Sell 10 PFE 2023 $33 puts for $5.15 ($5,150)

- Buy 20 PFE 2023 $30 calls for $7 ($14,000)

- Sell 20 PFE 2023 $37 calls for $4 ($8,000)

That's net $850 on the $14,000 spread that's $10,000 in the money to start with $13,150 (1,547%) upside potential if PFE can manage to gain $2 from where it is now over the next two years. I like those odds! Worst case is, of course, owning 1,000 shares with a loss of the $8.50 so net $30.85 is still $4 (12%) off the current price.

That one already went out as a Top Trade Alert to our Members because who doesn't like to make a 1,547% return on their money in two years. Reddit can't do that for you but sensible investing with options on a blue chip stock we don't mind owning can!

You don't have to chase after junk to make wonderful returns in the market – you just have to do the actual work and learn to be patient.

Join us at 1pm, EST, for our Live Trading Webinar with Bill Olsen!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!