How many times have we seen this?

How many times have we seen this?

Low volume rallies followed by big volume sell-offs are the norm in an end-stage bubble as institutional investors do their best to reel in retailers to "hold their bags" for them as the institutions run for the exits.

Seeing how fast the market falls as soon as the volume picks up should be sobering but the music is still playing and we've trained those dip-buyers like Pavlov's dog and they can't resist a chance to throw their cash at anything that's cheaper than it was yesterday which, today, is 80% of NYSE, which had a very broad sell-off on double the volume of the previous two bullish sessions.

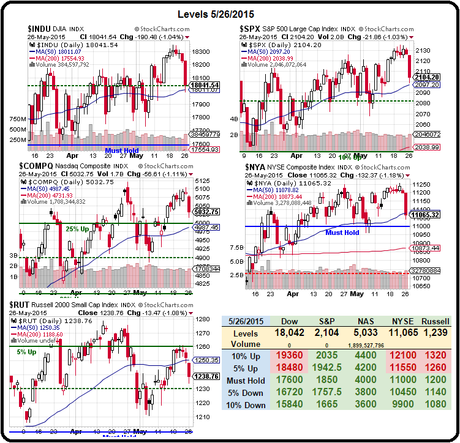

Remember how I was a stick in the mud all last week saying "don't buy, don't buy, don't buy"? This is the day I get to say "I told you so" but that's OK because we're going to bounce in the morning and all the bulls can make fun of me again but it's only the bounce we predicted in our Live Member Chat Room at 11:28 yesterday when I called the bottom and laid our our expected Futures bounce levels at:

- Dow (/YM) 18,050 (weak) and 18,100 (strong)

- S&P (/ES) 2,104 (weak) and 2,108 (strong)

- Nasdaq (/NQ) 4,473 (weak) and 4,481 (strong)

- Russell (/TF) 1,235 (weak) and 1,240 (strong)

There was great money to be made, of course, playing those bottoms and, in our Live Trading Webinar at 1pm, we found some laggards to play as well and we even added another bullish play to our Long-Term Portfolio because, even in a correcting market, there are still values to be had if you know where to look (and thanks to Jim for suggesting that one!).

We didn't need to find any short trades as we locked those in on the way up last week and our Member Portfolios are very well-balanced for this correction so far. We did lean a bit more bearish last week so we'll do better on a 5% move down than a move back up and, so far, after these bounces play out, that's still what we'll be looking for unless the data turns significantly better this week.

We still have a rate decision from the Bank of Canada this morning, Retail Sales in Japan tonight, the Fed's Williams speaks early tomorrow and we'll get Spanish GDP and Retail Sales, along with Italian Business Confidence (if there is such a thing) followed by UK GDP, US Home Data and Kocherlakota speaking in the afternoon, right after our 7-Year Note Auction, which makes me think the Fed thinks it's going to be bad and needs spinning. Tomorrow night we have Japanese Household Spending and that's sure to be ugly and that means their CPI will disappoint as well.

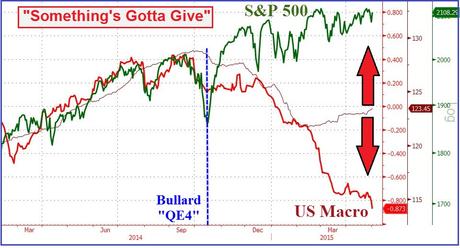

As you can see from the chart above, bad news has certainly been good news since Bullard hinted at more QE (that never came) in September but, should bad news start to be taken as bad news by equities – we certainly have a mountain of it stockpiled already.

As you can see from the chart above, bad news has certainly been good news since Bullard hinted at more QE (that never came) in September but, should bad news start to be taken as bad news by equities – we certainly have a mountain of it stockpiled already.

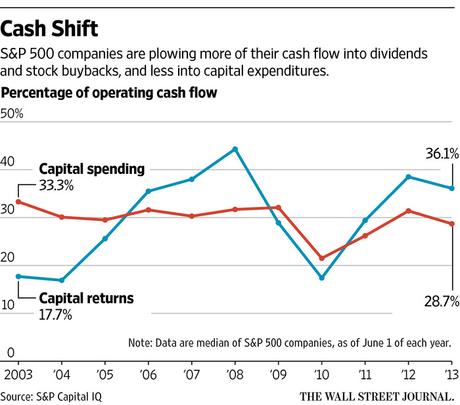

We are now in year 6 of tremendous underinvestment in Capital Spending by US Corporations and there's no sign at all that this trend is turning around. In fact, it's accelerating with huge increases in stock buybacks and huge decreases in energy sector investments. Why do "investors" think that companies don't have to invest money to make money? As it did in 2005, 6 & 7, stock buybacks and M&A deals are doing a wonderful job of increasing the PRICE of stocks but the VALUE of stocks is plunging and that's why we have days like we had yesterday – with very sharp and sudden corrections.

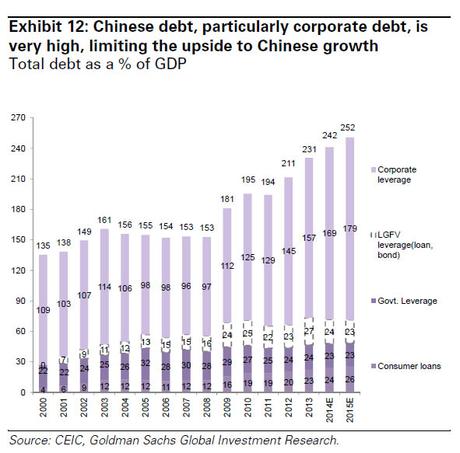

Chinese Corporate Debt alone is getting close to 200% of their GDP and, at this point, they have not choice but to "fake it 'till they break it" because there really is no exit strategy for what, in the US, would be $36Tn worth of debt. As I was saying in yesterday's webinar regarding Japan – these are the debts they are incurring at record-low borrowing costs – what happens when they can no longer roll over their debt at these low rates? As Goldman notes:

Chinese Corporate Debt alone is getting close to 200% of their GDP and, at this point, they have not choice but to "fake it 'till they break it" because there really is no exit strategy for what, in the US, would be $36Tn worth of debt. As I was saying in yesterday's webinar regarding Japan – these are the debts they are incurring at record-low borrowing costs – what happens when they can no longer roll over their debt at these low rates? As Goldman notes:

… after the onset of the global financial crisis and the collapse in world demand, exports collapsed. The Chinese government’s response involved large infrastructure outlays via bank financing. This led to a notable increase in China’s credit intensity, as investment growth is a more credit-intensive than exports and consumption, with heavy borrowing requirements and long payback periods.

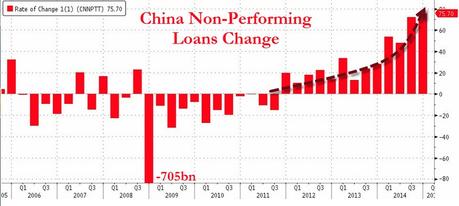

As I've been noting lately, this record debt in China is, of course, leading to record BAD Debt and, as you can see on this chart, 2014 came in at double the pace of 2013 and 2015 is off to a record start and just the defaults we noted on Friday will have us on tract to another double of bad debt this year. How long can this all be swept under the rug? Goldman continues:

As I've been noting lately, this record debt in China is, of course, leading to record BAD Debt and, as you can see on this chart, 2014 came in at double the pace of 2013 and 2015 is off to a record start and just the defaults we noted on Friday will have us on tract to another double of bad debt this year. How long can this all be swept under the rug? Goldman continues:

The equity market now plays an important role in terms of both the short-term policy objective (i.e., delivering this year’s growth target) and structural reform ambitions. Policy makers appear to have taken a largely benign view of the equity market rally, which, if sustained, can boost GDP by 0.5pp on our estimates through trading-related financial activities, and could add another 0.2pp or so through a rise in consumption from market wealth generation.

So, at this point, the PBOC has decided the best way to hit their GDP growth targets is to push the stock bubble to it's limits and generate a sense of prosperity – at least among China's elite. What they don't seem to understand (or even worse, maybe they do) is that these market bubbles do nothing but funnel money from the bottom 99% to the top 1% who take that money and invest it in safer parts of the World, which makes all that Government spending through the Central Bank a complete waste of resources that has no long-lasting benefit for the economy or the people.

So, at this point, the PBOC has decided the best way to hit their GDP growth targets is to push the stock bubble to it's limits and generate a sense of prosperity – at least among China's elite. What they don't seem to understand (or even worse, maybe they do) is that these market bubbles do nothing but funnel money from the bottom 99% to the top 1% who take that money and invest it in safer parts of the World, which makes all that Government spending through the Central Bank a complete waste of resources that has no long-lasting benefit for the economy or the people.

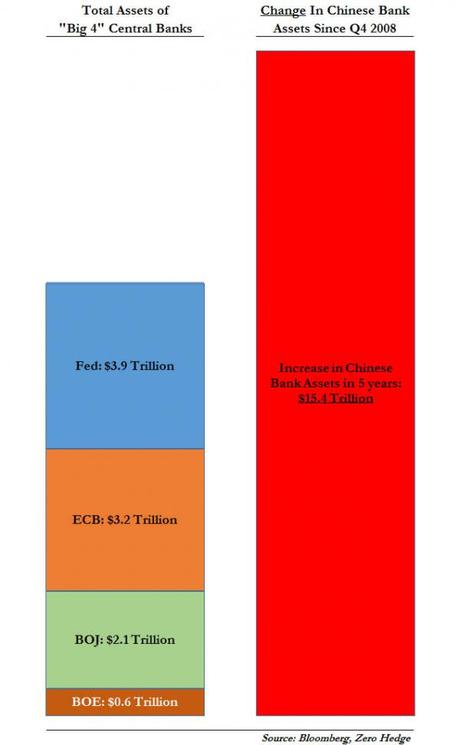

Was I talking about China or America? Gosh it's really hard to tell other than looking at our Fed's crazy QE policy or Dragi's Trillions or Kuroda's Quadrillions and, if we multiply them by 4-7 times – then we must be talking about China!

The chart on the right is from 2013, since then, all the Central Banksters have kicked it up a notch or two. Keep in mind though, it WAS this ridiculous in 2013 and it's more ridiculous today and will be more so tomorrow. I don't know when this house of cards will finally collapse – I'm simply saying it probably will – what with gravity and physics and all that…

And so castles made of sand, fall in the sea, eventually. – ">" target="_blank">Hendrix

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!