Traveling and living abroad has been an incredible experience. Upon reflection when writing this post, I realized that I left the U.S. a year and a half ago! Wow! Time flies! Since leaving the U.S., I have been able to travel and/or work in Holland, Laos, Indonesia, Thailand, and Vietnam.

I have had to overcome many obstacles while living and traveling abroad such as, getting vaccinated, finding apartments, acquiring visas, renewing my U.S. passport, finding work, and much more. Another obstacle which has never been a favorite pastime of mine is filling US taxes.

US Taxes For Expats

I have had to educate myself on U.S. tax law and the implications that living and working abroad has on paying taxes. There are some common misconceptions about US taxes that expats make which include:

- I do not need to file because I am working outside of the United States.

False, You still need to file US taxes regardless of where you are geographically in the world. If you are receiving money then you need to report your income.

- I do not have to file because I do not owe any taxes.

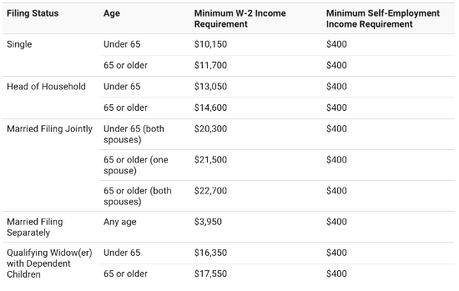

False, Just because you do not owe any money does not mean that you do not have to file. The only way that you do not have to file is if your annual income is below the federal minimum set standards. (Please see the graphic below for the federal minimum income requirements for the 2014 tax year.)

- I do not need to file because I do not make enough money.

Depends, as stated above, the IRS sets minimum income thresholds. If you have income greater then the set amount then you will need to file.

Now, while living in the U.S. filling your taxes is considerable easier comparatively to living abroad. When filling in the U.S. depends on the complexity of your financial situation, taxes can be relatively simple.

I tried to use several online tax services to file federal taxes as an expat but it was difficult to do since I had to submit my foreign earned income using Form 2555.

Assuming you qualify, you can use this form to calculate your foreign earned income exclusion. Basically, this is a huge tax benefit that exists for U.S. citizens residing abroad. In 2014, you can exclude up to $99,200 from you taxable income. O.k… What does this mean?

For example, lets say that you are working for a foreign company and living abroad. You are paid $50,000 U.S. dollars and you do not have any other income, then you can deduct $99,200 from your annual income and would not have to pay any federal income taxes. Although, you would still have to file a federal income tax form.

Finding US Expat Tax Preparation Help

After spending a considerable about of time researching all the forms that I would have to submit and filling out the forms to the best of my ability. I decided that I wanted a professional tax accountant to help me and make sure that I was not missing anything. I searched extensively online for a tax service that specializes in US Expat Tax Preparation and came across greenbacktaxservices.com.

After comparing them to other US tax preparation services that I found, I decided to choose them because they have an excellent web presence and youtube channel. Their website has a clean design and has a lot of free helpful information that answered many common questions that I had.

I contacted them and was able to work with one of their IRS enrolled agents one-on-one to aid me through the process. After talking briefly through email exchanges about my financial details, I uploaded relevant documents that the agent would need to fill-out my tax forms.

Following, the agent contacted me via email to ask me a few further questions about any discrepancies and then I was good to go. It made filling taxes a painless endeavor comparatively to previous experiences while living in the states.

After working with them, I found out that they have clients in 155 countries and an extensive expat tax services team. I was very happy to work with them and would recommend their service if you are in need of expat tax preparation services.

***Photo attribution to StockMonkeys.com***