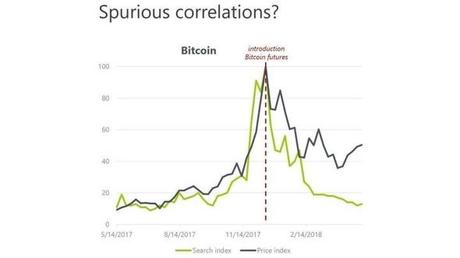

It seems like it could be the same as saying you can predict the future but an economist has an interesting take on how to predict Bitcoins price. It makes perfect sense as well. Quite simply research from accomplished economist Joost van der Burgt has simply suggested that Google searches can directly correlate with movements in the price of Bitcoin.

This makes sound logical sense as the investment will require reading and researching, typically on the internet and typically through the world’s largest search engine, Google. Now, loyal readers will have seen we have covered reasons and ways to predict the price rise with Metcalfe’s law being one of them.

This idea is similar. Metcalfe’s law states that the more an asset is purchased, the more the price will rise. In this case, the more a coin or token is searched, the more it will rise.

Mr Burgt is quoted as saying it’s nearly “a perfect match” continuing:

“every time Bitcoin was in the news, positive or negative, the price went up accordingly.”

Now, experienced traders amongst us will basically be screaming this is a case of “volume price” strategy of trading. This denotes that a trader will search the greatest volume of trades and piggyback on the back of it to make a quick buck on the price rise. This is the media way of finding this out.

The media hype the bubble and pump up the hysteria, he continued:

“If the buzz is everywhere, it doesn’t matter exactly what the news is about… nobody wants to miss out and everybody’s trying to get a piece of it.”

Currently, Bitcoin has settled at around $7200 despite a choppy week for other coins, it peaked on Dec 17, 2017 at $20,000.

Another popular figure in the cryptocurrency world and very public commentator is Fundstrat Global Advisors’, Thomas Lee. He was the idea behind the Metcalfe’s law and big crypto bull. He’s seen a link between cryptocurrency and emerging markets.

Mr Lee hypothesises the leading cryptocurrency’s correlation between emerging markets indicates bitcoin could end 2018 “explosively higher” than ever before.

Speaking on CNBC, Mr Lee said:

“In general, we thinking mining and fundamental factors like network effect really drive bitcoin’s value. But macro factors have an effect on network value.”

Mr Lee referenced a chart showing two lines – the MSCI emerging markets index relative to the S&P and bitcoin’s price.

He said: “EM (emerging markets) actually rallied into the end of the year we had a huge bitcoin rally and as EM has since fallen we have seen bitcoin fall sharply. The graph below is scarily similar to what happened last year:

He went on to explain why the markets react and pan out in this way, and with the increasing presence of wall street, this also makes perfect sense.

He said:

“The first is hedge funds, which typically rent emerging markets stock. So, they do risk on, risk off. When they are risk off bitcoin also suffers because they are risk off. The second reason has to do with wealth effect. Wealth effect means if you’re living in an emerging market and you see your stock market fall hugely it means you have a lot less money to buy bitcoin so that affects the network effect because you can’t buy bitcoin.”

He’s a bull on crypto if two macro factors occur also. If the dollar weakens and the federal reserve in the United States stops its rate hike policy then both areas could see another surge in popularity of search and buying. This will no doubt start another, more gentle bull run all the same and instil some confidence back in a bleak market.

Featured image: © Wit – stock.adobe.com