And up we go again!

And up we go again!

As you can see from our S&P (/ES) chart, we made a perfect weak bounce yesterday so today we see if we can get follow-through to the strong bounce line at 2,910 but keep in mind that it's easy to manipulate the indexes within their bounce lines – the hard part is breaking over them. Also, the end of the month is coming so we have the usual window-dressing to prop up the markets along with the Government and Fed meddling – everyone wants the market to go higher – so why isn't it?

Clearly SOMEONE is selling and they seem to be selling hard as these low-volume rallies exhaust themselves and it doesn't have to be one person but someone or some group clearly is cashing out of the market and then the suckers come in and buy the dips until it's time for the sellers to dump their shares again. Wash, rinse, repeat after that.

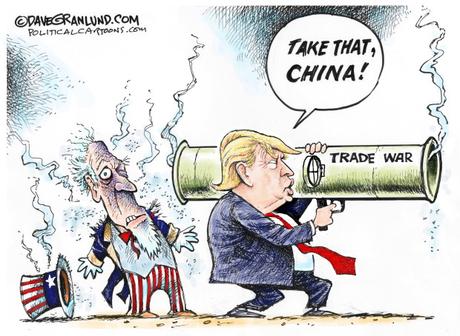

Yesterday, at the G7 conference, Trump was a bit more flexible-sounding on the China Trade deal and China said they would love to negotiate a deal but this is what they all say all the time – and we're now into year 2 of these "negotiations". The US and China both wanted peace in Vietnam and then Korea – remember how that worked out? These are two stubborn super-powers and, after two years, China has no reason to give into Trump as it's 50/50 that he'll be gone in a year – why would they give him concessions? No one in China is up for re-election next year.

Meanwhile, it's very possible we're all just being played and Trump's goal is simply to make the conflict appear worse than it is so he'll look better when he "fixes" it. Nothing the President has said or done has changed the fact that the last meeting with China was held on July 31st and the next meeting is scheduled for September. Between then and now, here's what happened:

- August 1, 2019: In a reversal, Trump abruptly announces the US will move forward with tariffs on virtually all remaining imports from China.

- August 2, 2019: China warns it will retaliate with "the necessary countermeasures" if Trump follows through with his latest tariff threats, which the country says violate an agreement reached at G20.

- August 5, 2019: The US Treasury Department labels China as a currency manipulator after the country allows the yuan to breach the psychologically key level of seven against the dollar. China says it will halt purchases of American agricultural products.

- August 9, 2019: Trump threatens again that the US will cut ties with Huawei. The Commerce Department says it will hold off on making a decision on licenses to do business with the telecommunications giant.

- August 13, 2019: The US delays a portion of tariffs on China, set to take effect September 1, until December 15. The administration says the move was meant to avoid disruptions to the holiday shopping season in the US, a rare acknowledgement that tariffs can raise prices.

- August 19, 2019: The Commerce Department says it will grant a temporary reprieve to Huawei, giving companies an extra 90 days to find an alternative to the telecommunications giant.

- August 23, 2019: China prepares retaliatory tariffs on $75 billion worth of US products and says it will reinstate duties on cars. The escalations are set to go into place the same dates as on the US side.

- Trump vows to hit back against those countermeasures, announcing the US will raise the tariff rates on Chinese products by about 5%. Financial markets tumble sharply as the president also orders private US companies to leave China, sowing confusion even though the command carries no legislative weight.

- August 25, 2019: Trump suggests to reporters that he's having "second thoughts" on trade escalations. The White House clarifies that statement hours later, saying the president only regrets not raising tariffs on China further.

- August 26, 2019: Trump moves to cast a positive light on trade negotiations as financial markets open. He says Chinese officials called over the weekend and want to make a deal but declines to elaborate. China disputes that claim.

So nothing actually changes until September which means all this is just THREATS Trump is essentially making to pressure the Chinese to come to the next negotiations ready to make a deal. This is how Trump negotiates – we can only hope China hasn't read "The Art of the Deal" or they'll be miles ahead of him. But, of course, this is what Trump says about China in the book:

So nothing actually changes until September which means all this is just THREATS Trump is essentially making to pressure the Chinese to come to the next negotiations ready to make a deal. This is how Trump negotiates – we can only hope China hasn't read "The Art of the Deal" or they'll be miles ahead of him. But, of course, this is what Trump says about China in the book:

“I’ve read hundreds of books about China over the decades. I know the Chinese. I’ve made a lot of money with the Chinese. I understand the Chinese mind.”

I guess that would be nice if we really believed Trump read hundreds of books about anything, but even Trump has admitted he pretty much never reads anything (except the bible!). Meanwhile, China has "The Art of War" which advises "Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win” and, another favorite of mine (and China's):

“If your enemy is secure at all points, be prepared for him. If he is in superior strength, evade him. If your opponent is temperamental, seek to irritate him. Pretend to be weak, that he may grow arrogant. If he is taking his ease, give him no rest. If his forces are united, separate them. If sovereign and subject are in accord, put division between them. Attack him where he is unprepared, appear where you are not expected .”

That does sound a bit like things are going in these negotiations and, unfortunately, the US is the arrogant, divided enemy in this case. Trump's negotiating tactics have certainly won him some victories but that type of brinksmanship has also caused him to go bankrupt 5 times – leaving his partners in a lurch while Trump quickly moves on to other projects – like running America!

Well, best of luck to Trump as passengers on the Titanic don't root for hitting an iceberg just because they don't like the captain. The wheels are in motion and now it's September so this market will be put up or shut down – depending on which way the China deal goes – and then we have the Fed on the 18th so hope springs eternal – or for another 3 weeks, at least…

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!