That's the word from an HSBC economist after the PBOC's Ling Tao assures the bank will keep money-market rates "within reasonable ranges." The People’s Bank of China has provided liquidity to some financial institutions to stabilize money market rates and will use short-term liquidity operation and standing lending facility tools to ensure steady markets, according to a statement posted to its website today. It also called on commercial banks to improve their liquidity management.

The PBOC is giving the market “a pill to soothe the nerves,” Xu Gao, Everbright Securities Co.’s Beijing-based chief economist. “The message is clear: the central bank doesn’t want to see a tsunami in China’s financial markets and market rates will drop further.” That saved the Hang Seng from an additional 500-point nosedive and, in fact, they bounced back 400 points off the low at 19,426 to finish back at 19,855

As I said yesterday, it's an artificial crisis and one we felt had ran its course (see yesterday's post) and, in our Member Chat, we went more aggressively bullish off yesterday's low as we flip-flopped our bearish index positions at 10:07, pretty much catching the day's lows on the nose.

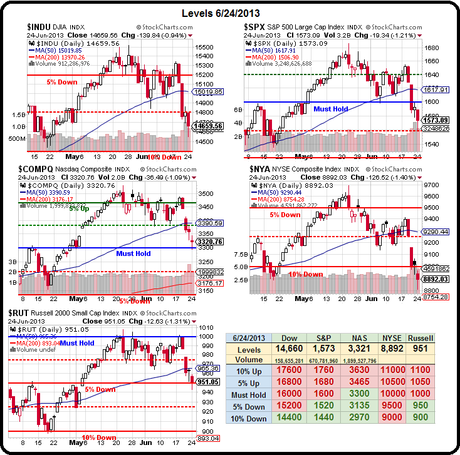

However, just because China is TRYING to stop their economic slowdown from turning into a crash doesn't mean they can successfully regain their lost momentum and now we need to turn our focus back to the myriad of problems that plague the rest of the World so we are in now way complacently bullish – merely playing for the bounce we expected to get into the end of quarter at some point this week – it just so happens that point came earlier than expected yesterday.

If, on the other hand, we stay below them – the daily dots will pull the line that connects them lower and we all know what happens when a 50 dma is falling and a…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.