Gathering steam?

Gathering steam?

“The recovery has progressed more quickly than generally expected and looks to be strengthening,” Powell said in prepared testimony to be delivered today to the House Financial Services Committee. “But the recovery is far from complete, so, at the Fed, we will continue to provide the economy the support that it needs for as long as it takes.” Powell will be appearing before the committee along with Treasury Secretary Janet Yellen as part of congressional oversight of the government’s response to the pandemic.

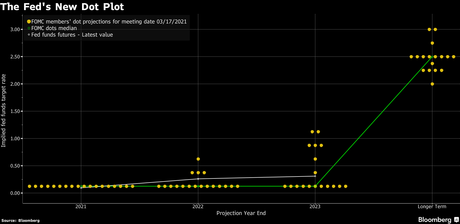

In forecasts released last week, Fed policy makers projected that the economy will grow 6.5% in 2021. That would be the fastest pace since 1983 when measured fourth quarter over the same three months a year earlier and would follow a 2.4% contraction in 2020 as a result of the pandemic. Inflation, as calculated by the personal consumption expenditures price index, is seen in the Fed’s median forecast as ending 2021 at 2.4%.

That all sounds great but already we're seeing some recovery issues in Europe, where Germany is imposing a hard lockdown over the Easter Holiday in an attempt to reverse a new wave of infections. Progress in fighting the crisis is showing signs of stalling. While fatalities in the U.S. and U.K. ease, places like India and eastern Europe are seeing a resurgence. Globally, we have only vaccinated 458M people – just 5% of the people. You can't "win" in vaccines – the whole World needs to eradicate the disease or it can keep coming back in different variants.

At $2,232, it's an expensive stock to short and we could just buy the Jan $1,000 puts at $15 – not because we think it will go down to $1,000 but because it's not likely BKNG goes over $2,400…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!