The weather isn't the only thing turning cold.

The weather isn't the only thing turning cold.

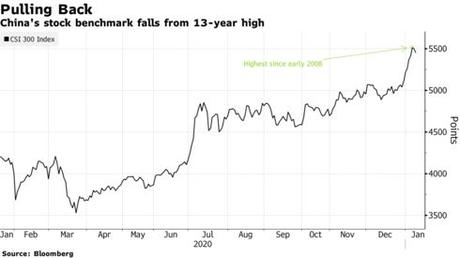

Chinese stocks fell the most in three weeks, led by consumer shares and commodity producers, amid concern valuations for the most popular stocks were stretched and as metal prices slumped. The CSI 300 Index dropped as much 1.5% before paring losses to 1% at the close. Gauges tracking energy, consumer staples and materials producers slumped more than 2%.

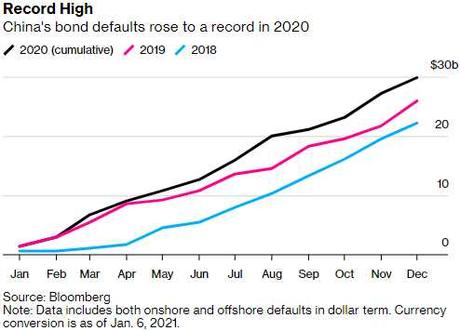

Some 39 Chinese companies both domestically and offshore defaulted on nearly $30 billion of bonds in 2020, pushing the total value 14% above 2019’s. Defaults by Chinese companies are likely to top last year’s record as tighter monetary policy squeezes borrowers, according to China Merchants Securities Co.

In the dollar-bond market, the financial sector accounted for about 43% of total defaults, followed by technology and energy. ?Five state-linked companies defaulted for the first time in the onshore bond market, the most since 2016.

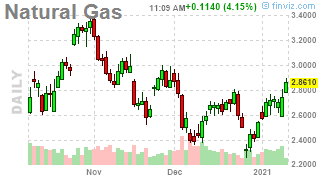

Meanwhile, Global Warming is making us cold as it disrupts the normal air currents and sends the frigid air mass that usually circles the arctic down to the Northern Hemisphere which is, as they say in acedemia, bad. The icy blasts threatening to sweep across North America, Europe and Asia starting in late January are from the same weather pattern that triggered the 2014 cold snap known as the polar vortex, which plunged temperatures in Chicago to minus 16 degrees Fahrenheit.

Enjoy your outdoor dining!

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!