When I started planning this trip, I knew I was going to have to save a lot of money over a relatively short period of time. I've never been a great saver and had to learn fast; the $217 sitting in my bank account was not going to last me long on my jaunt around the world. I do however excel at strategizing and research, so I began with my strengths in order to tackle my weaknesses and make a plan to save.

Research told me there were two main ways to go about developing a budget for the trip:

- I could either just indiscriminately save as much money as possible before it was time to leave, or

- I could figure out a number I wanted in the bank and decide when I could depart based on that goal.

I went with the latter, and began researching how much I figured I would need for my trip. I settled on $40,000 as my budget plus a $10,000 safety net for when I stopped traveling or if I came across any unexpected major expenses while on my trip.

The easy part is dreaming, the hard part is actually doing.

Saving for Travel Is Harder Than It Looks

Articles everywhere implored me to just give up my daily coffee and put that money aside - in no time at all I would be a millionaire! I briefly tried it, and then realized I did not even want to continue living without my daily coffee. Depriving myself of small luxuries has never sat well with me. It's hard to justify going completely without for an entire year just to go all out for the next year.

Thus, I had to develop a plan. I decided I would much rather get an extra job and supplemental income than cut back on my daily joys. For me, it is easier to work a Friday night so that I can both save and go out the Saturday night than it is to stay home all weekend obsessively refreshing my Facebook feed to see what fun my friends are having without me.

In order to reach my financial goal, I broke my plan down into steps.

Step One: Managing Expenses Ahead of Time

First, I saved up an entire month's worth of expenses. I saved this so that on the first of the month, I could take the entire lump sum and deposit it into my bank account. From there, I could pay all of my bills at once and use whatever remained for my variable expenses and fun. Thus, I never could go over budget theoretically as the money was not there.

This strategy worked well for me.Step Two: Three Separate Bank Accounts

Second, I set up three separate bank accounts. I had one bank account that all of my money was deposited into. Any money not taken from this account for my monthly budget or emergencies was put into savings at the end of the month.

The second bank account was where I deposited my month's budget into; this was the only money I could touch each month to pay all of my bills and little extras.

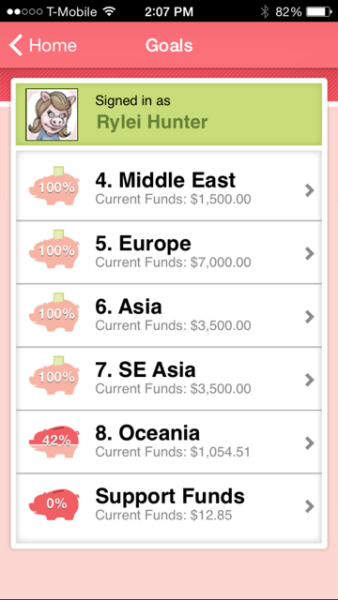

The last account was a SmartyPig account. It's basically a bank account with a great little app that allows you to make many separate goals and work toward them. I studied the psychology of saving and knew this method would work for me; the little sense of accomplishment I got when completing a goal kept me chugging on. I broke my categories down into continents and that also helped me keep track of how much was left over per budget, since I started spending well before I had even left on the trip.

Step Three: Breaking It Down Month to Month

Third, I broke down my budget to know how much I would need to save every month. In my case, my sister gave me a gift of $5,000 when I began planning this trip with the stipulation I not fall in love before I left and abandon my dreams. I also had a month's expenses ($2,000) saved up and, because I was budgeting monthly instead of per paycheck, there were three months in which I made an extra paycheck ($1,500×3). So I had $38,500 left to save over 18 months. With the extra income from the second job, I was able to average a savings of over $2,000 a month and meet my goal.

Saving when you love to spend is definitely not easy. Perhaps the only advice I took from those articles that pleaded with me to quit my coffee addiction was to keep the long-term picture in sight - working hard while my friends went off on trips was difficult, but I would tell myself every couple of hours of work bought me a day in Colombia, an experience diving with sharks, or dozens of priceless memories.

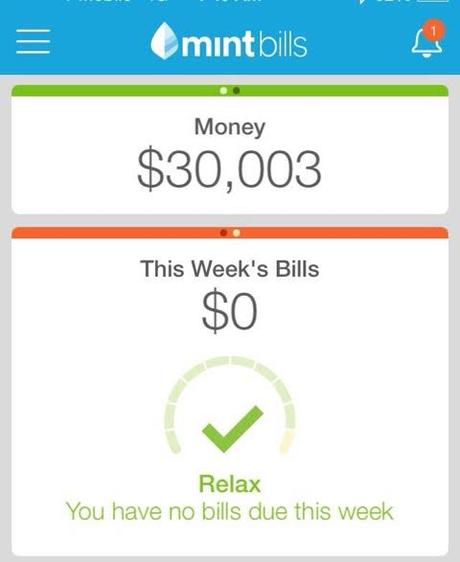

I should hit my goal at the end of next month, and I cannot wait to see all of my hard work pay off.