Wheeee, what a ride!

Wheeee, what a ride!

"THEY" have taken full advantage of the low-volume, holiday markets to bring the S&P up to new highs at just under 4,800 and we have Dow 36,272, Nasdaq 16,654 and only the Russell, at 2,264 is not at the all-time high – which was 2,460 back in November – so we're 8% below that level still.

Does that mean we should bet the Russell to catch up and make all-time highs? Not necessarily. There's no way to know that these low-volume rallies can stick once the participants return and start selling so we're just in a "watch and wait" sort of mode at the moment – we did all our bargain-hunting during the dip – now we are reaping the rewards on our bullish bets.

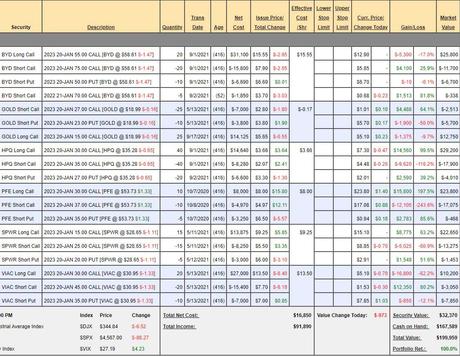

For example, on December 1st, I was on BNN's "Money Talk" and we announced our 2022 Trade of the Year play (IBM) along with 3 of our top runners up, with trade ideas for each one that were featured in that morning's PSW Report. The runner-up trades were for Intel (INTC), Altria (MO) and Walgreens (WBA) and, prior to adding these trades, on December 1st, our Money Talk Portfolio looked like this:

We begain the portfolio with $100,000 back on Nov 13th, 2019, so it's just over 2 years old and up 100% at the time is 50% a year – that's about what we shoot for and, by our calculations (all laid out in the 12/1 Report), the portfolio had another $235,336 left to gain – including our 4 new trade ideas.

Here we are, not even a month later, and our Money Talk Portfolio closed yesterday at $226,914, up $26,914 (26.9%) in less than a month. Now, we're SUPPOSED to make about $12,000 in a normal month – that's how we get to $235,000 so that's how far ahead of plan we are at the moment. Knowing how much money you expect to make on each trade and knowing whether or not each trade is on track is the key to strong portfolio management. We only adjust the Money Talk Portfolio when we're on the show (once per quarter) – so it's very important to make those…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!