The same cannot be said, however, for CitiGroup's Economic Surprise Index, which shows a sharp weakening in the Euro-zone and an even worse-looking picture for Emerging Markets (until the Euro-zone laps them, maybe in May) with ONLY the US still in positive territory (so far).

AA gave us an encouraging kick-off to earnings season but the reality is earnings were boosted by an income-tax benefit and positive mark-to-market changes in energy contracts that added .02 to their .11 earnings. Still, 0.11 is better than 0.08 expected and guidance was decent – which is why they are in our Income Portfolio in the first place. Even so, the news is not so exciting that we'll regret our hedge (see yesterday's note) either, so we're 1 for 1 on earnings already – perhaps we should quit while we're ahead…

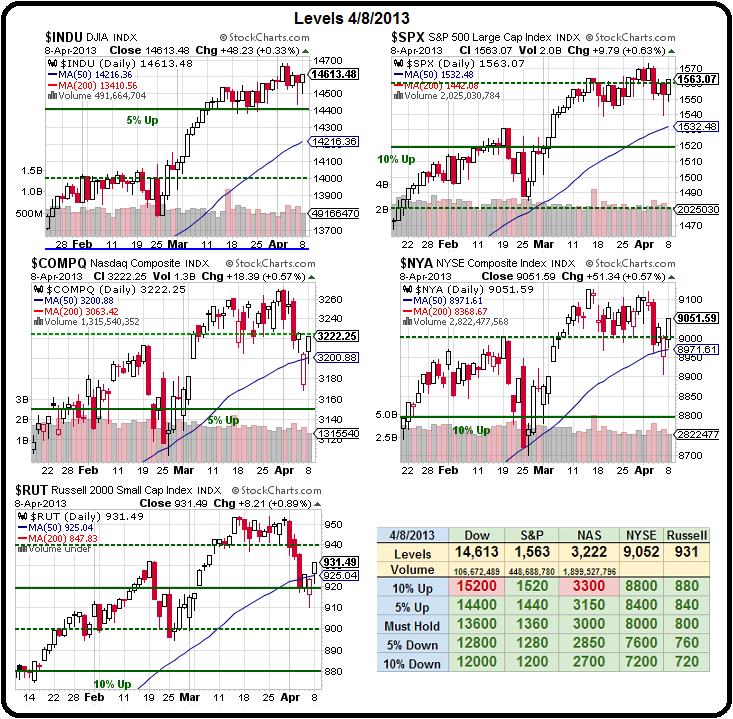

The markets are ahead of reality according to our friend David Fry, who was too disgusted by the artificial, low-volume nonsense yesterday to post more than just this one S&P chart that sums up the action nicely – "Ridiculous."

The markets are ahead of reality according to our friend David Fry, who was too disgusted by the artificial, low-volume nonsense yesterday to post more than just this one S&P chart that sums up the action nicely – "Ridiculous."

Now, I'm not "bearish" per se, but I do feel bearish in the face of ridiculous optimism simply because I feel the need to point out a few potential danger signs along the road back to our all-time market highs.

Being a contrarian can be a profitable occupation as I had noted (also in yesterday's morning post) that, despite the 4-year low on the Yen, we were shorting the /NKD (Nikkei) Futures and we targeted 13,500 as a new line to short into yesterday's close (after taking a failed poke at 13,400) and we were well-rewarded with a 250-point drop overnight, which was good for a lovely $1,250 per contract gain or $1,000 per contract with a trailing stop back at 13,300. I had set that one up at 1:47, saying to our Members:

Nikkei testing 13,400 with Yen at 98.89. This will be worth watching overnight for possible 13,500 action (short side) but 13,400 is also a good line if you don't mind stopping out a few times before we see which way things break.

Keep in mind that was just $2,200 of overnight margin per contract to make a quick $1,250 so it's a very margin-efficient way to cover your positions…

Keep in mind that was just $2,200 of overnight margin per contract to make a quick $1,250 so it's a very margin-efficient way to cover your positions…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.