You won’t have any shortcut to double your money overnight because there’s no magic in wealth creation. Wealth creation requires planning, patience, and early action. You will come to know about legitimate schemes to double your money.

Before we proceed you should first learn about the “Thumb Rule 72”.

What is Investment Thumb Rule of 72?

Rule 72 or Thumb Rule of 72 is a simple formula to know how much time your invested money will take to become double in the amount on the fixed rate of return.

The Formula is – Divide 72 with the Rate of Return on your Investment (ROI).

Let’s understand with the example below –

Assuming your investment in a Fixed Deposit at an interest rate of 6% p.a.

According to Rule 72,

the formula is “72/Interest rate”

= 72/6 = 12 years.

This means if you invest Rs. 1 lakh in FD today, it will take 12 years to become Rs. 2 lakhs.

How to Double Money in 5 Years

If you want to double your money in 5 years, then you can apply the thumb rule in a reverse way.

Divide the 72 by the number of years in which you want to double your money. So to double your money in 5 years you will have to invest money at the rate of 72/5 = 14.40% p.a. to achieve your target.

If you look for secure investment options, there is no option that offers 14.40% returns. You can expect that return from mutual funds & the stock market but those are not secure investment options.

If you are looking for an online side hustle to start with your job, there are many options to earn money online in India that include freelancing, content writing, and tutoring. You can start working from home to earn money without putting in any investment.

Top 10 Best Money Doubling Schemes in India 2023

#1. Tax-Free Bonds

Government issue Tax-Free Bonds to raise capital. Tax-Free bonds have a long-term maturity of 10 years to 20 years. You cannot liquidate the bonds before maturity.

You can expect a 5.50% to 6.50% rate of interest on Government Bonds. Bonds are a better deal than Fixed Deposits because your maturity corpus is tax-free as compared to a tax deduction on maturity amount in FDs.

You can double your money in 12-15 years based on the interest rates.

Tax-Free bonds are ideal for those people who come under tax bracket and want to invest for long term without putting money at risk (like stocks).

#2. Corporate Deposits/Non-Convertible Debentures (NCD)

Non-Convertible Debentures (NCDs) are good long-term investment options for those who want to invest in safe instruments but want better returns as well. NCDs (or Corporate Deposits) offer better interest rates than other schemes ranging between 5.50% to 9%. Their rate of interest depends on their CRISIL or ICRA ratings.

Big companies issue NCDs to accumulate long-term capital. Its a kind of taking a loan from the public and paying interest in return.

Image Source: ETMoney.Com

NCDs offer good returns, liquidity, and low risk.

You can double your money in approx. 8-10 years by investing in NCDs.

#3. National Savings Certificates

National Savings Certificates is a fixed income investment offered by the Postal Department of India. These are one of the safest investment avenues. NSCs come with a fixed interest rate and fixed tenure i.e. for 5 years and 10 years. You can also get tax benefits as no TDS is deducted on the maturity amount and you can also get tax rebate up to Rs.1.50 lakhs u/s 80C.

Along with that, you can also use NSCs as collateral security to get a loan from banks.

The current interest rate on NSCs is 6.8%. Your money will be doubled in 10.5 years.

You may also like to read – 11 ways to earn money online for students in India

#4. Kisan Vikas Patra (Post office scheme to double the money)

Kisan Vikas Patra (KVP) is a certification scheme in which invested money gets doubled in around 10 years based on the interest rate. KVP is a financial product of the Post Office.

Currently, KVP offers a 6.9% interest per annum.

KVP is a safe investment as it is not subjected to market risks. Double the investment is guaranteed once the tenure ends.

KVPs are more flexible than PPF or Bonds as you can withdraw from the KVP scheme after 2 ½ years. KVP can be transferred from one person to another person easily.

It can be used as collateral security in banks against loans. You can check the full details of post office double money scheme here

Kisan Vikas Patra (KVP) Interest rate – 6.9%

Post office interest rates table 2023

Investment Interest Rate

Post office savings account interest rate4%

National savings recurring deposit (5 years)5.8%

1 year fixed deposit 5.5%

2 year fixed deposit 5.5%

3 year fixed deposit 5.5%

5 year fixed deposit 6.7%

Kisan Vikas Patra6.9%

#5. Public Provident Fund (PPF)

Public Provident Fund (PPF) is a long term and risk-free saving scheme by the government of India. This scheme offers a tax-exempted return on investment with an added interest of around 7.10% per annum.

You can double your amount in 10 years by investing in PPF.

You can open PPF account in the post office as well as in the banks. The PPF has a minimum tenure of 15 years, but you can extend the investment in blocks of 5 years each time.

You have to contribute at least once a year till maturity.

#6. Bank Fixed Deposits

Fixed deposits are the most widely used investment instrument in India. You can open FD in banks as well as Post Offices. You may get better interest rates in the post office as compared to banks.

FDs give you an annual return around 2.90% to 5.30% (0.5% to 1% higher for senior citizens). You can double your amount in more than 14 years.

You will have to pay tax on the maturity corpus if the interest accrued is more than Rs. 10,000. However, senior citizen can get tax exemption on the interest earned against Fixed deposits. The exemption is up to Rs. 50,000 of interest earned.

You can use the fixed deposits for regular or monthly income plans in which your savings account will be credited with the interest amount at the prescribed regular period.

#7. Mutual Funds

Mutual funds are the most convenient way of investing in the markets when you do not have the time and expertise. You can take a little risk but rewards are good.

If you invest in equity mutual funds, you can expect a return in the range of 14% to 18%. Some funds like L&T India Value, Mirae Asset India, and ICICI Prudential Blue Chip has delivered return in the past.

You can double your income in 4-5 years.

The investment in mutual funds can be a lump sum or monthly SIP for an amount as low as Rs. 500.

#8. Stock Market

Stock investment is the best option for persons looking for growth and building wealth. Investing in direct stocks carries higher risks but returns are high. You may lose as much as 50% of the capital.

On the other side, if we talk about returns on individual stocks are high (>20%) for fundamentally strong companies over a longer period.

For example, Eicher Motors generated a 5-year CAGR of 28.77%.

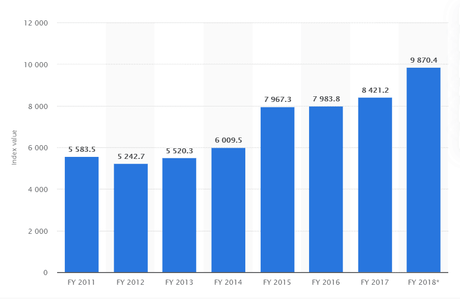

Image Source: Statista.Com

Currently, NSE has crossed 12000 mark. You can see NSE crossed double in the last 10 years. The last 1-year return of NSE is 12.40% and in the last 2 years generated a 26.5% return.

You can expect to double your money in 3.5 years, however, I would recommend investing for long-term (more than 5 years) in stocks.

You may like to read – 11 best ways to earn money from Instagram

#9. Gold/Gold ETFs

Love for the Gold is irresistible for Indian.

Gold has given consistent returns of around 10% in the previous years. A better way to invest in gold is to invest in Gold ETF and gold bonds.

You can also invest in Sovereign Gold Bond Scheme regulated by the government and RBI. You will own gold in the ‘certificate’ format. The value of the bonds is assessed in multiples of the gold gram. The initial minimum investment is 1 gram of gold.

You would earn 2.5% interest per annum on the amount invested. The Lock-in period is 8 years.

You can double your amount in 8 years approx.

#10. Real Estate

The investment in residential real estate generates regular rental income and appreciation. You can get the benefit of owning an asset, have diversification and even save on taxes (tax exemption on home loan).

You can expect an annual return of 11%. The amount of property can be doubled in 6-7 years.

Real Estate investment requires huge capital to invest and return depends on multiple factors like location and other infrastructure developments in nearby regions.

I have covered the reviews of top credit cards in India. If you love to save money using credit cards you can look for these articles

- Axis Vistara Infinite credit card review for up to 6 free business class air tickets on milestone

- Citibank IndianOil credit card review to save up to 5% on your fuel spends

- BPCL SBI credit card review to get up to 6.25% reward value on BPCL fuel and gas

- SBI Pulse credit card review to save up to 2.5% on your pharmacy & chemist expenses.

- IDFC First Classic credit card review is best in the category of lifetime free credit card

Conclusion

Now you have come to know about 10 legitimate schemes to double your money in India. Let me know about your thoughts in the comments.