I could take today off.

I could take today off.

Why? Because I already wrote this article last month, on a Thursday, when the S&P was at 1,988 and topped out at 1,991, which was $199.06 on SPY and, as you can see from Dave Fry's chart, SPY topped out at $199.16 yesterday (before plunging back to $198.90 on strong volume into the close).

Will this time be different? I certainly hope so because last time, we plunged about 5%, back to 1,904 over the next 10 sessions and it's taken us another 10 to claw our way back for another attempt at an all-time high.

In our Live Member Chat this morning, we shorted the run-up in the Futures at Dow 16,990 (/YM), S&P 1,985 (/ES), Nasdaq 4,045 (/NQ) and Russell 1,155 (/TF) because, as I said to our Members:

I'm sorry but I simply can't reconcile this news with what's going on in the markets so I'm going to continue to lose money hedging to make sure we keep what we have. The alternative is going to cash but there is simply no way I can endorse getting more bullish on this market at this point.

One major difference this time is we DON'T have money flowing out of SPY (as much), as we did last month and we DO have the Fed's Jackson Hole conference tomorrow, which looks to Global Investors like a Santa Claus convention with Yellen, Draghi, Carney and Kuroda sitting under the spruce trees with gigantic bags of FREE MONEY – and that's why traders are as giddy as kids before Christmas this week.

One major difference this time is we DON'T have money flowing out of SPY (as much), as we did last month and we DO have the Fed's Jackson Hole conference tomorrow, which looks to Global Investors like a Santa Claus convention with Yellen, Draghi, Carney and Kuroda sitting under the spruce trees with gigantic bags of FREE MONEY – and that's why traders are as giddy as kids before Christmas this week.

But, Virginia, is there really a Santa Claus, or are the bulls hopes and dreams about to be crushed by cruel economic realities they have, so far, been avoiding like the plague (or Ebola)? Realities like China's horrific PMI this morning, that dropped from 51.7 to 50.3 (barely positive) and France's PMI, which is back in heavy contraction at 46.5 this morning. Retail Sales in the UK were up just 0.1% vs. 0.4% expected and year/year has plunged from 3.4% to 2.6% in just one month.

Despite having a very nice net 4.5Mb draw, oil dropped to $93 this morning, down $10 or $10,000 PER CONTRACT from where we were pounding on the table to short it last month (same 7/24 post!). We're still not getting long on oil – it may be heading for an epic collapse ($85 or less).

Had the President listened to me and given me the keys to the SPR, we could have shorted 350M barrels for a $3.5Bn gain in just 30 days – enough money to buy a few GOP Senators and get some laws passed!

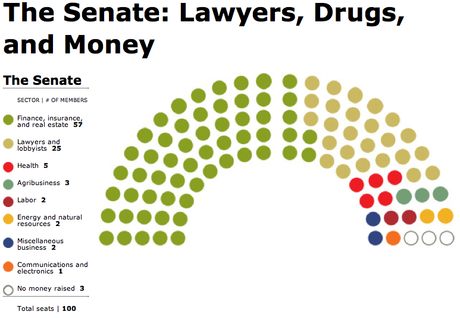

On the very likely assumtion that nothing is going to change politically, it is all up to the Fed to decide which way this country will go into the end of 2014. Isn't it interesting that a woman who wasn't elected and worked her way to the top of a powerful banking cartel (because that's what the Fed is, it's not part of the Government) is essentially running the country while our elected "leaders" accomplish essentially nothing at all?

While we are all very excited to hear what Yellen and her counterparts have to say tomorrow, the question is: "What can they possibly say that would be more accomodative than what they are already doing?"

While we are all very excited to hear what Yellen and her counterparts have to say tomorrow, the question is: "What can they possibly say that would be more accomodative than what they are already doing?"

Interest rates are already at just about zero for the Banksters in the US, Japan and Europe – are we going to go negative – will we begin PAYING the top 1% to borrow money? Will that, then, finally begin to trickle down and grow some jobs (Answer: No, see yesterday's post)?

So, as noted above, we will be pressing our hedges into this rally but, as I noted during Tuesday's Webinar, we are hedging to PROTECT our gains – sacrificing a portion of what we gain to insure we don't lose it in a market reversal. Using that strategy, we were able to hold on to our long-term postions during that little 5% correction and, in fact, back on July 24th, our Long-Term Portfolio was up 19.6% ($598,000) and our Short-Term Portfolio was up 11.5% ($115,000).

As of yesterday's close, DESPITE our aggressive hedging, our LTP finished the day up 21.2% for the year ($606,000) while the STP closed up 38.6% ($138,000) for a gain of $31,000 (5%) during a month where we went down then back up 5%. If that's what we can make playing defense – what are we missing by being cautious?

To get full access to all of our Member Portfolios as well as our daily Trade Ideas – SIGN UP HERE!

Tags: Dow Jones Industrial Average, Fed, Jackson Hole, oil futures, Portfolio Management, S&P 500, SPY, stock index futures, Strategic Petroleum Reserve, The Creature from Jekyll Island, trickle down economics

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!