Wheeee – what a ride!

Wheeee – what a ride!

As we expected, the anticipation of the Fed doing something wonderful led to a big rally in the morning and the fact that the Fed didn't actually do anything at all wasn't enough to stop the party train once it left the station. My comment in yesterday morning's post (which you can subscribe to HERE) was:

At the moment, we are expecting the Fed to keep things going and we're long on the indexes again at 17,100 (/YM), 1,975 (/ES), 4,100 (/NQ) and 1,135 (/TF) but with tight stops below and, if any two are below the line then none of them should be played

This morning, we are flipping SHORT at 17,500 on /YM (up $2,500 per contract from yesterday's call), 2,035 on /ES (up $3,000 per contract), 4,220 on /NQ (up $2,400 per contract) and 1,185 on /TF (up $5,000 per contract). We think the run is officially overdone at this point and we also added some Jan TZA calls back to our Short-Term Portfolio to hopefully catch another nice move down into Christmas.

Europe is up 2% and more on the Continent this morning as Putin gave a speech in which he assured his people that the country's economic troubles would pass in no more than two years. How that's considered rally fuel is beyond me but it's Christmas – people want the markets to go up – so they do. On the whole, it's all going according to plan. As I said to our Members into yesterday's close in our Live Chat Room:

Europe is up 2% and more on the Continent this morning as Putin gave a speech in which he assured his people that the country's economic troubles would pass in no more than two years. How that's considered rally fuel is beyond me but it's Christmas – people want the markets to go up – so they do. On the whole, it's all going according to plan. As I said to our Members into yesterday's close in our Live Chat Room:

They want to spin Yellen's comments as bullish as possible to get Asia and Europe to buy so we may be higher at the open (from Futures) but then I expect a sell-off from there.

So we're just following the plan and I drew up the lines from our 5% Rule™ on the Nasdaq to illustrate our expectations.

So we're just following the plan and I drew up the lines from our 5% Rule™ on the Nasdaq to illustrate our expectations.

We should see that 4,700 line tested and there we expect it to fail at which point the 140-pont run that got us there will cause a 25 to 30-point retrace back to 4,673 (the 50 dma) and then THAT will tell us whether or not we're having a real recovery.

I may have helped the Nasdaq along last night by naming AAPL my Stock of the Year for 2015 on Money Talk last night.

The trade idea we laid out was buying 20 of the AAPL 2017 $90/120 bull call spread at $13.50 ($27,000) and selling 20 of the 2017 $85 puts for $9.50 ($19,000) for net $8,000 on a spread that has a $60,000 upside potential (650%) if AAPL is over $120 in Jan of 2017 – not a big stretch considering it closed yesterday at $108.

The trade idea we laid out was buying 20 of the AAPL 2017 $90/120 bull call spread at $13.50 ($27,000) and selling 20 of the 2017 $85 puts for $9.50 ($19,000) for net $8,000 on a spread that has a $60,000 upside potential (650%) if AAPL is over $120 in Jan of 2017 – not a big stretch considering it closed yesterday at $108.

In our Long-Term Portfolio, we already had 20 of the 2016 $80/100 bull call spreads at $11.25 ($22,500) and we sold 20 of the 2017 $80 puts for $8.30 ($16,600) for net $5,900 on the $40,000 spread.

That was a trade we began in July for our Members and we added the 2017 $90/120 bull call spread at net $15.10 on Dec 5th, so we're in no hurry to add the put leg (we're waiting for the $80 puts to hit $15 – if ever) as we already have a large (2,000 share) commitment to buy AAPL as it is.

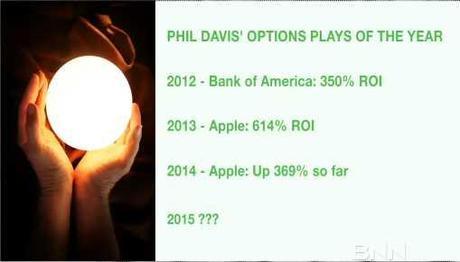

However, as noted by BNN, our Trade of the Year ideas have had a very good track record for outstanding returns and, as you can see from our LTP strategy, we like to layer these AAPL trades each year – so we always have something working for us.

However, as noted by BNN, our Trade of the Year ideas have had a very good track record for outstanding returns and, as you can see from our LTP strategy, we like to layer these AAPL trades each year – so we always have something working for us.

In addition to our Apple Trade of the Year, I sent out a revised version of our BHI Trade to our Top Trade Members yesterday morning. Sadly, that trade idea will only make 566% if BHI is indeed bought by HAL for over $65, so not quite as good a payoff as AAPL – though it may come sooner than AAPL if the deal does manage to close in 2015. That would be a nice bonus.

So, on the whole, we're short-term short but long-term, we're still long as we think all this money that is being tossed onto the pile by ALL the Central Banks around the World (and Switzerland just lowered their rates to NEGATIVE 0.25%) is bound to catch fire sooner or later and, once it does – there will be no putting inflation out. That's good for all assets, including stocks but especially good for our Secret Santa Inflation Hedges (Members Only this weekend).

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!