Now THIS is an exciting ride. We had a great sell-off in the Futures this morning – the same Futures that I mentioned, in yesterday’s Morning Post, that we had shorted at S&P 1,200 and Russell 710 in a post I had titled "1,200 or Bust!" Of course we also called for our usual monthly oil short with the (/CL) Futures hitting $99 on yesterday’s inventory and now down to $86 (up $3,000 per contract).

Of course, for the Futures Impaired – we still have our straight USO Sept $32 puts at .90, which we whittled down to a .75 in yesterday’s Member Chat as well as the very lovely idea of the SQQQ Sept $25/28 bull call spread at $1 (spread with short RIMM Sept $22.50 puts to make it FREE) that I mentioned right in the 2nd paragraph of Tuesday’s post. Those were just the ideas we gave away for free! In Member Chat, yesterday’s morning Alert to Members was this:

As I said earlier, we like the Futures short at RUT (/TF) 710 and S&P (/ES) 1,200 but the big play today will be shorting oil (/CL) below the $88.50 line or, hopefully, below the $90 mark if they get that high. Expect the Dollar to re-test 73.50 and, if they hold it, then it’s a great time to hit the shorts but, with oil, we’re waiting on that inventory report at 10:30.

As an overall short on oil, the Sept $32 puts are down to .65 and .60 is a good spot to DD in the $25KP (10 more). AFTER that, with an average of .75 per contract, we want to consider rolling up to the Sept $33 puts, now .90 for .30 or less.

Another fun way to play an oil sell-off is the SCO Aug $53/54 bull call spread at .60, selling the XOM Aug $72.50 puts for .27 for net .33 on the $1 spread that’s 100% in the money at the moment.

Thank goodness we have a nice pop in FAS and we’ll look to do another 1/2 sale of the Aug $15s if they get back to .85.

That was a GOOD PLAN! That’s why we can say "wheeeeeeeeeeeee" when the market takes a nice dip like this. Although we flipped more bullish on FAS at the end of the day and we will regret that one, as we are likely to regret the short XOM puts (we will be LUCKY) if we don’t on this morning drop. We flipped a little (very little) more bullish into the close as our expectation was that Bill Dudley will save the markets this morning at 8:35, when the Fed’s dove of doves makes a speech on the Regional and National Outlook in Newark – a spot selected to make sure a very large amount of press can cover it.

That was a GOOD PLAN! That’s why we can say "wheeeeeeeeeeeee" when the market takes a nice dip like this. Although we flipped more bullish on FAS at the end of the day and we will regret that one, as we are likely to regret the short XOM puts (we will be LUCKY) if we don’t on this morning drop. We flipped a little (very little) more bullish into the close as our expectation was that Bill Dudley will save the markets this morning at 8:35, when the Fed’s dove of doves makes a speech on the Regional and National Outlook in Newark – a spot selected to make sure a very large amount of press can cover it.

Dudley is ALSO scheduled to speak tomorrow at 8:30, also in New Jersey, on the same topic at the Meadowlands Chamber of Commerce (the same one Tony Soprano belongs to). We did add a BIDU short (Sept $120 puts at $3.65) in the afternoon yesterday but we also went short on TLT with the Sept $106 puts at $2.70 in our virtual $25,000 Portfolio and those are going to need adjusting this morning! We tried a little bottom-fishing with two long-term plays in the Steel and Telco sector but if we don’t hear the word’s QE3 this morning – we’re going to be adding more to the bear side pretty fast (see last week’s "Hedging for Disaster – 5 Plays that Make 500% if the Market Falls").

Just like the above image of Dudley Do Right, William Dudley may be the market’s last hope as that Recession train is coming down the tracks and a combination of low sentiment and no confidence is tying our economy to the tracks while the villainous politicians (pick your own party!) make it impossible for anyone to win who isn’t paying them off. We had a nice discussion about this in Member Chat this morning, so I won’t get into it again here.

Just like the above image of Dudley Do Right, William Dudley may be the market’s last hope as that Recession train is coming down the tracks and a combination of low sentiment and no confidence is tying our economy to the tracks while the villainous politicians (pick your own party!) make it impossible for anyone to win who isn’t paying them off. We had a nice discussion about this in Member Chat this morning, so I won’t get into it again here.

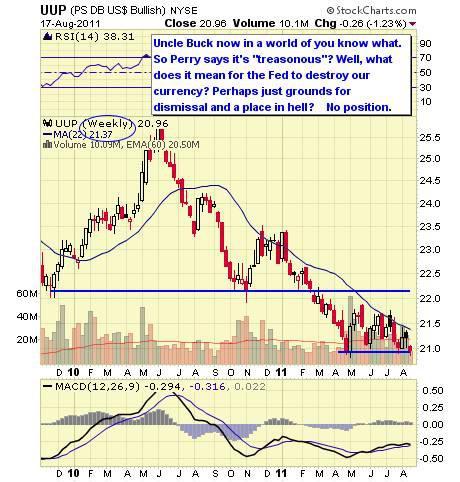

As David Fry notes in his Dollar chart, Bush love-child Rick Perry damned the Fed this weekend and it would be a true act of bravery at this point for Dudley to even suggest QE3 is wrong, under the threat of Treason from a sitting US Governor so we’ll see how this drama plays out this morning. Like yesterday, a strong move up in the Dollar in pre-markets is jamming down the futures and we’re going to need the buck to break to new lows to prop up the markets at this point.

In yesterday’s post, I warned you not to be fooled by the weak-dollar rally in the morning and suggested trading in your stocks and commodities for Dollars before they lost all their value. Today we are praying for the opposite – although we are still "Cashy and Cautious" and will benefit greatly from lower prices – we certainly don’t want to see the markets go back to the technical Hell they’ll be in if we break down here.

IN PROGRESS