It is ALL about the Dollar.

It is ALL about the Dollar.

This week, the Dollar was smacked down from 76.37 on Monday to 75.04 early this morning for a 1.7% drop on the week, costing US citizens $1.7Tn of their lifetime savings in order for Goldman Sachs to close out their month on a high note as commodities, once again, skyrocketed – pushing the key wholesale price of gasoline back over $3 so gas stations could mark it up to $4 at the pump and charge US consumers $1.15 more per gallon than last year (up 41%) for an estimated $3.75Bn of additional charges levied against 150M US drivers in the next 3 days.

Hey, that’s only $25 per driver, right? That’s totally right! If you are going to steal $2.5Bn, that’s exactly the way to do it – in small amounts over and over again. If you steal $2.5Bn from one person or from several people, like Madoff, you go to jail but if you steal $25 from every family in America – you go on the cover of Forbes and get to advise the President on Economic policy!

Also, Madoff’s big mistake was robbing rich people. That’s a big no-no in America but robbing poor people is called Capitalism and, if you complain about it, you are some sort of Communist and will be thrown off the island so shut up and give us your $25! Ah, ain’t that America?

As I mentioned yesterday, we won many thousands of tanks of gas betting against $101 oil in the fake rally and this morning we picked up another .40 win in the futures as I sent out an early morning Alert to Members to short oil at $100.90 and we got a nice ride back to $100.50. 40 cents may not sound like much but the QM futures contracts pay $12.50 per penny per contact so that little move nets $812.50 per contract – that’s enough to tank up the Range Rover AND take care of the monthly lease payment!

This is why the investor class doesn’t give a damn about a $25 rise in the price of gas – we may pay $25 just like the little people but we OWN the oil companies and the refiners and the gas stations and even the commodities and we pay $25 but collect $8,000 on just 10 contracts in 2 hours. Where does that money come from? Well, as I said Tuesday, we prefer to take the money from jackass speculators who get greedy and run oil too high but they, unfortunately, got that money from the bottom 99%. Just one rich guy buying 10 NYMEX contracts that go up 40 cents requires 320 people to pay $25 more at the pump to fund their $8,000 gain. How many contracts are open at the NYMEX? 400,000! 400,000 contract going up 40 cents at $12.50 per penny requires 1.2M people to hand over $25.

This is why the investor class doesn’t give a damn about a $25 rise in the price of gas – we may pay $25 just like the little people but we OWN the oil companies and the refiners and the gas stations and even the commodities and we pay $25 but collect $8,000 on just 10 contracts in 2 hours. Where does that money come from? Well, as I said Tuesday, we prefer to take the money from jackass speculators who get greedy and run oil too high but they, unfortunately, got that money from the bottom 99%. Just one rich guy buying 10 NYMEX contracts that go up 40 cents requires 320 people to pay $25 more at the pump to fund their $8,000 gain. How many contracts are open at the NYMEX? 400,000! 400,000 contract going up 40 cents at $12.50 per penny requires 1.2M people to hand over $25.

How much is oil up from last year? $30. $30 x 400,000 x $12.50 is (and you are going to love this) 150,000,000 people who need to pay $25 more for gas. See how that works out? Unfortunately for the poor little consumers, we need that $25 over and over and over again to maintain the prices at this level even though we only make the money once. Speculators don’t care though. It would be MUCH cheaper for the American public to just hand Lloyd Blankfien $25 each ($7.5Bn) one time than to play this game but we all like to pretend it’s market forces and not evil speculators that are destroying our country because, if we believed that evil speculators were the root of the problem then we may question the merits of Unrestrained Capitalism and NOBODY wants that (well, nobody who counts, anyway).

So oil prices will fly higher this morning as they try to make it to $30 per person this weekend (maybe $102 per barrel). Keep in mind that’s JUST the ADDITIONAL money you are paying above $70 a barrel for oil, the number Rex Tillerson of XOM says is the TOP of the fair price range for a barrel of oil if it were not for SPECULATORS (his words). So there’s nothing we can do about Goldman Sachs and the rest of their Bankster buddies taking Billions of free Dollars handed to them by the Federal Reserve (and, funny thing, it’s YOUR money the Fed is giving them) to jack up commodity prices and screw the American public out of hundreds of Billions of Dollars. The Banksters are screwing the Global public out of $2.5 TRILLION Dollars a year just so GS can rake in their $40Bn in fees and trading profits, $24Bn of which flows down to the management and traders and $7Bn of which is net profit for the shareholders.

So oil prices will fly higher this morning as they try to make it to $30 per person this weekend (maybe $102 per barrel). Keep in mind that’s JUST the ADDITIONAL money you are paying above $70 a barrel for oil, the number Rex Tillerson of XOM says is the TOP of the fair price range for a barrel of oil if it were not for SPECULATORS (his words). So there’s nothing we can do about Goldman Sachs and the rest of their Bankster buddies taking Billions of free Dollars handed to them by the Federal Reserve (and, funny thing, it’s YOUR money the Fed is giving them) to jack up commodity prices and screw the American public out of hundreds of Billions of Dollars. The Banksters are screwing the Global public out of $2.5 TRILLION Dollars a year just so GS can rake in their $40Bn in fees and trading profits, $24Bn of which flows down to the management and traders and $7Bn of which is net profit for the shareholders.

Would you screw over 150M of your fellow countrymen for a $350,000 (GS average) bonus? If not, you’ll never get a job on Wall Street, that’s for sure! As I mentioned in last week’s post, the only thing ordinary citizens can do is make trades like our XLE trade, which is already at net $655 per contract, up another 10% since last week and up 445% since we initiated it as a Secret Santa Inflation Hedge at Christmas. That’s what "ordinary" citizens can do to fight this BS but, unfortunately, ordinary citizens don’t have options accounts, do they. In fact, most 401K programs don’t even allow them and certainly don’t allow short selling long puts – regulations are in place to make sure poor people can’t make money off rich people’s manipulation of the markets – that would lead to chaos!

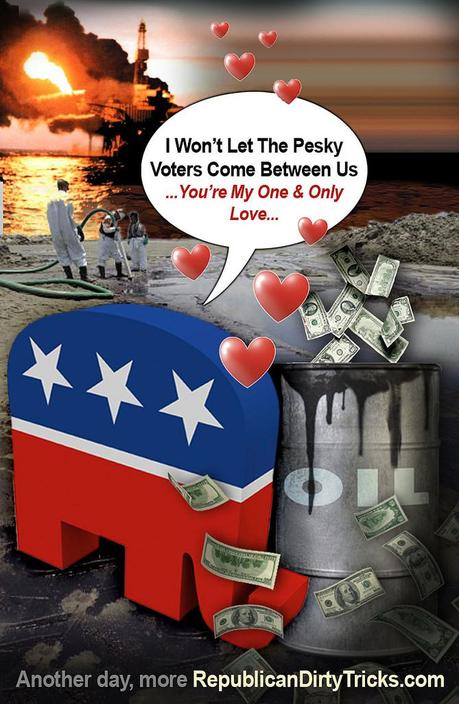

So sorry poor people, we really can’t help you because you keep voting in criminals to run the country and you put up with idiocy like the Supreme Court saying Corporations can make unlimited contributions to politicians because it’s their "freedom of speech." I mean, THINK about it for a minute. Phil Davis, private citizen, can only give $2,500 to an individual candidate and up to $46,200 to all candidates per year and up to $70,800 to PACs but Philco Incorporated can give unlimited amounts of money to politicians and PACs thanks to the Supreme Court. And they are right you know. All you poor people have to do is form your own corporations and you too can give unlimited amounts of money to candidates so, really, it is totally fair so stop complaining and give us $25 (which we can then use to make sure no regulations are passed to stop us from stealing another $25 from you – Muhahaha!).

So sorry poor people, we really can’t help you because you keep voting in criminals to run the country and you put up with idiocy like the Supreme Court saying Corporations can make unlimited contributions to politicians because it’s their "freedom of speech." I mean, THINK about it for a minute. Phil Davis, private citizen, can only give $2,500 to an individual candidate and up to $46,200 to all candidates per year and up to $70,800 to PACs but Philco Incorporated can give unlimited amounts of money to politicians and PACs thanks to the Supreme Court. And they are right you know. All you poor people have to do is form your own corporations and you too can give unlimited amounts of money to candidates so, really, it is totally fair so stop complaining and give us $25 (which we can then use to make sure no regulations are passed to stop us from stealing another $25 from you – Muhahaha!).

As I mentioned yesterday, this week’s action is fake, Fake, FAKE and we are waiting for the pump-job today to run it’s course and, as long as we remain below our 2.5% lines, we’ll be adding shorts into the long weekend because we think 75 will hold on the dollar and then, like Richard Gere in "An Officer and A Gentleman" the Dollar will have nowhere else to go but up. Speaking of UUP, we will be liking them long again this morning and the Jan $20 calls are only $1.85, which is very little premium with UUP at $21.62. If pressed, we can sell short calls against it but UUP was at $23.40 in January with the Dollar at 81 so that would be perhaps a 50% gain in the UUP calls if the Dollar goes up 7.5% but we’ll be very happy to take $2.20 (20% gain) and run on a good pop.

Gains in the euro were tempered before a European Commission report today forecast to show an index of executive and consumer sentiment in the region slid to 105.7 this month from 106.2 in April. The single currency slid to an all-time low against the franc after Luxembourg’s Jean-Claude Juncker, who heads euro- area finance chiefs, said the International Monetary Fund may not release its share of aid to Greece next month. “Concerns about sovereign debt are spreading in the region, weighing on the euro,” said Masahide Tanaka, a senior strategist in Tokyo at Mizuho Trust & Banking Co. “The European and U.S. economies are slowing down.” The euro has weakened 2.5 percent over the past month according to the Bloomberg Correlation-Weighted Currency Indexes, which track 10 developed-nation currencies.

And before you go thinking that means we should run to the Yen, consider that "Fukushima Faces ‘Massive’ Radioactive Water Problem": As a team from the International Atomic Energy Agency visits Tokyo Electric Power Co.’s crippled nuclear plant today, academics warn the company has failed to disclose the scale of radiation leaks and faces a “MASSIVE PROBLEM” with contaminated water. The utility known as Tepco has been pumping cooling water into the three reactors that melted down after the March 11 earthquake and tsunami. By May 18, almost 100,000 tons of radioactive water had leaked into basements and other areas of the Fukushima Dai-Ichi plant, according to Tepco’s estimates. The radiated water may double by the end of December. “Contaminated water is increasing and this is a massive problem,” Tetsuo Iguchi, a specialist in isotope analysis and radiation detection at Nagoya University, said by phone. “They need to find a place to store the contaminated water and they need to guarantee it won’t go into the soil.” Don’t worry though, perhaps the "SUPER TYPHOON" will clean it all up this weekend….

- How about Emerging Markets? Nope: "Emerging Stock Funds Post 2nd Week of Outflows": Citi Says. Emerging-market equity funds reported a second consecutive week of outflows as escalating concerns over Europe’s sovereign debt crisis dented demand for riskier assets, according to Citigroup Inc. Funds investing in developing-nation stocks lost an overall $1.03 billion during the week ended May 25, compared with net outflows of $1.64 billion the previous week, Citigroup analysts led by Markus Rosgen said in a report today, citing data compiled by EPFR Global. “Investors remained cautious amid lingering credit concerns in Europe,” the analysts wrote.

- China? Nope: "China Drought Ignites Global Grain Supply Concerns": Analysts are closely watching the weather in China, warning any further supply shocks in the grain markets would fuel a further rally in U.S. corn and wheat futures, already stoked by harsh crop weather in the United States and Europe. China’s consumer prices may increase as much as 5.5% from a year earlier this month, rather than 5.4%, citing Huachuang Securities Co. The brokerage raised its May consumer price index estimate because vegetable prices in southern China had large gains due to drought.

- India? Nope: "In India, Bad Loans Rising": State run banks in India, long seen as one of the key pillars in a healthy and regulated banking sector, are seeing a rash of bad loans on their books, the Times of India reported Friday.

So, as I said – the Dollar has no place else to go. We may be a mess (50% Expect U.S. Government To Go Bankrupt Before Budget is Balanced) but we’re no worse than the others and that means 75 is just too low for the Dollar index and all the manipulative bastards who are using it to screw American consumers this weekend certainly know it so we will be Selling the F’ing Pops today and having ourselves a lovely holiday.

Have a great weekend,

- Phil